From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Hit by Tariffs; Mexican Plant Defies Downturn

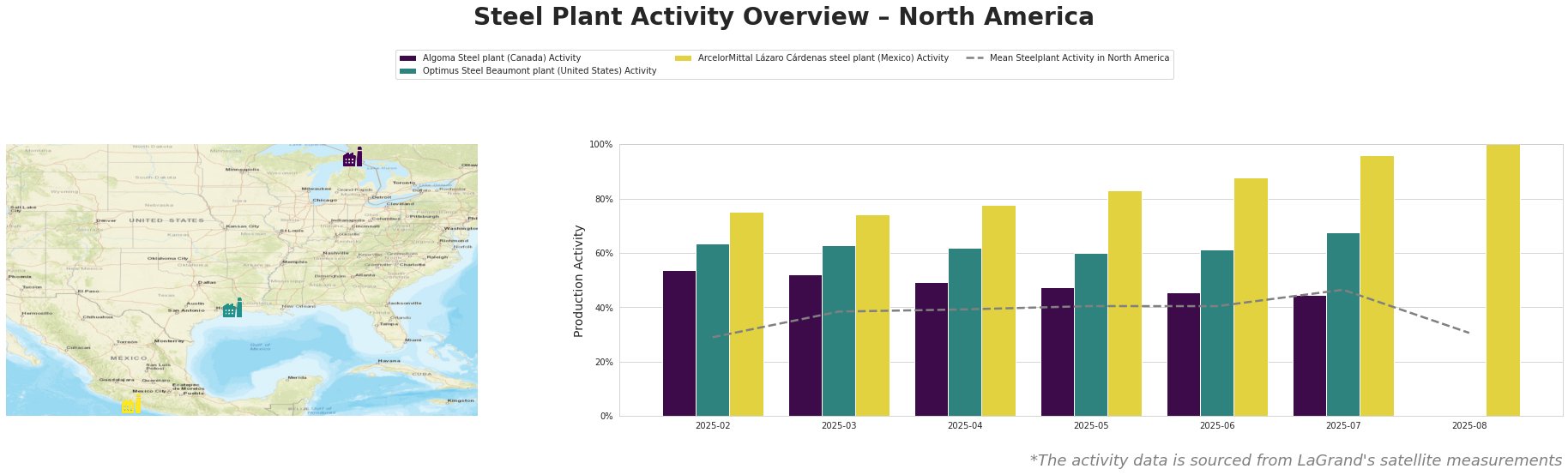

The North American steel market faces headwinds due to increasing trade tensions, while activity at some plants shows divergent trends. The negative impact of tariffs is highlighted in articles like “US-Zollstreit: Statt einem Deal gibts für die Schweiz 39 Prozent Zoll” and “Trump wird durch die Zölle zum Verlierer,” suggesting potential disruptions. While tariffs might impact production at facilities like Algoma Steel and Optimus Steel Beaumont plant, ArcelorMittal Lázaro Cárdenas shows increasing activites.

The mean steel plant activity in North America peaked in July 2025 at 46% but dropped significantly to 31% in August 2025. Algoma Steel plant’s activity steadily decreased from 54% in February to 44% in July. Optimus Steel Beaumont plant saw a decrease in activity from 64% in February to 68% in July. The ArcelorMittal Lázaro Cárdenas steel plant demonstrated a consistent rise in activity, reaching 100% in August.

Algoma Steel, an integrated BF/BOF steelmaker in Ontario with a 2.8 million tonne crude steel capacity producing mainly flat rolled products for automotive and infrastructure, experienced a decline in activity from 54% in February to 44% in July. This drop might be correlated with potential trade barriers highlighted in “Trump wird durch die Zölle zum Verlierer,” given that tariffs can impact demand for steel-intensive automotive components.

Optimus Steel Beaumont plant, a Texas-based EAF steelmaker with 700,000 tonnes of crude steel capacity focused on wire rods and coiled rebar, showed fluctuation in activity levels. Plant activity levels decreased from 64% in February to 68% in July. However there is no data for August which would be helpful for understanding recent plant trends. No direct connection could be established between this plant’s activity and the news articles provided.

ArcelorMittal Lázaro Cárdenas, a major integrated steel plant in Mexico with both BF/BOF and DRI/EAF routes and a 5.7 million tonne crude steel capacity, showed a continuous increase in activity, reaching 100% in August. While “Trump wird durch die Zölle zum Verlierer” discusses potential disadvantages for the US due to tariffs, ArcelorMittal Lázaro Cárdenas plant activity levels could be impacted positively by the imposed tariffs.

The observed increase in trade tensions and potential supply chain realignments, reflected in the provided news articles, combined with the divergent plant activity data, warrants specific procurement actions. Given the Algoma Steel plant’s reduced activity and the imposition of tariffs as reported in “US-Zollstreit: Statt einem Deal gibts für die Schweiz 39 Prozent Zoll“, steel buyers reliant on flat rolled products from this plant should immediately explore alternative supply options within North America or from regions unaffected by the new tariffs. Given the strong increase in activity at ArcelorMittal Lázaro Cárdenas plant in Mexico, buyers could shift their focus to procure wire rod and rebar from this plant to meet demand. Analysts should closely monitor further policy developments from “Trumps US-Zölle im Liveticker: Schweizer Bundespräsidentin fliegt nach Washington, um Trump umzustimmen” as they unfold, especially if they affect supply chains outside North America, and incorporate them into their forecasting models.