From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Faces Downturn: Trump’s Tariffs Threaten Supply Amid Plant Activity Shifts

The North American steel market faces increased uncertainty following announced tariffs. The potential impact is highlighted by fluctuations in steel plant activity, as seen in satellite observations. The imposition of tariffs by Donald Trump, as reported in “US-Handelspolitik: Donald Trump droht Kanada mit 35 Prozent Zoll,” “Donald Trump droht EU mit Zöllen von 30 Prozent,” “Trump threatens Mexico, EU with 30pc tariffs,” “Trump imposes 35 percent tariffs on Canadian imports starting August 1,” “Trump announces 30% tariffs on imports from the EU and Mexico,” and “Trump threatens 35pc tariff on Canada by 1 August” could significantly impact the steel supply chain, although no direct correlation to immediate plant activity drops is observed in the reported period. “Stock Market Today: 35% Tariff on Canada Spooks Investors” further underscores the negative market sentiment.

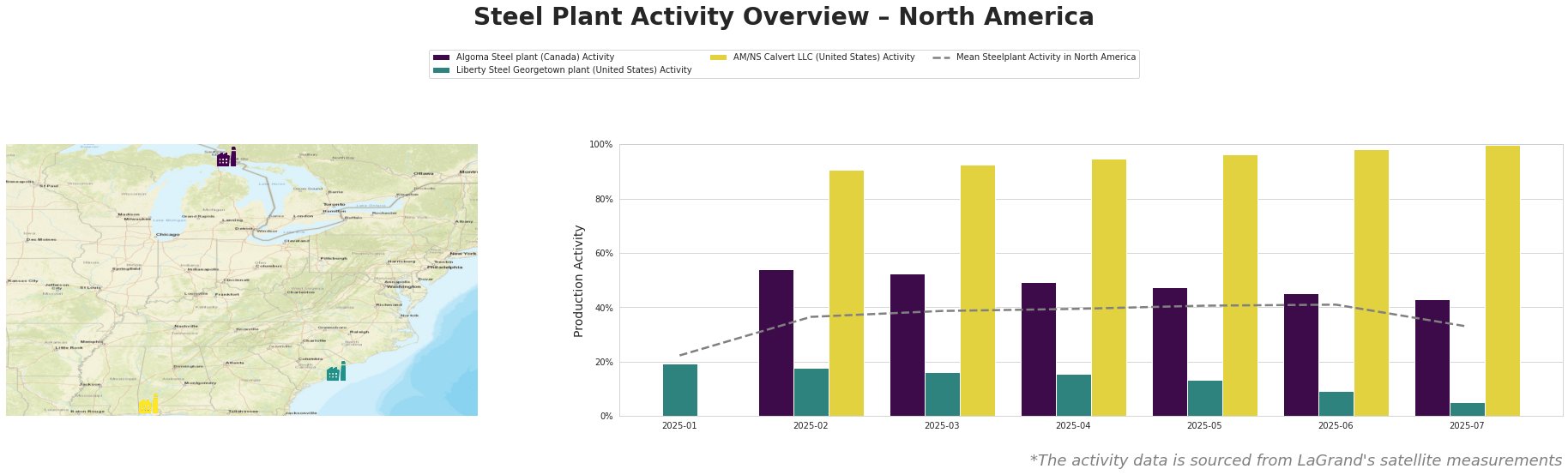

The mean steel plant activity in North America shows a general upward trend from January (22%) to June (41%), followed by a notable drop to 33% in July. Algoma Steel plant in Canada, a major integrated steel producer utilizing blast furnace (BF) and basic oxygen furnace (BOF) technologies with a crude steel capacity of 2.8 million tonnes per annum (ttpa), exhibited activity levels consistently above the North American average. Activity decreased steadily from a peak of 54% in February to 43% in July. This downward trend may be influenced by the announced 35% tariff on Canadian imports, detailed in “US-Handelspolitik: Donald Trump droht Kanada mit 35 Prozent Zoll,” “Trump imposes 35 percent tariffs on Canadian imports starting August 1,” and “Trump threatens 35pc tariff on Canada by 1 August,” as it directly impacts Algoma’s export competitiveness, but a definitive causal relationship cannot be established from the provided data alone.

Liberty Steel Georgetown plant, a smaller electric arc furnace (EAF) steel plant in the United States producing around 908 ttpa of crude steel, shows a significant decline in activity. The plant’s activity steadily decreased from 19% in January to a low of 5% in July. This sharp decline might indicate operational issues or reduced demand, but no direct link to the named news articles related to tariffs can be established.

AM/NS Calvert LLC, a US-based EAF steel plant with a crude steel capacity of 1.5 million ttpa, stands out with a continuous increase in activity, reaching 100% in July,significantly above the North American average. This indicates robust production and demand for its hot-rolled, cold-rolled, and coated sheet products. The tariff announcements do not appear to have impacted this plant’s activity, and no explicit connection can be made between its performance and the provided news articles.

Evaluated Market Implications:

The announced tariffs, particularly those targeting Canada and potentially the EU and Mexico, create significant downside risk for North American steel buyers.

- Potential Supply Disruptions: The announced tariffs covered in “US-Handelspolitik: Donald Trump droht Kanada mit 35 Prozent Zoll,” “Donald Trump droht EU mit Zöllen von 30 Prozent,” “Trump threatens Mexico, EU with 30pc tariffs,” “Trump imposes 35 percent tariffs on Canadian imports starting August 1,” “Trump announces 30% tariffs on imports from the EU and Mexico,” and “Trump threatens 35pc tariff on Canada by 1 August,” especially the 35% tariff on Canadian imports, could reduce the availability of steel from Algoma Steel. A major supplier of plate and sheet to key sectors, especially those requiring ResponsibleSteel Certification, faces increased export barriers.

- The activity drop at Liberty Steel Georgetown, while not directly linked to tariff news, further restricts domestic supply, particularly for wire rod and bar products.

- AM/NS Calvert’s high activity may not be sufficient to offset potential supply constraints caused by tariffs and other plant-specific issues.

Recommended Procurement Actions:

- Short-Term: Steel buyers reliant on Canadian steel (especially from Algoma) should immediately explore alternative supply sources within the US or from countries not subject to the new tariffs. Given the August 1st implementation date, securing inventory before the tariffs take effect is crucial.

- Mid-Term: Buyers should closely monitor the trade negotiations between the US, Canada, the EU, and Mexico. Prepare for potential price increases due to tariffs. Buyers dependent on Liberty Steel Georgetown for specific grades should secure alternative suppliers, if they have not done so already.

- Long-Term: Diversify the supply base and consider establishing relationships with multiple suppliers to mitigate risks associated with trade policy changes. Invest in understanding the origin and certification status of steel to ensure compliance with environmental and social standards, as ResponsibleSteel Certification could become a differentiating factor in a disrupted market.