From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market Reacts to EU Trade Shifts: Mixed Plant Activity Signals Procurement Challenges

Oceania’s steel market is showing signs of adjustment influenced by shifts in the EU steel trade landscape, although a direct connection between the EU news and Oceania plant activity levels can not be explicitly established. While “EU plate offers move up, supported by upcoming trade regulations“, “ArcelorMittal raises prices for hot-rolled coil in Europe“, and “ArcelorMittal announces two-step flat steel price rise across Europe amid shifting EU trade landscape“ signal potential global price pressures, regional plant activity offers a mixed picture.

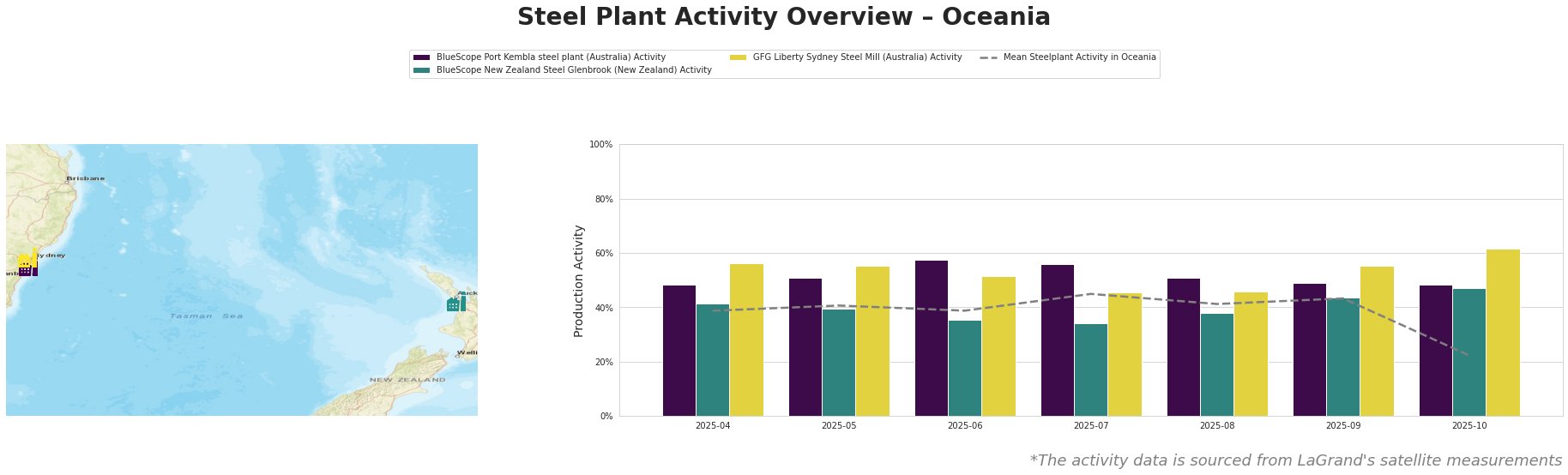

The mean steel plant activity in Oceania experienced a significant drop in October, falling to 22% from 43% in September.

BlueScope Port Kembla steel plant (Australia), an integrated BF-BOF steel plant with a 3.2 million tonnes per annum (ttpa) crude steel capacity primarily producing slabs, hot-rolled coil, and plate, has maintained relatively stable activity around the 50% level over the observation period. Its activity was at 48% in October, a slight decrease from previous months. There is no direct correlation to the news articles regarding EU trade measures and plant activity.

BlueScope New Zealand Steel Glenbrook (New Zealand), an integrated DRI-BOF steel plant with a 650 ttpa crude steel capacity, producing slabs, hot-rolled, and cold-rolled products, shows fluctuations. Its activity decreased to 34% in July, then rose to 47% in October. There is no direct correlation to the news articles regarding EU trade measures and plant activity.

GFG Liberty Sydney Steel Mill (Australia), an EAF-based steel plant with a 750 ttpa crude steel capacity producing long products including reinforcing bar and mesh, shows a general increase in activity over the observed period, peaking at 62% in October. This increase contrasts with the overall Oceania average. There is no direct correlation to the news articles regarding EU trade measures and plant activity.

Evaluated Market Implications

The decline in average steel plant activity across Oceania coupled with the news of rising European steel prices indicates potential upward pressure on steel prices in the region.

Recommended Procurement Actions:

- Given the “ArcelorMittal announces two-step flat steel price rise across Europe amid shifting EU trade landscape”, buyers dependent on flat steel products should consider accelerating planned purchases to pre-empt potential price increases in Oceania.

- Monitor the GFG Liberty Sydney Steel Mill’s production levels. Its increasing activity, even as the mean falls, suggests it may be an increasingly important regional supplier of long products, particularly reinforcing bar and mesh. Buyers seeking these products may consider proactively engaging GFG Liberty to secure future supply at predictable prices.