From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Report: April 2025 Observations Show Robust Growth

Steel market sentiment in North America remains Very Positive, driven by robust production activity and encouraging forecasts from the automotive sector. Significant insights can be discerned from plant activity changes following recent news, particularly highlighted in the articles: “Is Rivian Automotive, Inc. (RIVN) The Best Stock Under $15 To Buy?”, “Is Lucid Group, Inc. (LCID) Among the Best Car Stocks To Buy In 2025?”, and “Is CarMax, Inc. (KMX) Among the Best Car Stocks To Buy In 2025?”.

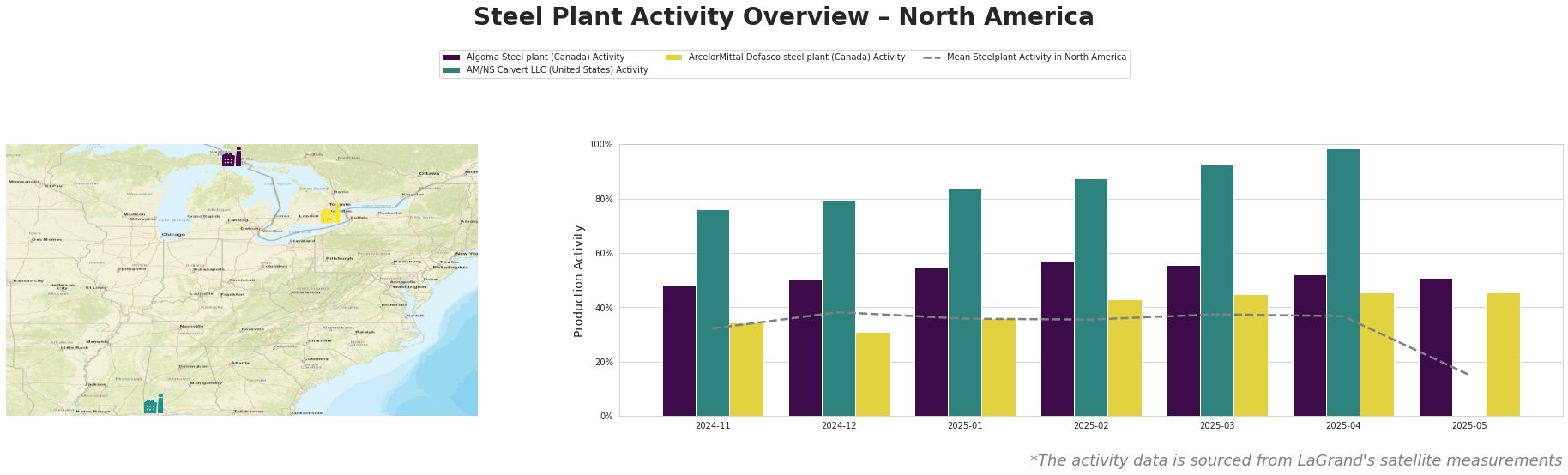

Recent satellite-observed data indicates a notable uptick in plant activity across key facilities. However, amid these positive trends, AM/NS Calvert LLC was unable to report activity for May 2025, demonstrating a significant anomaly within data consistency.

Algoma Steel Plant in Ontario has shown stable activity trends, maintaining a solid post-pandemic recovery. The activity peaked at 57% in February 2025 and remained resilient at 52% throughout April 2025. Its growth parallels the optimism in automotive stocks, as highlighted in “Is Lucid Group, Inc. (LCID) Among the Best Car Stocks To Buy In 2025?”, suggesting the plant’s robust operations could effectively support automotive demand.

AM/NS Calvert LLC originally demonstrated substantial activity levels, peaking at 99% in March 2025. However, the lack of reported data for May 2025 raises potential concerns for supply stability amid increasing automotive production demands, as reflected in “Is CarMax, Inc. (KMX) Among the Best Car Stocks To Buy In 2025?”. The sustained demand for steel in the vehicle sector underscores the significance of monitoring this plant’s activity metrics closely.

ArcelorMittal Dofasco maintains a consistent operation with activity levels around 45% in April 2025, slightly reflecting a decrease from earlier peaks. Yet, its position aligns well with ongoing infrastructure and energy sector projects and resonates with the sustained auto industry growth signals from “Is Rivian Automotive, Inc. (RIVN) The Best Stock Under $15 To Buy?” and other automotive forecasts.

Evaluating market implications, potential supply disruptions may arise from the inconsistencies at AM/NS Calvert LLC. Steel buyers should prioritize procurement strategies that account for backup sourcing from Algoma or ArcelorMittal Dofasco to ensure continuity and mitigate risks influenced by plant downtimes. Investing in diversified sources will enhance procurement reliability in light of fluctuating activity trends influenced by evolving automotive production needs.