From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Braces for Tariff Impact: Nucor Activity Strong Amidst Trade Policy Shifts

The North American steel market is poised for significant changes due to potential tariff implementations. As “Trump to Announce Tariffs on Steel Imports in Coming Weeks” and “Trump Reaffirms Plans to Impose Tariffs on Steel and Semiconductor Chips” indicate, new tariffs on steel imports are anticipated to bolster domestic manufacturing. While the news suggests a potential impact on domestic production, we have no data to conclude a direct effect on all steel plants’ activity from these announcements.

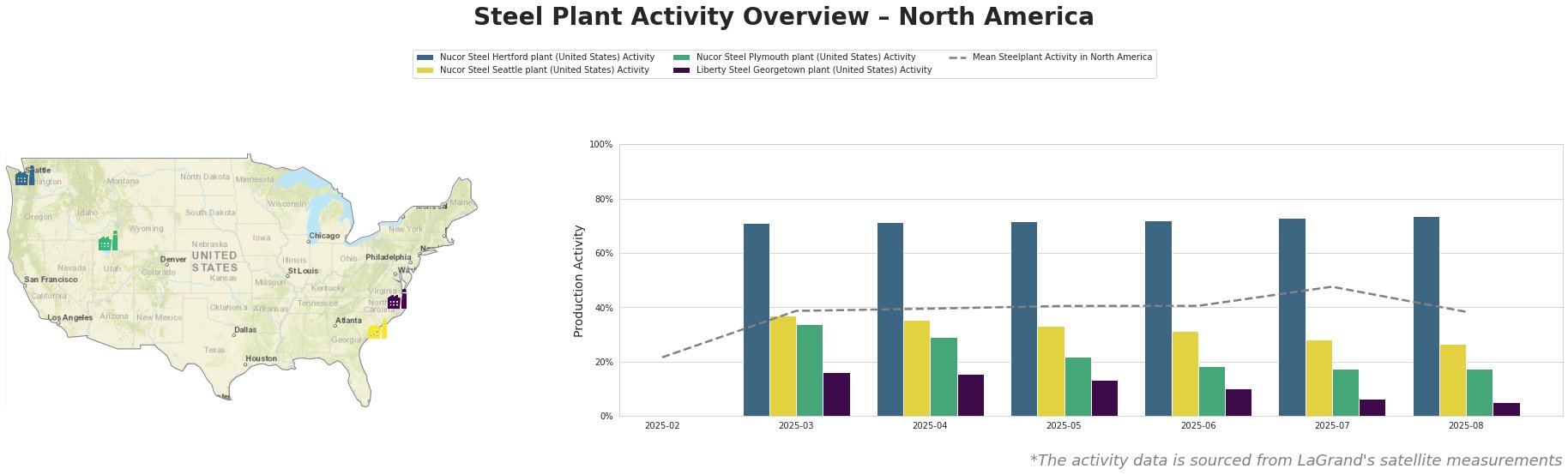

The mean steel plant activity in North America shows a general upward trend from February (22%) to July (48%), followed by a decrease to 38% in August. Nucor Steel Hertford plant consistently operates significantly above the mean, reaching 74% activity in August. Other plants like Nucor Steel Seattle, Nucor Steel Plymouth, and Liberty Steel Georgetown operate below the mean, showing decreasing activity levels in recent months. No direct correlation between the news articles and the mean activity levels can be explicitly established at this point.

Nucor Steel Hertford plant in North Carolina, a key EAF-based plate producer with a capacity of 1542 ttpa, shows consistent high activity. Its activity increased from 71% in March to 74% in August. This sustained high activity, significantly above the North American mean, could indicate preparations for increased domestic demand in anticipation of tariffs, as per “Trump to Announce Tariffs on Steel Imports in Coming Weeks” and “Trump Reaffirms Plans to Impose Tariffs on Steel and Semiconductor Chips”, even though no direct relationship can be explicitly established at this point.

Nucor Steel Seattle plant in Washington, an EAF-based bar producer with a capacity of 855 ttpa, has seen a decline in activity from 37% in March to 26% in August. This decline could be attributed to various factors affecting regional demand or production strategies; however, no direct connection can be made to the tariff announcements.

Nucor Steel Plymouth plant in Utah, another EAF-based bar producer with a capacity of 908 ttpa, also experienced a decrease in activity from 34% in March to 17% in August. Similar to the Seattle plant, this decline might be due to regional market dynamics, but no explicit link to the impending tariffs is evident.

Liberty Steel Georgetown plant in South Carolina, an EAF-based producer of semi-finished and finished rolled products with a capacity of 908 ttpa, shows the most significant decline, dropping from 16% in March to only 5% in August. This substantial decrease requires further investigation into potential operational issues or market-specific challenges. No explicit link to the tariff announcements can be established.

Given the anticipated steel tariffs (“Trump to Announce Tariffs on Steel Imports in Coming Weeks” and “Trump Reaffirms Plans to Impose Tariffs on Steel and Semiconductor Chips”), procurement professionals should consider the following:

- Increase Domestic Sourcing: Favoring domestic suppliers, especially those like Nucor Steel Hertford, which exhibit strong production activity, can mitigate potential supply chain disruptions caused by tariffs.

- Monitor Regional Activity: Closely monitor the activity levels of plants like Nucor Steel Seattle, Nucor Steel Plymouth and Liberty Steel Georgetown. Their declining activity, while not directly attributable to tariffs, could signal regional supply vulnerabilities that need to be addressed proactively through alternative sourcing or inventory adjustments.

- Evaluate Inventory Levels: Steel buyers should assess their current inventory levels and strategically increase reserves of critical steel products, particularly plates.