From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Resilient Despite Tariff Threats: AM/NS Calvert Activity Soars

The North American steel market shows resilience despite new trade uncertainties. Rising stock index futures, as reported in “Stock Index Futures Climb on Nvidia Boost Ahead of U.S. Inflation Data and Big Bank Earnings,” suggest underlying strength, but the potential impact of tariffs looms large, particularly after the announcement of a 35% tariff on Canada, as reported in “Stock Market Today: 35% Tariff on Canada Spooks Investors“. Satellite data reveals shifts in steel plant activity, with some facilities showing significant growth while others face declines. The activity developments at Algoma Steel cannot be clearly linked to these news items.

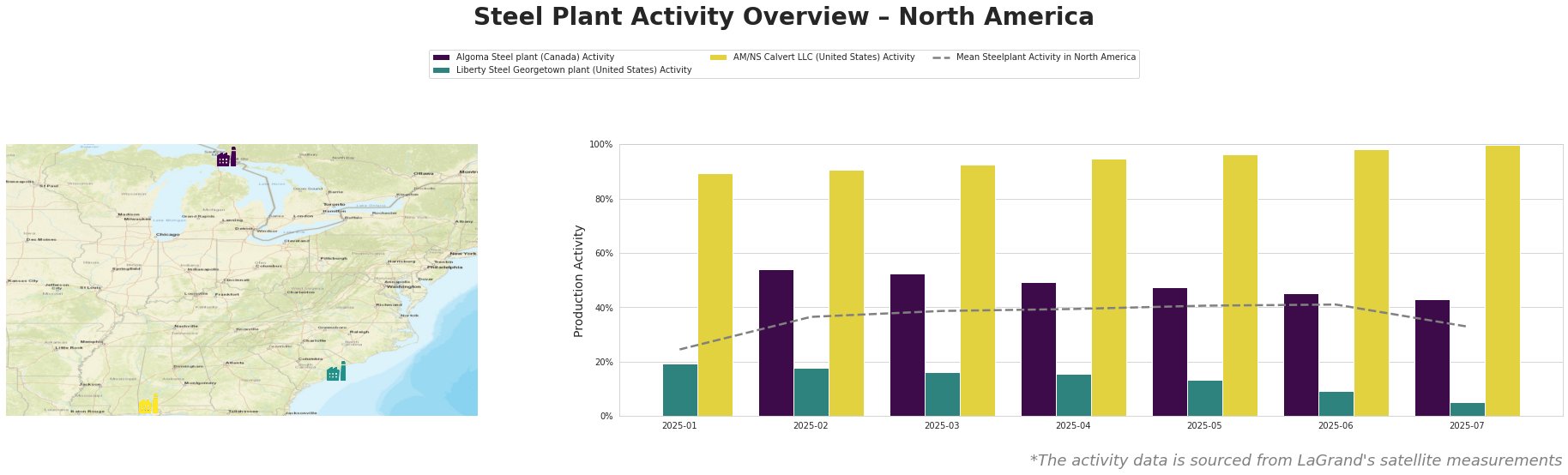

Overall, the mean steel plant activity in North America has decreased to 33% in July, after remaining stable at 41% for two months.

Algoma Steel, an integrated BF/BOF steel plant in Ontario with a crude steel capacity of 2.8 million tonnes annually, saw a gradual decrease in activity from 54% in February to 43% in July. As Algoma Steel is in Canada, the announced tariffs in “Stock Market Today: 35% Tariff on Canada Spooks Investors” may have impacted its production, but a clear and direct link cannot be established based solely on the provided information. The fluctuations in Algoma Steel’s activity do not appear to correlate directly with the discussed news events about inflation or interest rates in the United States.

Liberty Steel Georgetown, a smaller EAF-based plant in South Carolina with a capacity of 908,000 tonnes, experienced a sharp decline in activity, dropping from 19% in January to only 5% in July. This substantial decrease has no clear relationship to any of the provided news articles. The plant focuses on semi-finished and finished rolled products, including wire rod, and serves various sectors.

AM/NS Calvert, an EAF-based plant in Alabama with a 1.5 million tonne capacity, recorded a substantial and consistent increase in activity, reaching 100% in July from 90% in January, far exceeding the North American mean. This rise in activity, occurring while tariff threats are escalating as described in “Stocks Set to Open Lower as Trump Ratchets Up Tariff Threats, U.S. Inflation Data and Big Bank Earnings Awaited,” suggests a potential shift in production focus towards domestic supply, especially given the plant’s focus on finished rolled products for the automotive and infrastructure sectors. The rising stock index futures, as reported in “Stock Index Futures Climb on Nvidia Boost Ahead of U.S. Inflation Data and Big Bank Earnings,” could be linked to AM/NS Calvert’s rise in activity.

Evaluated Market Implications:

The tariff threats reported in “Stocks Set to Open Lower as Trump Ratchets Up Tariff Threats, U.S. Inflation Data and Big Bank Earnings Awaited,” coupled with the 35% tariff on Canada announced in “Stock Market Today: 35% Tariff on Canada Spooks Investors,” may lead to supply disruptions, particularly affecting plants like Algoma Steel in Canada. The significant activity decrease at Liberty Steel Georgetown further tightens supply.

Recommended Procurement Actions:

- Steel Buyers: Given the potential supply disruptions, especially regarding Canadian imports due to tariffs as well as the reduced activity from Liberty Steel Georgetown, steel buyers should:

- Prioritize securing contracts with domestic suppliers, particularly those like AM/NS Calvert demonstrating high production capacity.

- Consider increasing inventory levels to mitigate potential price increases linked to tariff uncertainty, especially for hot-rolled, cold-rolled sheet, and advanced coated products produced by AM/NS Calvert.

- Diversify the supplier base to reduce reliance on regions potentially affected by tariffs or production cuts.

- Market Analysts: Closely monitor the activity levels of Algoma Steel and Liberty Steel Georgetown. Any further declines could exacerbate supply concerns and impact pricing. Also, monitor the impact of tariffs on imported steel prices and the production strategies of major domestic players like AM/NS Calvert.