From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorway Steel Market Booms Amid CBAM Push: Celsa Nordic Activity Surges

Norway’s steel market shows strong growth potential, fueled by its proactive stance on carbon border adjustments. This positive outlook is reinforced by significant activity increases at key steel plants. Norway’s commitment is highlighted in the news articles “Norway has expressed its position on CBAM,” “Norway calls for stronger EU CBAM to prevent carbon leakage and close loopholes,” and “Norway calls for strengthening of EU CBAM to prevent carbon leakage and eliminate loopholes,” indicating a proactive approach to leveling the playing field for its domestic steel producers, especially those utilizing renewable energy.

Observed Plant Activity:

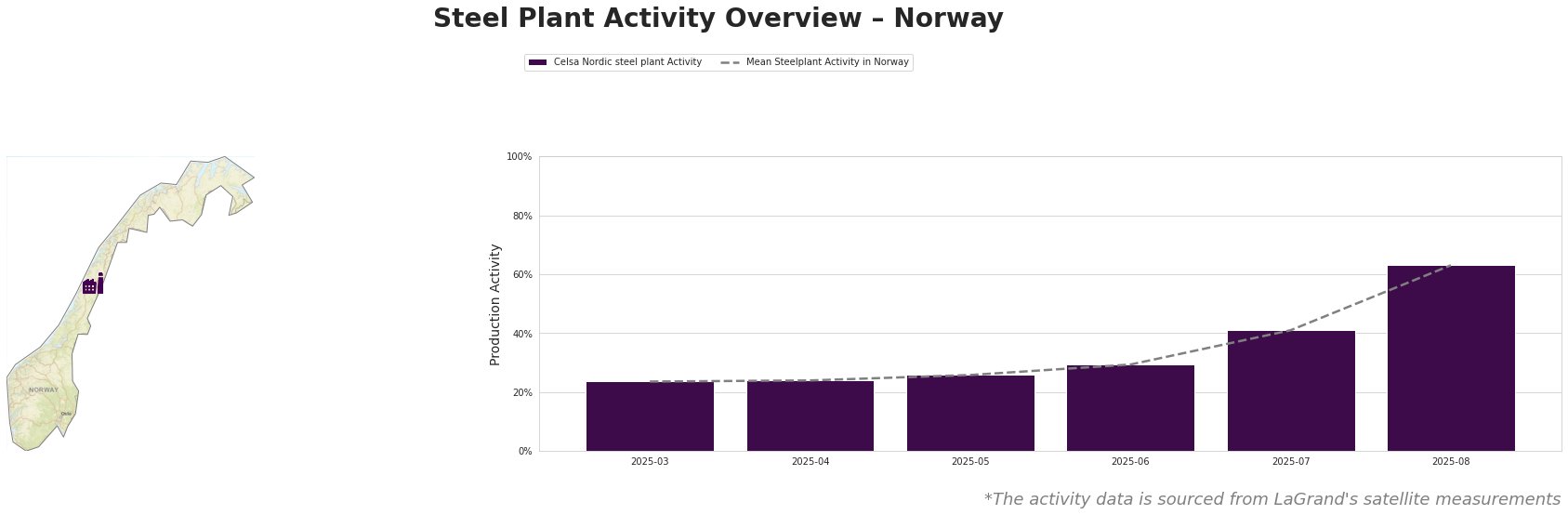

The data reveals a consistent increase in steel plant activity in Norway. The mean steel plant activity rose significantly from 24% in March-April 2025 to 63% in August 2025. The Celsa Nordic steel plant closely mirrors this trend, exhibiting identical activity levels to the national average. This increase may be influenced by Norway’s support for a stronger CBAM, as highlighted in the news articles, though a direct causal link cannot be definitively established.

Steel Plant Name: Celsa Nordic steel plant

Celsa Nordic, located in Mo i Rana, is an electric arc furnace (EAF) based steel plant with a crude steel production capacity of 700 thousand tonnes per annum, specializing in semi-finished and finished rolled products such as billet, rebar, and wire rod for the building and infrastructure sectors. The plant is ResponsibleSteel certified and employs 340 people. Its activity has increased considerably, from 24% in March-April 2025 to 63% in August 2025, mirroring the national average. This substantial increase in activity could be a response to anticipated demand shifts resulting from Norway’s advocacy for a more robust CBAM, aimed at protecting domestic industries like Celsa Nordic. However, the news articles do not explicitly mention the plant, so a definite cause-and-effect relationship cannot be proven.

Evaluated Market Implications:

The consistent rise in activity at Celsa Nordic suggests an increase in domestic steel supply capacity within Norway. Given Norway’s strong support for an enhanced CBAM, as evidenced by “Norway has expressed its position on CBAM,” “Norway calls for stronger EU CBAM to prevent carbon leakage and close loopholes,” and “Norway calls for strengthening of EU CBAM to prevent carbon leakage and eliminate loopholes,” steel buyers should anticipate potentially reduced reliance on imports from regions with less stringent carbon emissions regulations. Procurement actions should include exploring longer-term contracts with Celsa Nordic to secure supply, potentially mitigating future price volatility as the CBAM implementation progresses. Market analysts should closely monitor the impact of Norway’s CBAM policies on import/export dynamics and regional steel pricing.