From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America’s Steel Market Report: Activity Soars Amid Positive Economic Indicators

Recent developments in North America’s steel industry reflect a robust landscape, particularly in the context of the ongoing U.S. economic recovery. As highlighted in Is Westlake Corp. (NYSE:WLK) a Small-Cap Construction and Materials Stock Hedge Funds Are Buying?, the recent addition of 177,000 jobs combined with stable unemployment rates is fostering investment interest in construction and materials stocks. This economic backdrop correlates with observed growth in steel plant activities, reinforcing a very positive sentiment in the market.

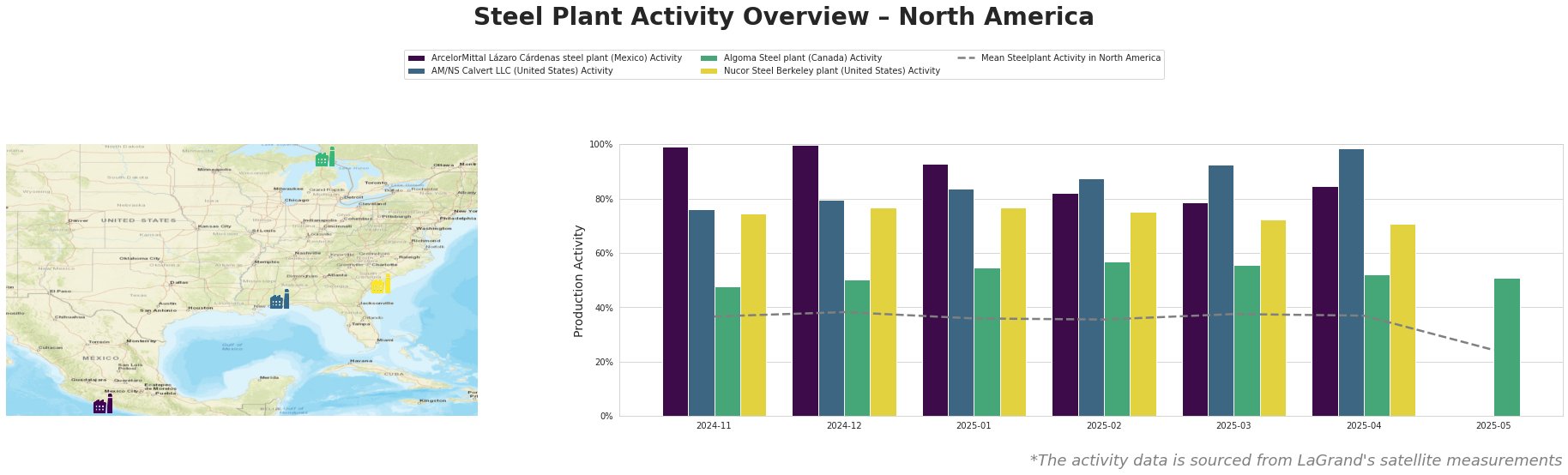

Activity levels at the ArcelorMittal Lázaro Cárdenas steel plant have impressively peaked at 100% in December 2024. The plant’s integrated processes, including a significant DRI capacity, suggest a strong operational performance potentially driven by increased construction demand as noted in the job growth highlighted in the aforementioned article.

AM/NS Calvert LLC demonstrated sustained activity, hitting 99% in April 2025, aligning well with growing sector investments. The electric arc furnace (EAF) technology employed here supports a quick response to the upward demand in finished steel products, particularly in the automotive sector, corroborated by the job data trends mentioned.

In Algoma Steel‘s report, activity levels fluctuated but remained robust, registering a maximum of 57% in February 2025. Recent trends show stable employment in construction sectors which could be aligning with moderate production adjustments at this facility.

The Nucor Steel Berkeley plant experienced slight variability, peaking at 77%. With its operational focus on EAF and a smaller workforce, this site’s production efficiency highlights adaptability to market conditions, linking back to broader positive industry sentiment.

Evaluated Market Implications

Supply disruptions should be monitored at plants experiencing declines, notably the drop in activity at Nucor Steel Berkeley from April to May 2025. Continued vigilance in procurement practices is recommended. Steel buyers should explore agreements with AM/NS Calvert LLC, leveraging their high activity levels for increased volume negotiations amidst rising demand forecasts and accelerated hiring trends drawn from insights in the news around small-cap stock investments linked to the uptick in construction. The strong performance at ArcelorMittal Lázaro Cárdenas may also provide opportunities for collaborations in high-demand sectors like automotive.