From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market Report: Neutral Signals Amidst Stable HRC Prices and Activity Fluctuations

The steel market in Oceania presents a neutral sentiment as evidenced by recent shifts in plant activity levels and external market dynamics. Key reports such as European domestic steel HRC prices stable, demand subdued and European HRC prices steady, with CBAM confusion limiting imports highlight a general stability in pricing trends across regions, influencing local market behaviors but without direct correlations to activity changes at specific plants.

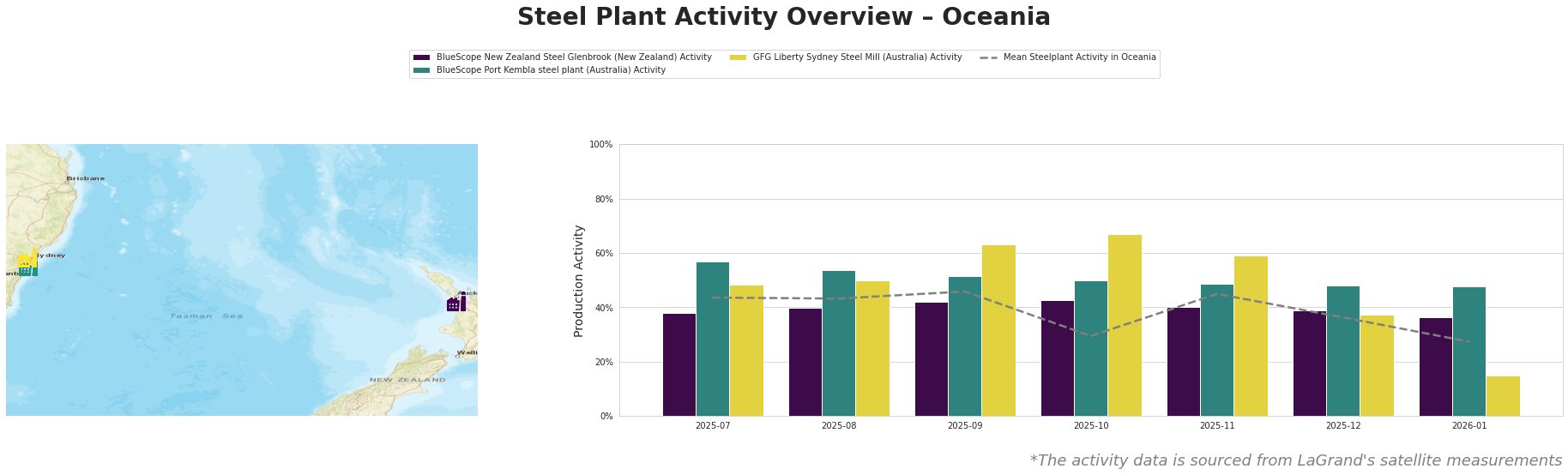

Recent changes indicate a notable decline in mean activity levels, dropping from 45.0% in November 2025 to 27.0% by January 2026, with individual plant fluctuations reflecting this trend. GFG Liberty Sydney Steel Mill faced a significant decrease, plummeting from 59.0% in November 2025 to just 15.0% in January 2026, indicating substantial operational challenges, likely related to external market conditions.

At BlueScope New Zealand Steel Glenbrook, activity levels fell from 40.0% in August 2025 to 36.0% in January 2026, reflecting a steady decrease alongside subdued demand signals discussed in the aforementioned articles. Meanwhile, BlueScope Port Kembla’s activity similarly decreased, indicating constrained operational momentum despite being relatively stable until then.

The observed activity trends do not establish direct correlations to the news pertaining to hot-rolled coil prices in Europe. Although local dynamics reflect broader global themes, direct impacts remain unquantified within the provided information scope.

Supply disruptions may be anticipated at GFG Liberty Sydney Steel Mill due to its low activity, risking delays in fulfilling orders for the building and infrastructure sector. Procurement actions amid this environment should pivot towards securing contracts with BlueScope Port Kembla, which, despite its declining activity, still demonstrates higher operational capacity compared to GFG.

In conclusion, steel buyers are advised to monitor regional production levels closely, particularly those at GFG Liberty, while considering placement of orders with BlueScope Port Kembla to mitigate potential delays and inventory shortages driven by ongoing global market conditions.