From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Surges: Trade Deal & Tech Optimism Fuel Plant Activity

North America’s steel market exhibits very positive sentiment, influenced by trade developments and tech sector optimism. Increased plant activity is potentially linked to positive market signals from articles such as “Wall St futures rise on trade hope; earnings kick into high gear” and “Stock Index Futures Climb as U.S. Reaches Trade Deal With Japan, Tesla and Alphabet Earnings Awaited“, although a direct connection cannot be definitively established through the provided data alone.

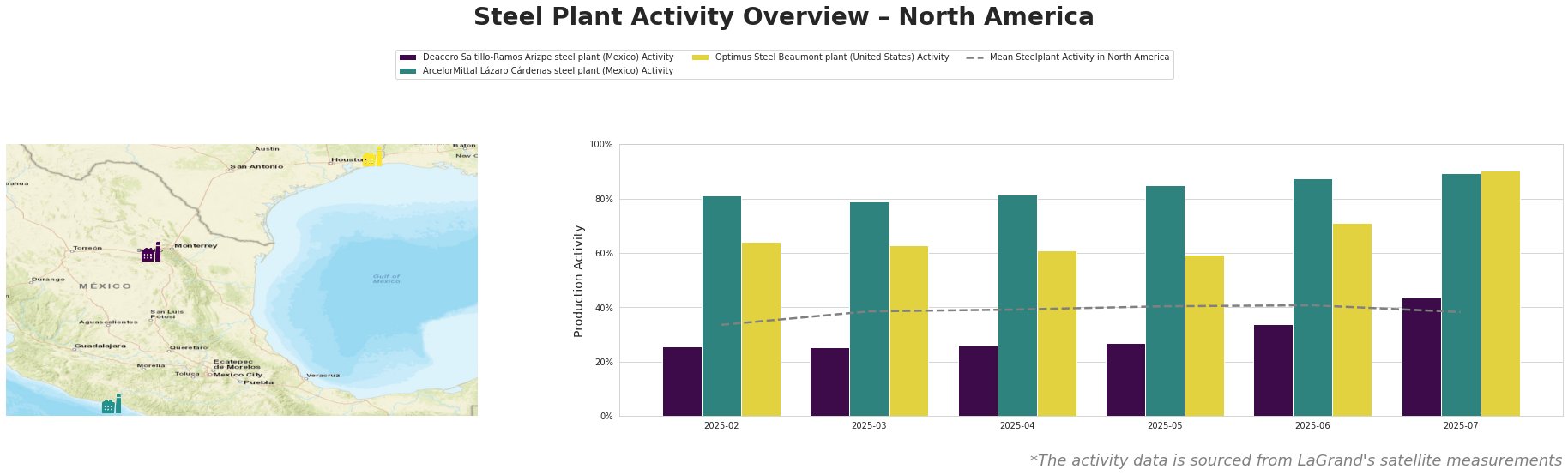

The mean steel plant activity in North America shows a generally increasing trend from February to June, peaking at 41.0%, before declining slightly to 38.0% in July. ArcelorMittal Lázaro Cárdenas steel plant consistently operated well above the average, reaching a peak of 90.0% in July. The Optimus Steel Beaumont plant saw a significant increase to 90.0% activity in July, while Deacero Saltillo-Ramos Arizpe steel plant consistently operated below the average until July when it experienced a sharp rise to 44.0%.

Deacero Saltillo-Ramos Arizpe steel plant: This EAF-based plant in Coahuila, Mexico, with a 700 ttpa crude steel capacity producing steel profiles for building and infrastructure, demonstrated a notable increase in activity in July, reaching 44.0%. This represents a significant jump from previous months and surpasses the overall North American average. While articles like “Stock Index Futures Climb as U.S. Reaches Trade Deal With Japan, Tesla and Alphabet Earnings Awaited” suggest a positive economic outlook, no direct connection can be explicitly established between these general trends and the plant’s activity surge based on the provided information.

ArcelorMittal Lázaro Cárdenas steel plant: This integrated steel plant in Michoacán, Mexico, boasts a 5700 ttpa crude steel capacity utilizing both BF/BOF and DRI/EAF processes. The plant maintained high activity levels throughout the observed period, peaking at 90.0% in July, significantly above the North American average. This could indicate strong demand for its products like rod, wire rod, billet, and slab across various sectors, including automotive and infrastructure. However, without more specific data, a direct causal link to news events such as those surrounding U.S.-Japan trade relations in “Stock Index Futures Climb as U.S. Reaches Trade Deal With Japan, Tesla and Alphabet Earnings Awaited” cannot be established.

Optimus Steel Beaumont plant: Located in Texas, United States, this EAF-based plant with a 700 ttpa crude steel capacity experienced a substantial surge in activity in July, reaching 90.0%. This marks a significant recovery from lower activity levels in previous months. While the rise may be connected to the improved market sentiment indicated in “Wall St futures rise on trade hope; earnings kick into high gear,” no direct link is confirmable from the provided data. The plant’s output of wire rods, coiled rebar, and billets likely serves the building and infrastructure sectors.

Evaluated Market Implications:

The marked increase in activity at Optimus Steel Beaumont plant (United States) and Deacero Saltillo-Ramos Arizpe steel plant (Mexico) in July, combined with the consistently high output from ArcelorMittal Lázaro Cárdenas (Mexico), could indicate either increased regional demand or preparations for future demand growth spurred by positive trade news. While the news articles suggest overall optimism, procurement professionals should monitor spot prices closely in Texas and Coahuila for potential short-term price increases due to the rapid activity increases at the Optimus Steel Beaumont and Deacero Saltillo-Ramos Arizpe plants. The consistency and high activity at ArcelorMittal suggests a stable supply of its products for the time being.