From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America’s Steel Market: Strong Upswing Amid Positive Automotive Sales Outlook

The North American steel market exhibits a very positive sentiment, attributed primarily to buoyant automotive sector forecasts. Notably, U.S. new car sales surged to 15.9 million units in 2024, marking a 2.2% increase from 2023, as reported in the article “Is Lithia Motors, Inc. (LAD) Among the Best Car Stocks To Buy In 2025?” This increase in production reflects rising demand for hybrid vehicles and aligns with observed spikes in steel plant activity levels across the region.

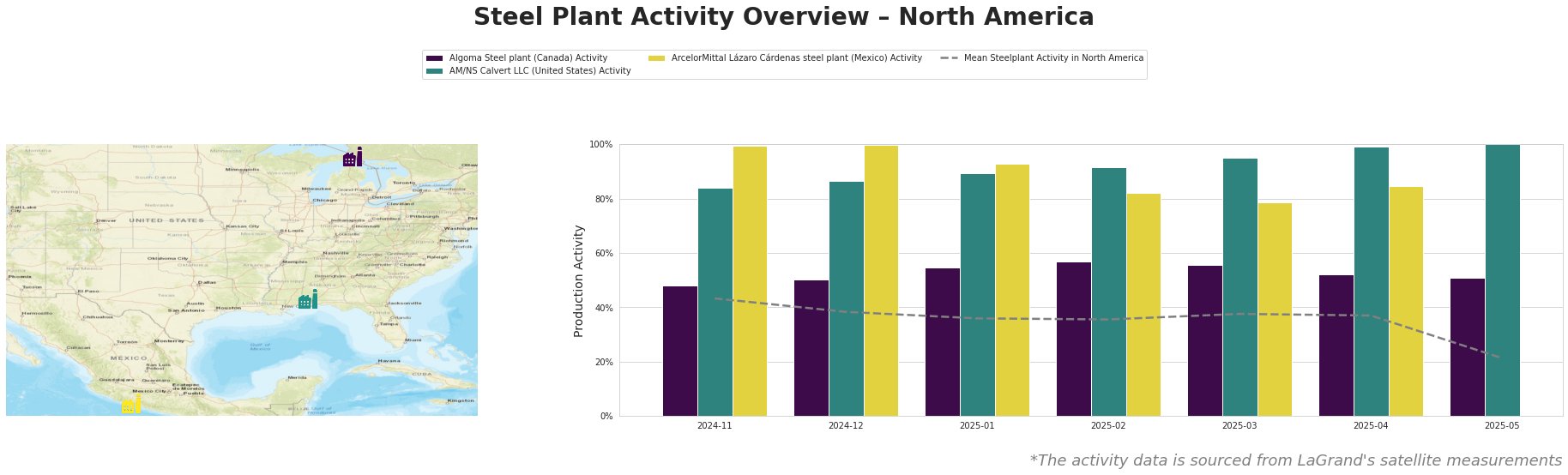

Recent data indicates that AM/NS Calvert LLC reached a peak activity level of 100% in May 2025, aligning with increased demand for finished steel products driven by automotive recovery. This is corroborated by trends observed in the automotive sector, including reports from “Is Ford Motor Company (F) Among the Best Car Stocks To Buy In 2025?”. Conversely, the ArcelorMittal Lázaro Cárdenas plant achieved an all-time high of 100% in December 2024, later stabilizing at 79% by March 2025 without clearly established correlation to any named article’s content.

Algoma Steel demonstrated stable production fluctuations, maintaining activity levels between 48% and 57% throughout the observation period, suggesting resilience but minor adjustment in response to the overall market dynamics highlighted in the automotive sales growth.

Both Algoma and AM/NS Calvert LLC are expected to face potential supply pressures should the automotive industry experience unexpected demand shifts due to political uncertainties as noted in “Is Li Auto Inc. (LI) Among the Best Car Stocks To Buy In 2025?” While no direct activity link was observed with respect to Algoma Steel’s fluctuations, the sustained performance of AM/NS Calvert LLC may indicate short-term procurement opportunities for steel buyers focusing on automotive and infrastructure sectors.

Careful monitoring of these plants is imperative as the industry navigates the interplay between market sentiment, automotive production forecasts, and policy changes that could affect steel supply dynamics. It is recommended that procurement strategies prioritize contracts with AM/NS Calvert LLC to capitalize on their peak capabilities and monitor political developments that might impact overall demand in the automotive space.