From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market: Mixed Activity Amidst Stable Demand

Oceania’s steel market shows mixed activity levels across its major plants, while European HRC price standoffs may influence global supply dynamics. Though the provided news articles focus on the European HRC market, their implications for global supply chains warrant attention, particularly if European mills reduce exports due to CBAM, as suggested in “European HRC market faces price standoff between mills, buyers” and “The European HRC market is facing a price standoff between manufacturers and buyers“. However, no direct connection between these European developments and observed Oceania steel plant activity can be currently established based on the provided data.

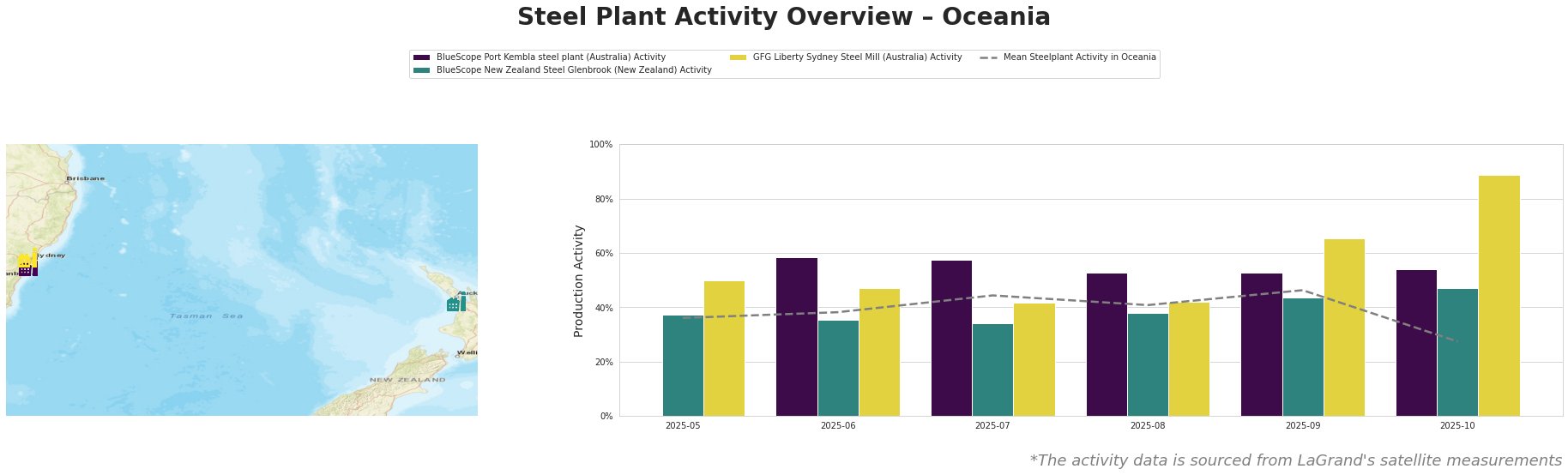

The mean steel plant activity in Oceania experienced a sharp drop to 27% in October, a significant deviation from the 46% recorded in September, indicating a potential regional slowdown.

BlueScope Port Kembla steel plant, an integrated BF-BOF facility in New South Wales with a 3.2 million tonne crude steel capacity, shows relatively stable activity, fluctuating between 53% and 58% from June to October. No direct relationship can be established with the named news articles.

BlueScope New Zealand Steel Glenbrook, an integrated DRI-BOF plant in South Auckland with 650,000 tonnes crude steel capacity, had more variable activity. It rose steadily from 34% in July to 47% in October, exceeding the Oceania average in the last month. No direct relationship can be established with the named news articles.

GFG Liberty Sydney Steel Mill, an EAF-based plant in New South Wales with 750,000 tonnes crude steel capacity, demonstrates the most significant change, peaking at 89% activity in October after a steady increase from 42% in July. This is notably above the Oceania average. No direct relationship can be established with the named news articles.

The European HRC market’s situation, as described in “The European HRC steel market remains calm, expecting a revival in January” and “European steel HRC market remains quiet, awaiting January revival,” could indirectly influence Oceania steel prices if European mills redirect supply due to CBAM. The October drop in mean Oceania steel plant activity, especially contrasting the high level at GFG Liberty Sydney Steel Mill, suggests varied operational decisions across the region.

Procurement Actions:

- Steel Buyers: Closely monitor European HRC price trends and CBAM implementation as outlined in “European HRC market faces price standoff between mills, buyers” to anticipate potential global supply chain shifts. Although no direct link to Oceania activity is confirmed, prepare for possible price volatility driven by international market dynamics. Diversify supply sources and negotiate flexible contract terms to mitigate risks associated with potential import price fluctuations.

- Market Analysts: Investigate the reasons behind the sharp drop in average Oceania steel plant activity in October, with focused data collection on the 3 facilities described above. Further research is needed to determine whether this decline is temporary or indicative of a broader trend and the driving factors of the GFG Liberty Sydney Steel Mill activity increase.