From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market Faces Downturn: Plant Activity Declines Amid Global Uncertainty

Oceania’s steel market is showing signs of weakness as evidenced by decreasing steel plant activity. While European manufacturers are raising prices, as highlighted in “ArcelorMittal and other European manufacturers of rolled products raise prices: sources,” this upward pressure doesn’t appear to be impacting Oceania positively. No direct relationship to plant activity changes can be established from this news. In contrast, the “Long products prices in Northern Europe are declining due to limited demand” article reflects a broader trend of weakening demand, which may indirectly contribute to the observed activity declines in Oceania.

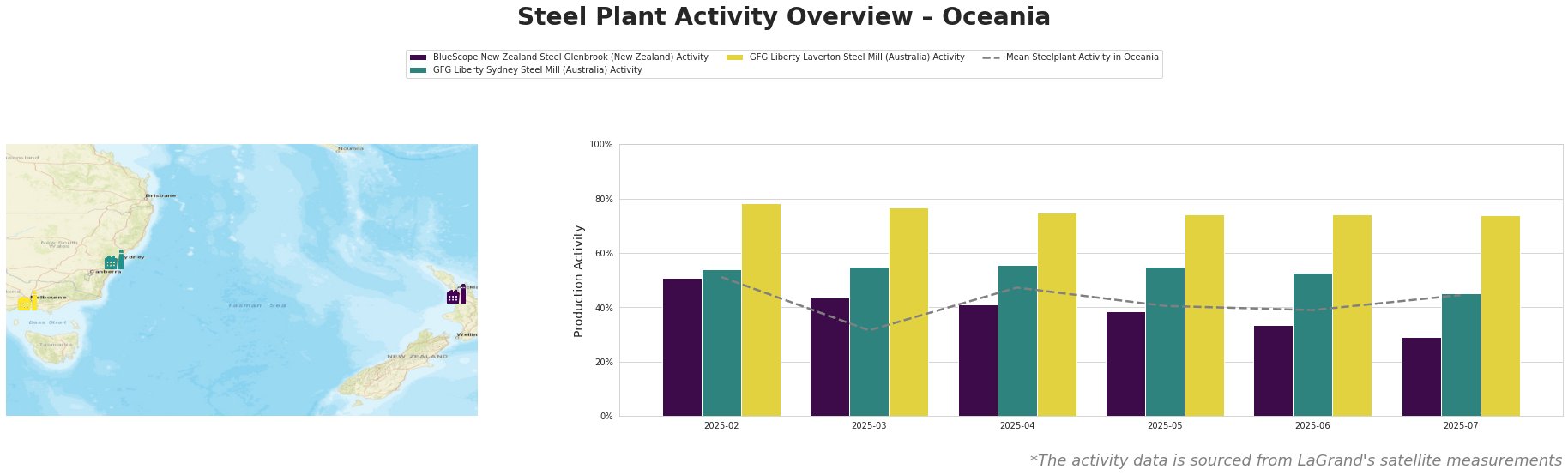

The mean steel plant activity in Oceania has fluctuated, reaching a low of 32.0% in March and peaking at 51.0% in February. By July, it settled at 45.0%, indicating a general downward trend over the observed period. BlueScope New Zealand Steel Glenbrook shows a notable decline, reaching its lowest activity level in July at 29.0%. GFG Liberty Sydney Steel Mill also shows a significant drop, from 54.0% in February to 45.0% in July. GFG Liberty Laverton Steel Mill has maintained a relatively stable activity level throughout the period, consistently above the mean.

BlueScope New Zealand Steel Glenbrook, an integrated plant with DRI and BOF technologies producing 650 ttpa of crude steel, experienced a significant drop in activity, plummeting to 29.0% in July. This decline contrasts with the news from “ArcelorMittal and other European manufacturers of rolled products raise prices: sources“, suggesting that regional factors in Oceania may be overriding any global price increases. However, the connection is not explicit.

GFG Liberty Sydney Steel Mill, an EAF-based plant with a capacity of 750 ttpa, experienced a decrease in activity to 45.0% in July. This decline may be reflective of the broader demand slowdown as suggested by “Long products prices in Northern Europe are declining due to limited demand“, considering that this plant focuses on long products such as reinforcing bar and mesh for the building and infrastructure sector, a sector sensitive to economic conditions.

GFG Liberty Laverton Steel Mill, another EAF-based long products producer with a capacity of 660 ttpa, has maintained a stable activity level around 74-78% throughout the observed period, remaining consistently above the regional mean. Despite overall downward trends, this plant’s relative stability might indicate a strong order book or a focus on specific niche markets less affected by broader economic downturns. No direct connection to news articles can be established.

The observed activity declines at BlueScope New Zealand Steel Glenbrook and GFG Liberty Sydney Steel Mill, combined with the general downward trend in mean activity levels across Oceania, indicate a potential weakening of the steel market in the region. While European mills are attempting price increases as reported in “European HRC market slows for summer; prices steady despite higher offers“, the lack of a corresponding increase in Oceania suggests regional demand is not strong enough to support higher prices.

Evaluated Market Implications:

Given the observed reduction in plant activity, especially at BlueScope New Zealand Steel Glenbrook, steel buyers should:

- Monitor Inventory Levels: Closely track inventory levels of hot-rolled and cold-rolled products sourced from BlueScope New Zealand Steel Glenbrook. The sharp decline in activity to 29.0% in July raises concerns about potential supply disruptions in the coming months.

- Diversify Sourcing: Explore alternative sources for long products, particularly reinforcing bar and mesh. The activity decline at GFG Liberty Sydney Steel Mill, coupled with the broader decline in European long product prices, suggests that diversifying sourcing may provide opportunities to secure more favorable pricing.

- Negotiate Contracts Carefully: When negotiating contracts, be cautious about accepting higher prices based on European market trends. The Oceania market appears to be facing different dynamics, with potential for weaker demand and reduced domestic production.