From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Report: Optimistic Outlook Amid Auto Tariff Adjustments

Recent developments in North America’s steel market signal a very positive sentiment driven by strategic tariff relief announcements. The articles “Trump To Sign Order Granting Some Auto Tariff Relief: White House” and “Trump Eases Auto Tariffs Burden, Offers Relief For US Carmakers” indicate a shift that could stabilize both the automotive and steel industries, potentially increasing demand for domestically produced steel.

Measured Activity Overview

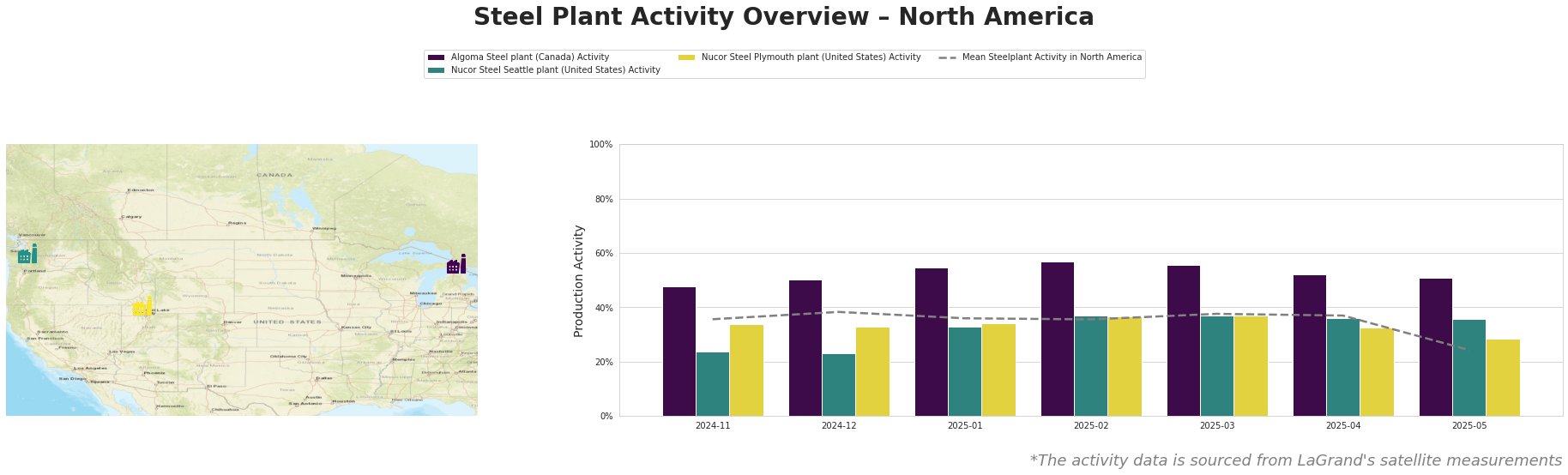

Activity levels show fluctuation across plants, with notable declines in overall mean activity post-April, reaching a low of 24.0% by May. Algoma Steel has maintained a relatively stable output, with a peak activity of 57.0% in February. This behavior contrasts with the Nucor Seattle plant, where activity dipped sharply to 24.0% in November but rebounded later. The potential influence of recent tariff adjustments, while positive on market sentiment, does not directly explain the observed activity drops.

Plant Overview and Insights

Algoma Steel Plant in Ontario demonstrates strong resilience, consistently reported activity levels peaking at 57.0% in February before stabilizing in the mid-50s range. Its integrated production capacity mainly focusing on finished and semi-finished products positions it well to meet rising demand, especially in the automotive and construction sectors, potentially boosted by the easing tariffs noted in the article “Trump Eases Auto Tariffs Burden, Offers Relief For US Carmakers.”

Nucor Steel Seattle Plant has seen pronounced activity fluctuations, with a recent decline to 24.0%. Since this plant primarily serves the automotive and infrastructure sectors, the auto tariff adjustments could create volatility in both demand and operational capacity, linking back to potential procurement shifts for steel products in a recovering automotive industry. However, direct correlations with the recent tariff changes are not established.

Nucor Steel Plymouth Plant has experienced downward pressure, hitting 28.0% in May from a previous stable level, reflecting broader trends in domestic demand likely influenced by overall industry tariff anxieties addressed in “Donald Trump eased some tariffs for the auto sector.” Despite recent drops, its focus on electric arc furnace technology allows for rapid adjustments to market conditions.

Evaluated Market Implications

-

Potential Supply Disruptions: The fluctuating activity levels, particularly at the Nucor Seattle and Plymouth plants, suggest vulnerabilities in responding to market changes. Should demand from the auto sector surge post-tariff relief, these plants might struggle to ramp up production swiftly, leading to potential supply chain bottlenecks.

-

Procurement Recommendations: Given Algoma Steel’s resilience and its strategic positioning in the automotive supply chain, stakeholders should prioritize securing contracts for semi-finished and finished products from Algoma to mitigate risks associated with the uncertainty surrounding Nucor’s output stability. Additionally, monitoring month-to-month trends can provide deeper insights into Nucor’s responsiveness to the evolving tariff landscape, aiding informed purchasing decisions over the upcoming quarters.

Investors and analysts should remain vigilant as shifting market dynamics interplay with reported plant activities, ensuring procurement strategies are adaptable to these changes reinforced by the evolving tariff landscape.