From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Faces Downturn Amid Trade Tensions; Plant Activity Declines

In North America, the steel market faces increasing headwinds due to trade disputes, as evidenced by observed declines in steel plant activity. According to “Liveblog USA unter Trump: Trump bricht Handelsgespräche mit Kanada ab | FAZ” and “Trump says he’s terminating all trade negotiations with Canada over an ad featuring Ronald Reagan“, trade tensions are escalating, but there is no clear direct relationship with recent changes in activity in the provided satellite data.

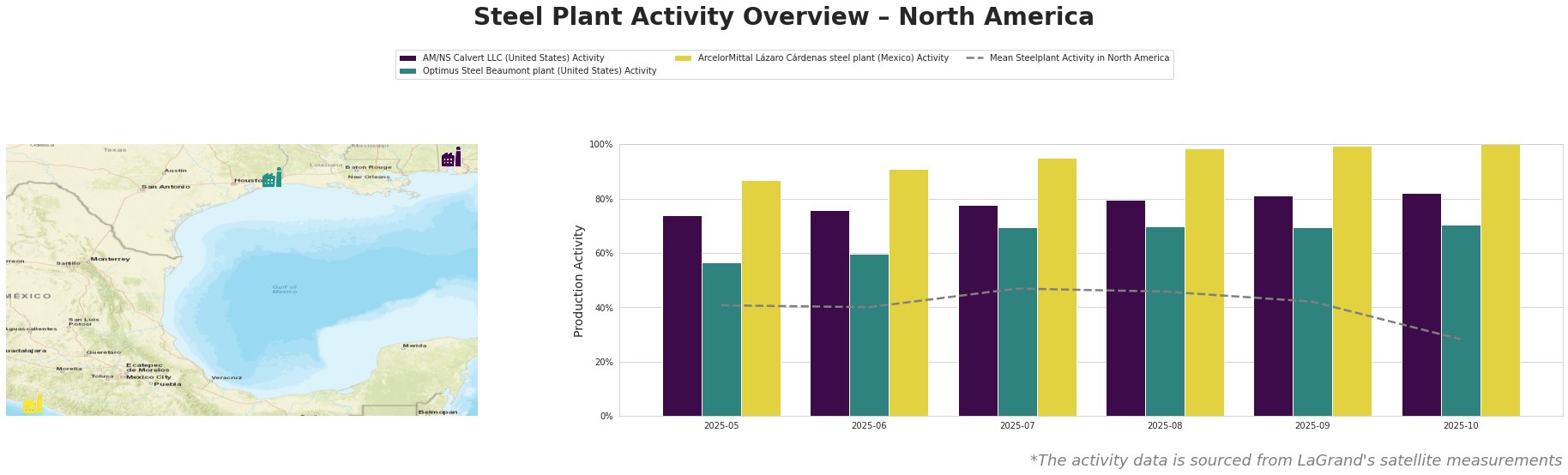

The mean steel plant activity in North America has shown a declining trend, from 41% in May to 28% in October. This represents a significant drop, particularly in the last month.

AM/NS Calvert LLC, an EAF steel plant in Alabama with a capacity of 1.5 million tonnes, primarily produces finished rolled products for the automotive, building, and energy sectors. Its activity levels have shown a steady increase from 74% in May to 82% in October, contrasting the overall negative trend in North America. No direct connection to the named news articles can be established based on the provided information.

Optimus Steel Beaumont plant, located in Texas, has a 700,000-tonne EAF capacity. It produces semi-finished and finished rolled products like wire rods and coiled rebar. Activity levels at this plant show a slight increase from 56% in May to 70% in October. The activity levels are below the mean North American levels in May, June and September, and above in July and August. No direct correlation with the named news articles is apparent.

ArcelorMittal Lázaro Cárdenas, a major integrated steel plant in Mexico with both DRI and BF-BOF production routes, has seen its activity increase steadily from 87% in May to 100% in October. This plant boasts a 5.7 million tonne crude steel capacity and serves diverse sectors. The observed increases are above the mean and counter the overall North American trend. Despite the Trump administration’s focus on trade with Mexico and the potential impact from the breaking off of trade negotiations with Canada, as mentioned in “Liveblog USA unter Trump: Trump bricht Handelsgespräche mit Kanada ab | FAZ” and “Trump says he’s terminating all trade negotiations with Canada over an ad featuring Ronald Reagan”, no direct relationship to this Mexican plant’s activity can be definitively established based on the provided information.

The overall downturn in mean North American steel plant activity, coupled with escalating trade tensions, signals potential supply chain disruptions. Specifically, the significant drop in mean activity levels in October warrants caution.

Recommended Action:

Steel buyers should consider diversifying their sourcing strategies. Monitor activity at AM/NS Calvert LLC, where activity bucks the regional trend, but be aware that its product range is heavily reliant on automotive, which may be affected by the trade disputes reported in “Liveblog USA unter Trump: Trump bricht Handelsgespräche mit Kanada ab | FAZ” and “Trump says he’s terminating all trade negotiations with Canada over an ad featuring Ronald Reagan”. Carefully weigh opportunities with supply assurance in mind. Closely monitor policy developments with Canada and Mexico. Consider shorter procurement cycles to quickly adjust to potential market fluctuations.