From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America Steel Market Report: Activity Declines Amid Geopolitical Tensions

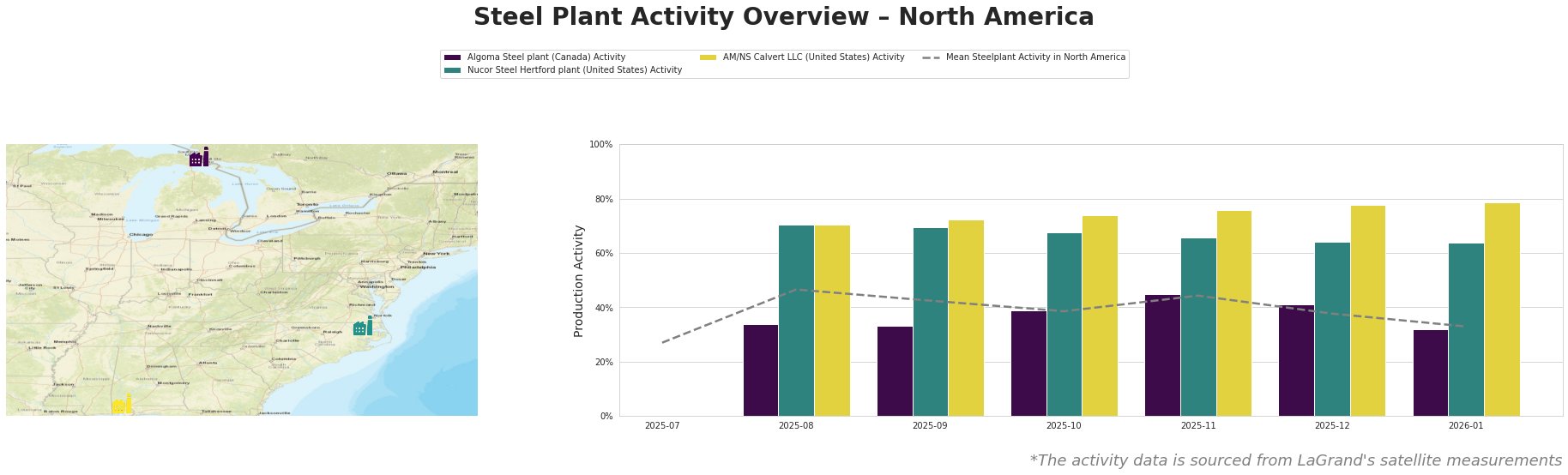

Recent geopolitical tensions tied to U.S. President Trump’s proposed tariffs in response to opposition over Greenland have negatively affected North American steel market sentiment. The articles “Trump mulls tariffs in quest for Greenland“ and “Trump’s decision on customs duties for 8 European countries after tensions in Greenland“ highlight escalating trade tensions that could impact steel procurement strategies. Satellite observations reflect a decline in operational activity at key steel plants, directly correlating with heightened market uncertainty.

The data shows a notable decrease in activity of the Algoma Steel Plant, dropping to 32.0% in January 2026 from a peak of 45.0% in November 2025. This decline is not directly linked to the recent news articles but reflects a consistent downward trend. In contrast, the Nucor Steel Hertford plant has maintained stable levels around 64.0% activity, indicating resilience amidst market fluctuations.

The AM/NS Calvert LLC plant experienced slight increases, ending at 79.0% in January, further indicating competitive operational stability against geopolitical shifts. However, overall market sentiment remains negative, as highlighted by the increasing tariffs which may precipitate further production adjustments due to increased costs.

The connection between rising tariffs, particularly affecting the automotive sector, which is a major end-user for both Nucor and AM/NS, suggests possible future procurement challenges. However, the German auto lobby warns that Trump’s duties on Greenland will have “huge” consequences, indicating that if tariffs impact EU relationships, they may further strain steel supply chains reliant on imports.

In summary, procurement professionals should prepare for potential supply disruptions as tariffs may cascade into increased production costs and operational adjustments across affected steel plants. It is prudent to consider diversifying suppliers and assessing stock levels proactively to mitigate supply chain risks associated with ongoing geopolitical tensions. Specific attention should be given to plants most affected by tariff impacts, particularly in the automotive sector, as long-term ramifications from these tariffs unfold.