From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market: Stable Activity Despite Global Uncertainty; Focus on Domestic Supply

Oceania’s steel market demonstrates stable plant activity levels despite global uncertainty reflected in the European market, as highlighted by “The expectations of buyers and sellers in the European HRC steel market differ“, “Buyers’, sellers’ expectations vary in European steel HRC market“, and “European HRC market in wait-and-see mode“. While these articles portray cautious sentiment and diverging expectations between buyers and sellers in Europe, no direct correlation to immediate activity changes in Oceania steel plants can be established based on the provided data. The article “The prices of rolls in Northern Europe are stable compared to import offers“ highlights the stability of the market rolls in Northen Europe when compared with import offers. Again, no direct correlation to immediate activity changes in Oceania steel plants can be established based on the provided data.

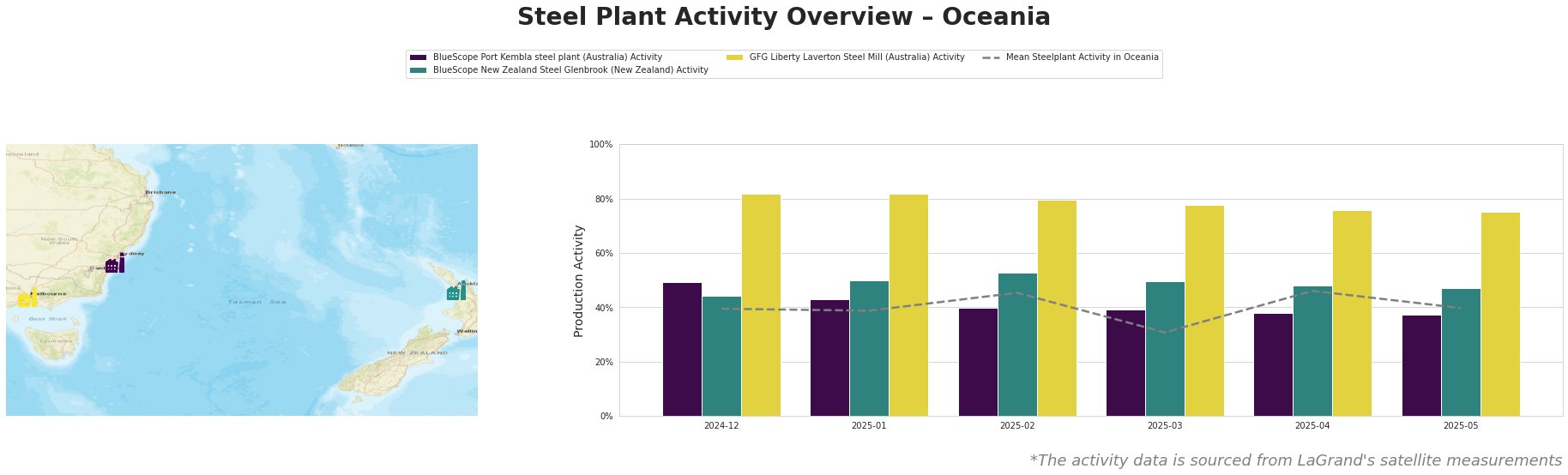

The mean steel plant activity in Oceania fluctuated, reaching a low of 31% in March 2025 and a high of 46% in April 2025. BlueScope Port Kembla experienced a gradual decline from 49% in December 2024 to 37% in May 2025. BlueScope New Zealand Steel Glenbrook showed relative stability around 50%, with a slight peak at 53% in February 2025. GFG Liberty Laverton Steel Mill consistently operated at high activity levels, starting at 82% and gradually decreasing to 75% in May 2025.

BlueScope Port Kembla steel plant, an integrated BF-BOF producer in New South Wales with a capacity of 3.2 million tonnes of crude steel, has seen a steady decrease in activity from 49% in December 2024 to 37% in May 2025. The decline does not directly align with any specific event mentioned in the provided European market news articles, indicating potential local factors influencing production.

BlueScope New Zealand Steel Glenbrook, an integrated DRI-BOF producer in South Auckland with a capacity of 650,000 tonnes, maintained a relatively stable activity level, fluctuating between 44% and 53% during the observed period. Given the focus of provided articles on the European HRC market, no direct impact on the Glenbrook plant’s activity can be inferred from the news.

GFG Liberty Laverton Steel Mill, an EAF-based producer in Victoria with a capacity of 660,000 tonnes focusing on long products, exhibited the highest activity levels among the observed plants, although its activity gradually decreased from 82% to 75% over the period. Given the focus of provided articles on the European HRC market, no direct impact on the Laverton plant’s activity can be inferred from the news.

The observed stable activity levels, particularly at GFG Liberty Laverton, suggest that domestic demand for long products in Australia remains robust. The European market’s uncertainty, as described in “The expectations of buyers and sellers in the European HRC steel market differ”, has not translated into immediate volatility in Oceania’s steel production. The decline in BlueScope Port Kembla’s activity, contrasted with the relative stability of BlueScope New Zealand Steel Glenbrook, may suggest localized supply chain adjustments or maintenance activities impacting the Australian plant.

Evaluated Market Implications:

- Potential Supply Disruptions: The gradual decline in activity at BlueScope Port Kembla (from 49% to 37% over six months) warrants close monitoring. Should this trend continue, it could lead to localized supply constraints for hot-rolled coil and plate in the Australian market, potentially impacting building and infrastructure projects.

- Recommended Procurement Actions:

- Steel Buyers: Given the stable activity at GFG Liberty Laverton, prioritize securing contracts for long products (reinforcing bar, mesh, etc.) directly with them to mitigate potential price increases resulting from any supply disruption at BlueScope Port Kembla.

- Market Analysts: Closely monitor domestic demand indicators within Australia, particularly construction activity, to assess whether the decline in BlueScope Port Kembla’s activity is demand-driven or supply-side driven. This would help to understand the stability of GFG Liberty Laverton, or if they have further room to expand production.