From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market: Port Kembla Surge Offsets Glenbrook Dip Amid Stable European Prices

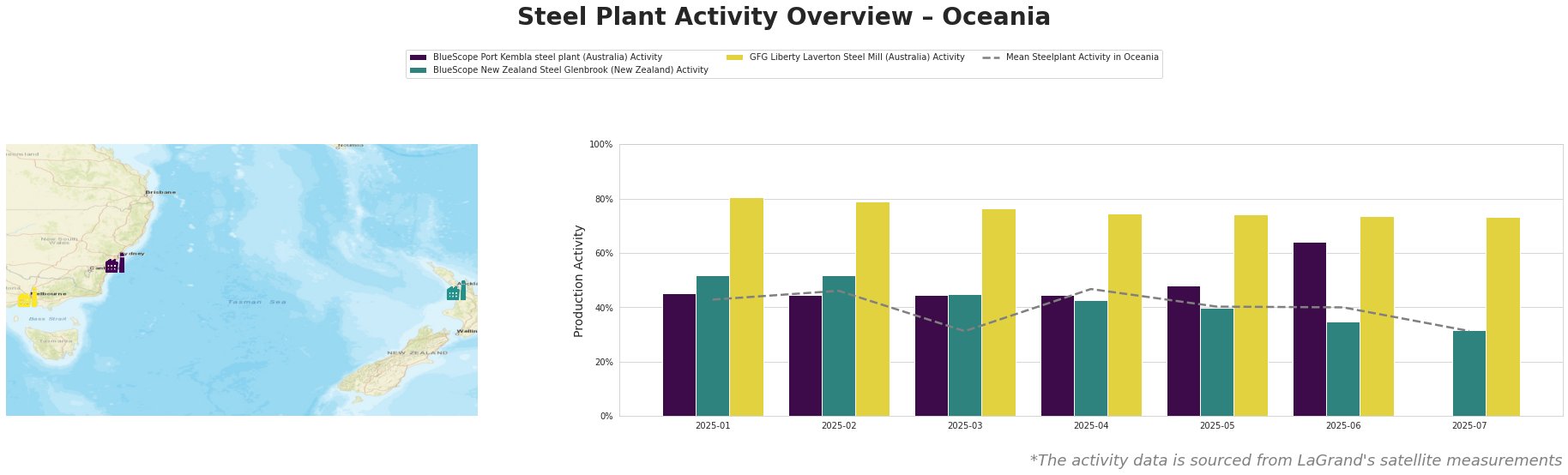

Oceania’s steel market shows mixed signals. Activity at BlueScope Port Kembla surged in June, while activity at BlueScope New Zealand Steel Glenbrook dipped, contrasting with stable European steel prices reported in articles such as “European steel prices CRC, HRC HRC stable amid seasonally low demand” and “Long products prices in Europe are stable and may decrease due to the upcoming holidays“. A direct relationship between European price stability and the activity changes in Oceania cannot be established based on the provided information.

The mean steel plant activity in Oceania fluctuated, with a high of 47% in April and a low of 31% in March and July. BlueScope Port Kembla’s activity peaked at 64% in June. BlueScope New Zealand Steel Glenbrook saw a decrease to 35% in June and 32% in July. GFG Liberty Laverton Steel Mill shows a consistently high activity level, remaining above 70% throughout the observed period, with a slight decreasing trend.

BlueScope Port Kembla, an integrated steel plant in New South Wales, Australia, utilizes BF/BOF technology with a crude steel capacity of 3.2 million tonnes per annum. Its activity jumped significantly to 64% in June. Based on current data, no direct connection to news articles can be established.

BlueScope New Zealand Steel Glenbrook, an integrated DRI-based plant, experienced a decline in activity, dropping to 35% in June and 32% in July. The Glenbrook plant has a crude steel capacity of 650,000 tonnes per annum. This decline occurs during a period when European markets are experiencing seasonally low demand, however no direct connection can be established.

GFG Liberty Laverton Steel Mill, a smaller EAF-based plant in Victoria, Australia with a capacity of 660,000 tonnes per annum, maintained a relatively stable, high level of activity. No direct connection can be established based on current data.

The increased activity at BlueScope Port Kembla, coupled with the decreased activity at BlueScope New Zealand Steel Glenbrook, may indicate a shift in regional supply dynamics. Steel buyers should:

- Monitor Port Kembla’s output: Given the surge in activity at BlueScope Port Kembla, buyers in the building and infrastructure sectors (its primary end-user sector) might find increased availability of slabs, hot rolled coil, and plate.

- Diversify sourcing: The drop in activity at BlueScope New Zealand Steel Glenbrook suggests potential supply constraints for hot and cold-rolled products. Buyers relying on Glenbrook should explore alternative sources to mitigate risk. The article “The mood in the European steel HRC market is mixed, trading is calm” indicates potential import opportunities, but buyers should closely monitor trade conditions.

- Consider Forward Purchasing: given the mixed mood within the HRC market, it may be wise to consider forward purchases from alternative locations to compensate for decreased activity at BlueScope New Zealand Steel Glenbrook, as well as the potential risk of increased prices in the near term if Port Kembla is affected by unforeseen circumstances.