From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market: Activity Fluctuations Amidst European HRC Uncertainty

Oceania’s steel market shows mixed activity trends amidst global uncertainty reflected in the European HRC market. Although no direct connection can be established, the sentiment expressed in the article “The expectations of buyers and sellers in the European HRC steel market differ,” highlighting cautious buyer behavior, may influence Oceania’s import/export dynamics. Similarly, “Buyers’, sellers’ expectations vary in European steel HRC market“ and “European HRC market in wait-and-see mode” reveal a cautious market with uncertain demand and potential price instability, which could impact Oceania’s steel market.

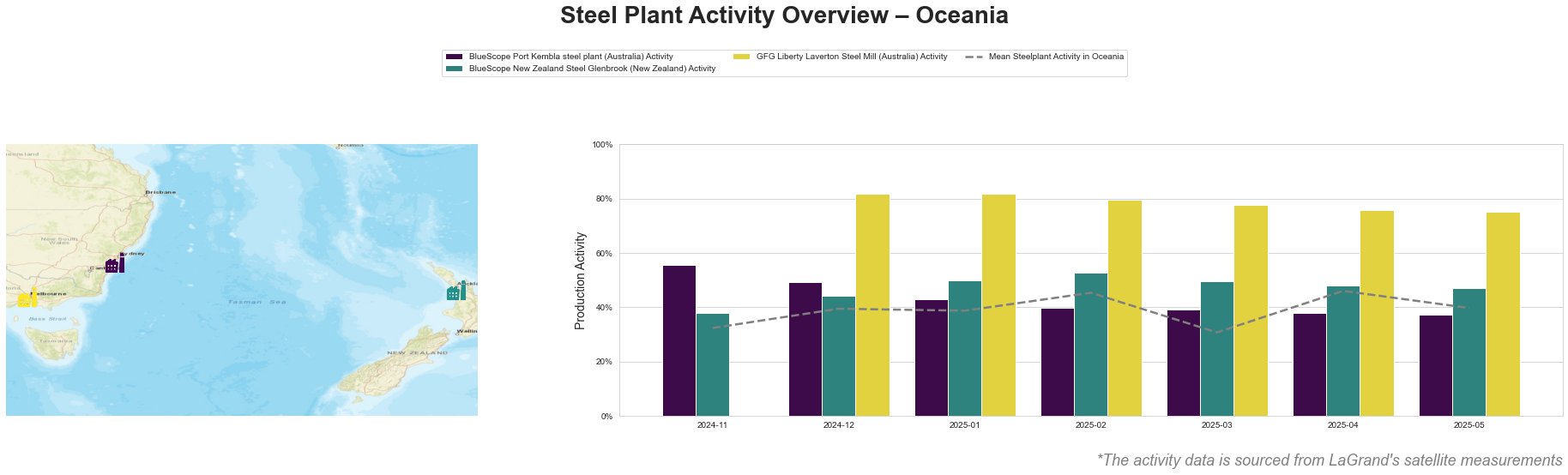

Overall, Oceania’s mean steel plant activity shows volatility. After peaking in April 2025 at 46.0%, it dropped to 40.0% in May 2025.

BlueScope Port Kembla steel plant, an integrated BF-BOF operation in New South Wales, Australia with a 3.2 million tonnes per annum (ttpa) crude steel capacity, has shown a consistent decline in activity from 56.0% in November 2024 to 37.0% in May 2025. No explicit connection can be established between this decline and the European market news, but the drop might indicate localized operational adjustments or demand shifts in the building and infrastructure sectors it serves.

BlueScope New Zealand Steel Glenbrook, an integrated DRI-BOF operation in South Auckland, New Zealand with a 0.65 million ttpa crude steel capacity, experienced fluctuating activity. Starting at 38.0% in November 2024, it peaked at 53.0% in February 2025, before settling at 47.0% in May 2025. This variability may reflect the plant’s responsiveness to regional demand in sectors like building, infrastructure, and steel packaging. There is no direct link to the European HRC market news.

GFG Liberty Laverton Steel Mill, an EAF-based mill in Victoria, Australia with a 0.66 million ttpa crude steel capacity, has maintained high activity levels, ranging from 75.0% to 82.0% between December 2024 and May 2025. Its focus on long products for building, infrastructure, energy, and transport sectors may explain its relatively stable output. There is no direct link between this plant’s activity and the European market news.

Given the consistent decline in activity at BlueScope Port Kembla, coupled with the cautious sentiment in the European HRC market as reported in “The expectations of buyers and sellers in the European HRC steel market differ,” steel buyers focused on hot-rolled coil and plate products from this plant should:

- Closely monitor inventory levels: The declining activity might lead to potential supply delays. Increase safety stock if possible.

- Diversify supply options: Explore alternative suppliers of similar grade steel to mitigate risks associated with potential disruptions at Port Kembla.

- Negotiate contract terms: Revisit contract terms with BlueScope Port Kembla, paying close attention to delivery timelines and force majeure clauses.

The overall volatility in Oceania’s steel plant activities and the uncertainty in the European HRC market necessitate a proactive and flexible procurement strategy.