From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Surges on Tariff News: Monitor Mexican Supply Chains

The North American steel market exhibits strong upward momentum driven by anticipated and implemented tariffs, yet with differentiated regional impacts. News articles “The United States plans to impose duties on imports of steel and semiconductor chips” and “Weitere Produkte betroffen: USA weiten Einfuhrzölle auf Stahl und Aluminium aus – Fortschritte bei China-Gesprächen” both indicate increasing protectionism in the US steel market, possibly affecting activity at various plants. The DOC amendment to Section 232, as highlighted in “Cleveland-Cliffs applauds the DOC adding more derivative steel items to Section 232,” directly correlates with heightened vigilance needed concerning tariff circumvention, particularly affecting Mexican and Canadian steel supply chains. No direct link between these articles and the satellite data could be observed.

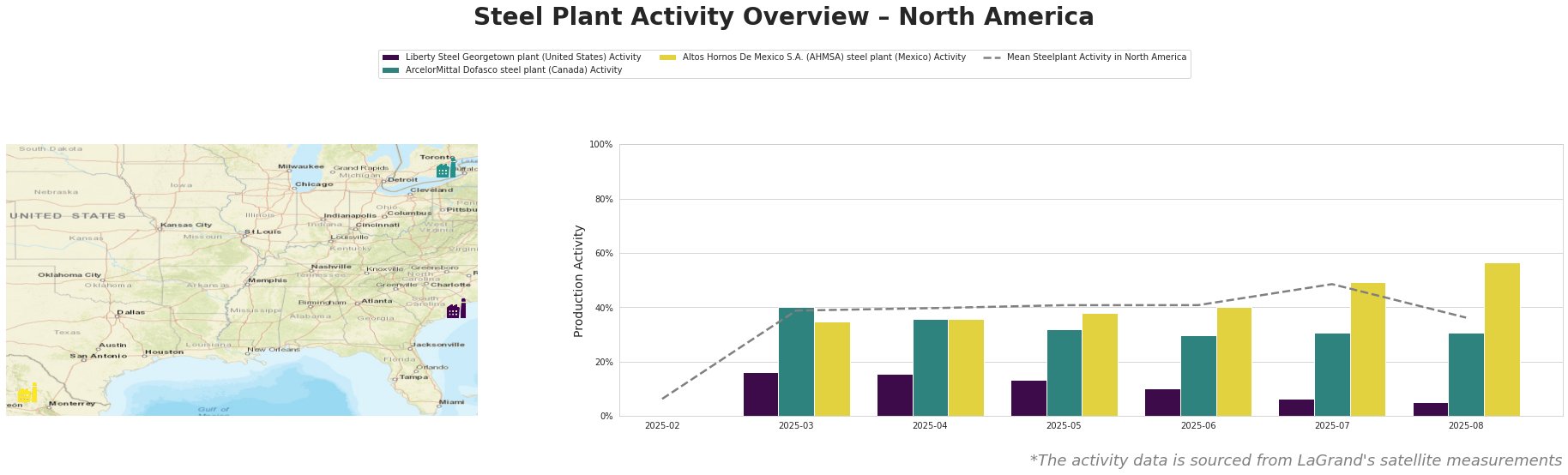

The average North American steel plant activity shows a peak in July 2025 at 49%, followed by a sharp decline to 36% in August. Liberty Steel Georgetown plant consistently operates well below the North American average, declining to a low of 5% in August. ArcelorMittal Dofasco displays more stable activity, peaking at 40% in March and then decreasing to 31% in August. Altos Hornos De Mexico (AHMSA) shows a significant increase, reaching its highest activity level in August at 57%, diverging from the overall North American downward trend. No direct correlation could be established between the general activity and the mentioned news articles.

Liberty Steel Georgetown, a US-based plant with a 908 ttpa EAF-based crude steel capacity focusing on semi-finished and finished rolled products, including wire and bar products, experienced a steady decline in activity, hitting a low of 5% in August. This continuous decline, while potentially concerning, could not be explicitly linked to any of the tariff-related news articles.

ArcelorMittal Dofasco, a Canadian integrated steel plant with a 4050 ttpa crude steel capacity using BF, BOF, and EAF technologies, producing finished rolled products for automotive and infrastructure, saw its activity decrease steadily from 40% in March to 31% in August. This decrease doesn’t show drastic changes that can be related to tariffs.

Altos Hornos De Mexico (AHMSA), a Mexican integrated steel plant boasting a 5500 ttpa crude steel capacity and utilizing BF, BOF, and EAF production routes, including hot and cold rolled sheets, observed a significant activity increase to 57% in August. This surge occurs even as the North American average declines, indicating a potentially strategic response to US tariffs, possibly aimed at increased exports before tariffs fully impact Mexican steel. The news article “Cleveland-Cliffs applauds the DOC adding more derivative steel items to Section 232” mentioned circumvention of tariffs via Mexico.

The observed activity data, specifically the increase in AHMSA’s output, combined with the “Cleveland-Cliffs applauds the DOC adding more derivative steel items to Section 232” article, suggests potential circumvention strategies are being employed.

Recommendations for Steel Buyers and Analysts:

- Increase monitoring of Mexican steel supply chains: The surge in activity at AHMSA, coinciding with the implementation of US tariffs and concerns about circumvention, suggests closer scrutiny of steel originating from Mexico is crucial to avoid unintended tariff liabilities.

- Assess impact of Cleveland-Cliffs’ support for Section 232: The article “Cleveland-Cliffs applauds the DOC adding more derivative steel items to Section 232” suggests that US domestic producers are actively supporting and benefiting from the expanded tariff protection. Thus, steel buyers should evaluate opportunities to engage with Cleveland-Cliffs as a strategic partner for domestic supply.

- Diversify sources in Canada and United States: Given the stable, though declining, activity at ArcelorMittal Dofasco (Canada), coupled with uncertainties surrounding US tariff policies, diversify steel sourcing within North America to mitigate potential supply disruptions.