From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America Steel Market Report: Encouraging Activity Amid Economic Uncertainties

Recent developments in the North American steel industry point toward a positive market sentiment despite underlying economic challenges. Notably, plant activity levels have shown resilience, partially attributed to insights from the articles “Volkswagen: 41‑Prozent‑Gewinneinbruch – Aktie sackt ab“ and “Trump tariff whiplash forces more automakers to scrap profit guidance“, which highlight the pressures on automotive manufacturers impacting demand for steel but also indicate potential for increased automotive production in response to strategic maneuvers.

Measured Activity Overview

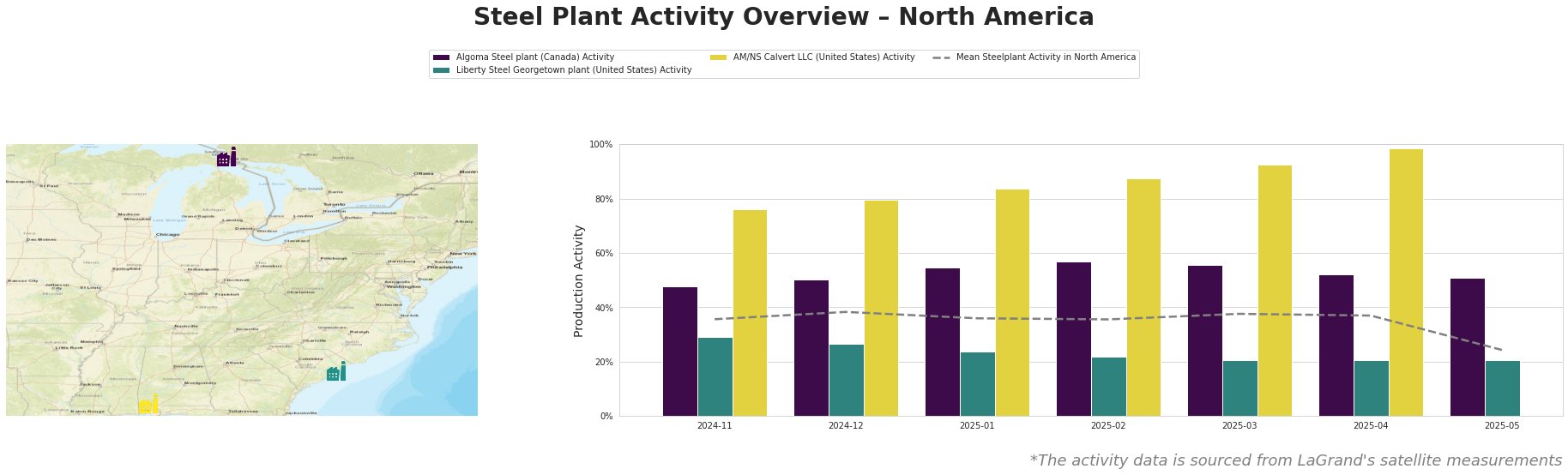

Overall, the mean activity across all observed plants in North America remains stable, hovering around 36-38%. Algoma Steel has shown solid performance with activity levels fluctuating between 48.0% and 57.0%, while the Liberty Steel Georgetown plant has experienced notable dips, declining to a low of 20% in March and April, impacted likely by the overall decline in automotive demand. In contrast, AM/NS Calvert LLC has steadily ramped up production, reaching a peak of 99.0% in April, likely responding to the industry’s need for rolled products amidst shifting demand landscapes influenced by news regarding automotive tariffs.

Plant Insights

Algoma Steel Plant in Ontario exhibits resilient performance despite slight dips, maintaining activity above 50% for most months, affirming its central role in meeting steel demands across sectors such as energy and automotive. However, the plant’s ability to sustain operations should be monitored closely, particularly if automotive demand falters as suggested by “Mercedes, VW & Co: Verhagelte Bilanzen – Zölle bremsen aus“.

In South Carolina, Liberty Steel Georgetown Plant has shown significant weakness with activity decreasing to 20%. This drop corresponds to increased operational challenges and external tariff pressures as highlighted in the aforementioned articles, necessitating strategic evaluation for potential cutbacks or operational shifts.

AM/NS Calvert LLC, located in Alabama, has rapidly improved its output, reaching 99.0% activity by April. This remarkable trend may be tied to rising demand for hot-rolled and coated products, albeit under the shadow of tariff implications highlighted in the news. Given this upward trajectory, procurement strategies should include securing material from this plant while capacity remains robust.

Evaluated Market Implications

Given the identified trends, steel buyers should be particularly cautious about potential supply disruptions from Liberty Steel Georgetown due to its declining activity levels while proactively engaging with AM/NS Calvert LLC for procurement needs. The resilience shown by Algoma Steel suggests it may serve as a reliable source amidst uncertainty. Buyers are encouraged to consider diversifying their procurement strategies accordingly. Staying informed on geopolitical developments, particularly around tariff landscapes, will be crucial for navigating future supply chain decisions effectively.