From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America’s Steel Market Soars Amid Tariff Strategies: Insights for Buyers

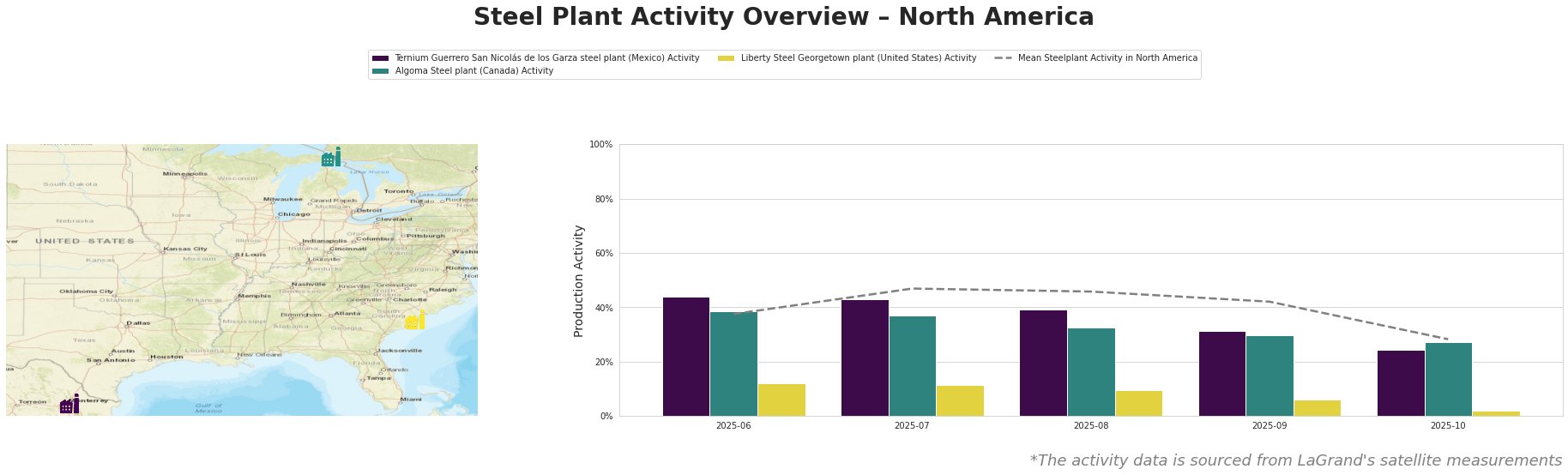

Activity levels at steel plants in North America demonstrate a robust market outlook, particularly influenced by Mexico’s recent tariff announcements targeting Asian imports. The articles titled “Mexico Announces Up To 50% Tariffs On India, China And Other Asian Countries — Details Inside“ and “Mexico approves new tariff hikes against China“ highlight significant changes that are set to shift supplier dynamics and bolster local production.

The data reveals a downward trend for all plants in October, culminating in an aggregate mean activity of 28%. Notably, the Ternium Guerrero plant saw its activity drop to 24%, signaling possible inefficiencies amidst increasing tariffs. Conversely, the Algoma Steel plant remained comparatively stable with 27%, while Liberty Steel Georgetown sharply fell to 2%. This decrease could be linked to increasing price pressures resulting from competitive imports, raised by Mexico’s tariffs.

Ternium Guerrero relies heavily on local iron ore for its DRI and EAF production methods, producing semi-finished and finished rolled products predominantly for the construction and machinery sectors. The plant’s activity trends suggest an unsteady market response, likely affected by the upcoming tariff changes which aim to fortify domestic industry, as noted in “Mexico approves tariff increases on Chinese and other Asian imports.” However, these shifts might exacerbate the overall regional supply situation, particularly affecting pricing and availability of imported steel.

The Algoma Steel plant’s robust activity level and certifications mark it as a resilient player amid fluctuating regional dynamics. Its integrated BF process allows for efficient transitions to local market demands despite external pressures. However, the recent tariff constructions might complicate supply choices if other plants in North America begin to dominate the domestic market. The imminent tariff measures outlined in “Mexico approves new tariff hikes against China” will heighten competition and could eventually lead to shifts in supplier preferences.

Liberty Steel Georgetown’s diminutive performance at 2% presents a critical potential supply disruption for customers in the South Carolina area, particularly given the plant’s role in producing niche products for sectors like automotive and building construction. The plant’s singular focus on EAF technology—though environmentally friendly—may need strategic reassessment to counteract tariff-induced pricing effects from non-North American steel.

Market Implications and Recommendations

Given the strong tariff alignments, buyers should prepare for potential short-term supply disruptions as domestic capacity may not immediately compensate for the imported goods previously sourced from Asia. For steel buyers:

- Consider securing contracts with Algoma Steel or Ternium Guerrero, which are less exposed to foreign trade disputes, ensuring more predictable pricing and availability.

- Evaluate Liberty Steel’s product offerings, particularly for local supply needs, but be cautious of its current low output which might not meet demand.

- Monitor the evolving tariff situation, as increased costs for competitors could create pricing opportunities in the domestic market, ensuring negotiations with suppliers reflect these changes.

Acting on these insights will better position steel buyers leveraging local capacities while adapting to the shifting global trading landscape.