From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Remains Positive Despite Activity Shifts Amid Economic Uncertainty

North America’s steel market maintains a positive outlook despite fluctuating plant activity levels, with investors closely monitoring economic factors and potential policy changes. Recent developments highlight market dynamics, as evidenced by news articles such as “Futures dip after record run as investors focus on Trump’s tax bill” and “S&P Futures Muted With Focus on Powell’s Testimony.” While these articles reflect broader economic concerns, a direct relationship to recent observed changes in specific plant activity levels cannot be explicitly established.

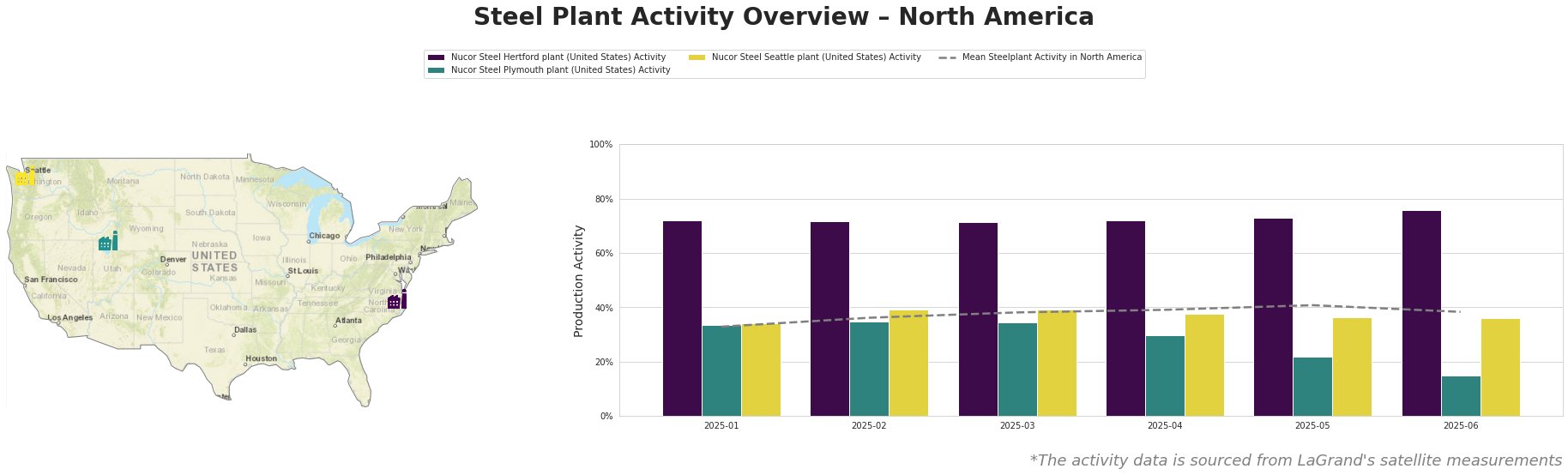

Observed steel plant activity levels are presented in the table below:

The mean steel plant activity in North America increased steadily from January to May, peaking at 41%, before dropping to 38% in June. Nucor Steel Hertford plant consistently operated well above the average, reaching its highest activity level of 76% in June. In contrast, Nucor Steel Plymouth plant saw a significant decline in activity, dropping from 34% in January to 15% in June. Nucor Steel Seattle plant’s activity remained relatively stable throughout the period, fluctuating between 34% and 39%.

Nucor Steel Hertford, located in North Carolina, is an EAF-based plant with a crude steel capacity of 1542 ttpa, producing semi-finished plate products for various sectors. The plant’s activity consistently exceeded the North American average and even peaked at 76% in June, indicating strong and sustained production. Given this high production, the plant appears well-positioned to meet ongoing demand, regardless of broader economic uncertainties discussed in “S&P Futures Muted With Focus on Powell’s Testimony.”

Nucor Steel Plymouth, situated in Utah, utilizes EAF technology with a crude steel capacity of 908 ttpa, specializing in finished rolled bar products. The plant experienced a sharp decline in activity, dropping from 34% in January to a low of 15% in June. This substantial decrease could indicate potential production adjustments or maintenance activities. The article “Futures dip after record run as investors focus on Trump’s tax bill” highlights potential trade tensions; however, a direct link between this and the Plymouth plant’s reduced activity cannot be explicitly established.

Nucor Steel Seattle, based in Washington, operates an EAF plant with a crude steel capacity of 855 ttpa, also producing finished rolled bar products. The plant’s activity remained relatively stable, fluctuating between 34% and 39% throughout the observed period. This stable production suggests consistent operation despite broader market fluctuations and uncertainties detailed in “Morning Bid: Senate’s vote-a-rama continues.”

Evaluated Market Implications:

The significant activity drop at the Nucor Steel Plymouth plant suggests a potential tightening of supply for finished rolled bar products, particularly in regions served by this plant. Given this reduction, steel buyers should:

- Monitor Inventory Levels: Closely track inventory levels of bar products to mitigate potential shortages.

- Diversify Suppliers: Consider diversifying suppliers to include regions where production remains robust, such as those served by the Nucor Steel Hertford plant which exhibits consistently high activity levels.

- Negotiate Contracts: Proactively negotiate contract terms to secure supply and hedge against potential price increases driven by reduced output from the Plymouth plant.