From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market: BlueScope Port Kembla Activity Surge Contrasts Flat European HRC Prices

Oceania’s steel market presents a mixed picture. While European HRC prices remain largely flat due to sluggish demand and competitive imports, as indicated by news articles such as “HRC prices broadly flat in Europe; slow demand, competitive imports weigh on sentiment” and “HRC prices in Europe generally remain at the same level; low demand and competitive imports affect sentiment,” observed activity at BlueScope Port Kembla in Australia has increased. However, these European price trends do not directly influence Oceania, and no explicit link between the European news articles and Oceania steel plant activity can be established.

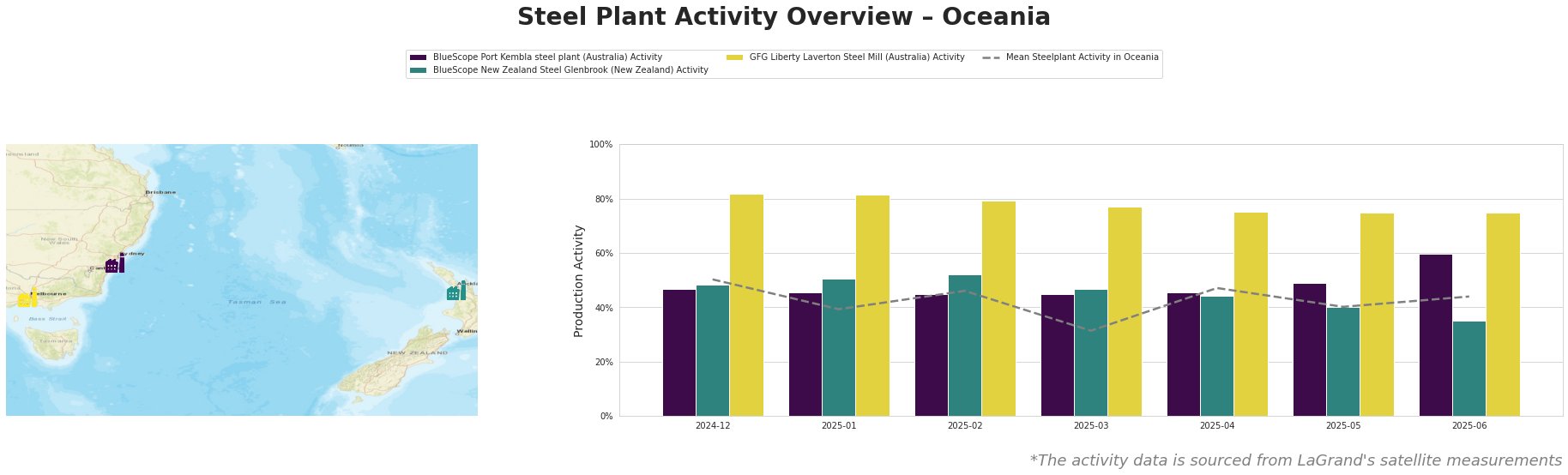

The mean steel plant activity in Oceania has fluctuated significantly, reaching a low of 31% in March 2025 and peaking at 50% in December 2024. BlueScope Port Kembla’s activity saw a notable increase to 60% in June 2025, significantly above the Oceania mean of 44%. GFG Liberty Laverton Steel Mill consistently showed high activity, remaining between 75% and 82% throughout the observed period. BlueScope New Zealand Steel Glenbrook experienced a decrease to 35% in June 2025.

BlueScope Port Kembla steel plant: This integrated steel plant in New South Wales, Australia, utilizes basic oxygen furnace (BOF) technology with a crude steel capacity of 3.2 million tonnes per annum. The plant produces semi-finished and finished rolled products, including hot-rolled coil and plate, primarily for the building and infrastructure sectors. Satellite data reveals a significant activity increase to 60% in June 2025, up from 49% in May 2025. This increase is notable. Given that all listed news articles discuss the European market, no direct connection can be established.

BlueScope New Zealand Steel Glenbrook: Located in South Auckland, this plant employs DRI (Direct Reduced Iron) and BOF technologies, with a crude steel capacity of 650,000 tonnes per annum. Its product range includes hot and cold-rolled products, serving the building, infrastructure, steel packaging, and machinery sectors. The plant’s activity decreased to 35% in June 2025, a substantial drop from 40% in May and significantly below the Oceania average. Given that all listed news articles discuss the European market, no direct connection can be established.

GFG Liberty Laverton Steel Mill: This electric arc furnace (EAF) based mill in Victoria, Australia, has a crude steel capacity of 660,000 tonnes per annum. It specializes in steel long products, including reinforcing bar and mesh, catering to the building, infrastructure, energy, and transport sectors. The plant has maintained a consistently high activity level, remaining at 75% since April 2025. Given that all listed news articles discuss the European market, no direct connection can be established.

Evaluated Market Implications:

The observed increase in activity at BlueScope Port Kembla, coupled with the decreased activity at BlueScope New Zealand Steel Glenbrook, suggests a potential shift in regional supply dynamics within Oceania. However, the news articles provided pertain exclusively to the European market and therefore offer no direct insights into the drivers behind these Oceania-specific trends.

Recommended Procurement Actions:

- Steel Buyers in Australia: Given the increased activity at BlueScope Port Kembla, buyers should anticipate stable or potentially increased availability of hot-rolled coil and plate from this source. It would be prudent to confirm stock levels and lead times with Bluescope directly.

- Steel Buyers in New Zealand: The observed decrease in activity at BlueScope New Zealand Steel Glenbrook implies potential supply constraints for hot and cold-rolled products. Buyers should proactively assess their inventory levels and explore alternative supply sources, potentially including imports, while closely monitoring the situation for any announcements regarding operational adjustments at the Glenbrook plant.

- Market Analysts: Focus on gathering more granular data regarding Oceania specific dynamics in order to better understand the implications of trends. The trends observed could offer valuable insights for refining predictive models and optimizing procurement strategies within Oceania’s steel market.