From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Faces Downturn: Mexico’s Trade Deficit and Plant Activity Drop Signal Challenges

North America’s steel market shows signs of weakness, primarily driven by economic challenges in Mexico and reduced steel plant activity. The contraction of Mexico’s economy, as reported in “Mexico’s economy contracts in 3Q“, coincides with a widening trade deficit highlighted in “Mexico trade deficit widens in Sep on record imports“, “Mexico’s trade deficit widened in September amid record imports“, and “Mexico’s trade deficit widened in September amid record imports“. These factors appear to be linked to observed declines in steel plant activity, particularly in Mexico and the US.

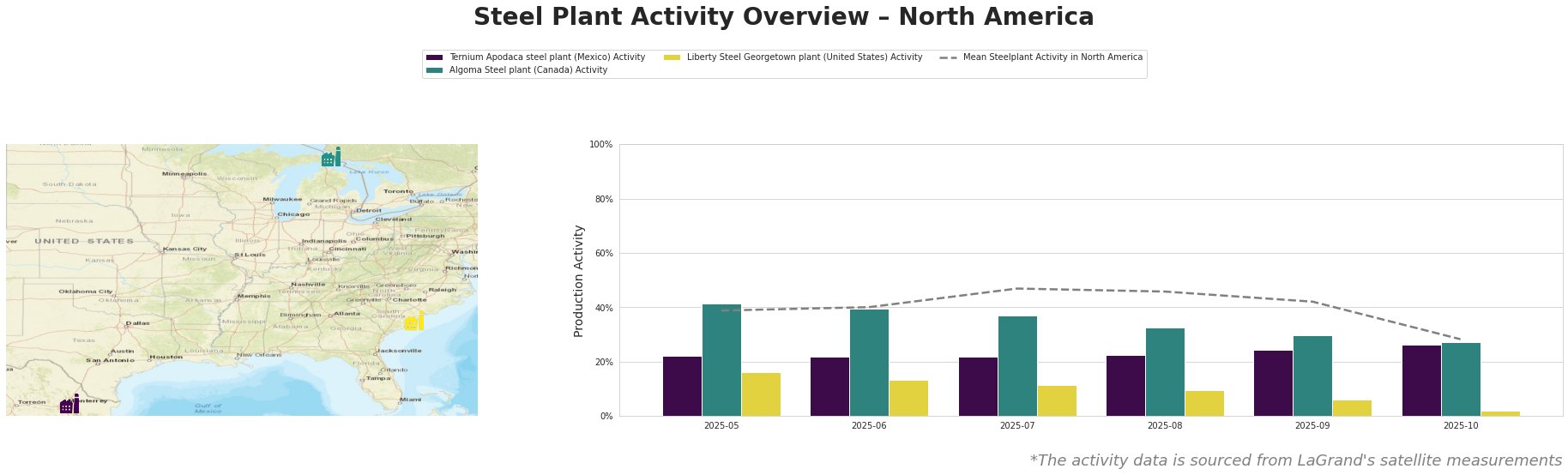

Overall, the mean steel plant activity in North America experienced a significant drop in October to 28.0, after a peak of 47.0 in July. All three plants showed a decrease in activity in October.

Ternium’s Apodaca plant in Nuevo León, Mexico, primarily produces semi-finished and finished rolled products using EAF technology with a crude steel capacity of 600 ttpa. The plant’s activity level remained relatively stable between May and September, hovering around 22-24%, increasing slightly to 26% in October, while the other plants experienced a decrease. This suggests the economic headwinds in Mexico may not be immediately impacting this specific plant, or that the plant is fulfilling existing order backlogs. No direct connection can be established between this observed activity and the news articles concerning Mexico’s trade deficit or economic contraction.

Algoma Steel in Ontario, Canada, an integrated BF/BOF producer with a crude steel capacity of 2800 ttpa, experienced a steady decline in activity from 41.0% in May to 27.0% in October. This decrease aligns with the overall negative market sentiment but no direct connection can be established between the drop in activity and the news articles concerning Mexico, as they are geographically disconnected.

Liberty Steel Georgetown, a US-based EAF producer with a capacity of 908 ttpa, suffered the most significant decline, plummeting from 16.0% in May to a low of 2.0% in October. This sharp decrease is particularly concerning. The drop may be connected to impacts from the tariff discussions reported in the news articles, but a definitive link cannot be established based on the provided information alone.

Given the economic downturn in Mexico, evidenced by a widening trade deficit and contraction in the third quarter, coupled with declining steel plant activity across North America, steel buyers should consider the following:

- Diversify Suppliers: Reduce reliance on suppliers heavily dependent on the Mexican economy, specifically for automotive-related steel products, given the decrease in automotive exports described in the news articles.

- Monitor Algoma Steel’s Output: Closely track Algoma Steel’s production and inventory levels due to the steady decline in plant activity. Evaluate potential supply disruptions and explore alternative sources, especially for cold-rolled products, plate, and sheet.

- Assess Liberty Steel Georgetown’s Viability: Given the drastic reduction in activity at Liberty Steel Georgetown, buyers should assess the long-term viability of this supplier and immediately qualify alternative sources for wire rod, and agricultural fence products.