From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America Steel Market Outlook: Exciting Growth Potential Amid Trade Developments

A very positive sentiment is emerging in the North American steel market as recent trade policies and agreements reshape the landscape. Recent articles, such as SMA Highlights US Administration Trade Policies Strengthening Steel Industry Capacity in 2026 and The United States will reduce tariffs on imports from India to 18%, point towards increasing activity at certain plants, although not all data aligns directly with these developments.

Measured Activity Overview

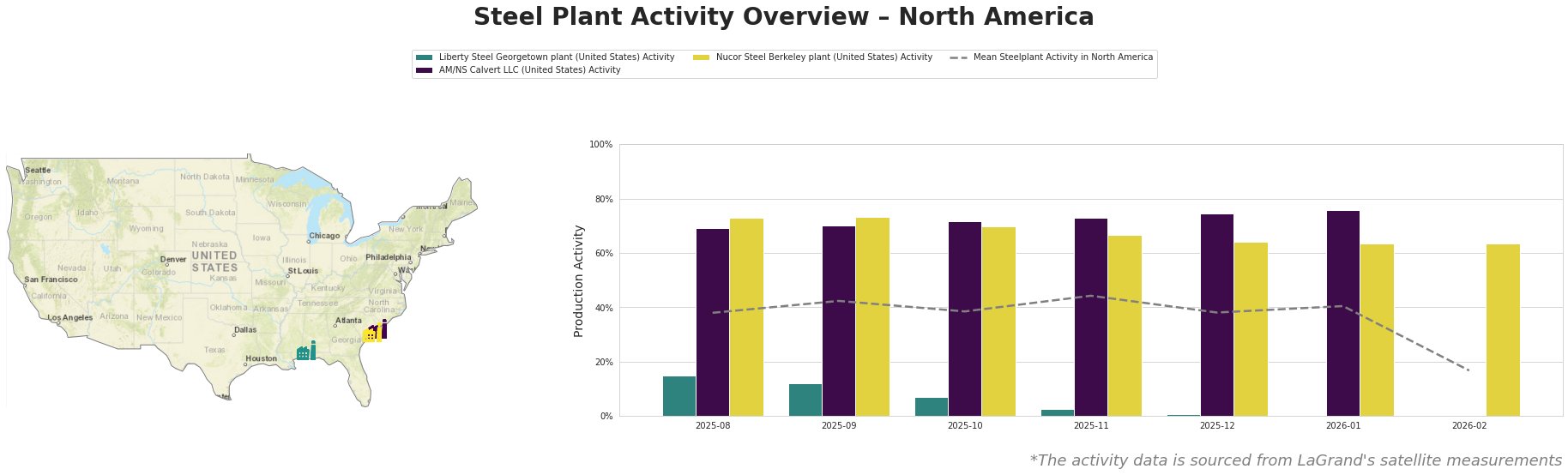

Liberty Steel Georgetown, experiencing a drastic decline from 15% in August 2025 to 0% in January 2026, did not display a direct correlation with recent trade policies. In contrast, AM/NS Calvert achieved its peak activity of 76% in January 2026, benefiting from the favorable trade climate highlighted in SMA Highlights US Administration Trade Policies Strengthening Steel Industry Capacity in 2026. Nucor Steel Berkeley held relatively stable activity levels around 64-73%.

Plant Insights

The Liberty Steel Georgetown plant in South Carolina operates two Electric Arc Furnaces (EAF) with a crude steel capacity of 908 tons, focusing on semi-finished and finished rolled products. Its sharp decline to 0% activity in January correlates with heightened market uncertainty but does not connect explicitly to any recent news, indicating potential operational issues unique to this facility.

Conversely, AM/NS Calvert LLC in Alabama is ramping up production, currently benefiting from the renewed trade environment due to its strategic positioning in the automotive and infrastructure sectors. The plant’s impressive climb to 76% underscores the positive impact of reduced tariffs on imports from India, as mentioned in The United States will reduce tariffs on imports from India to 18%.

Nucor Steel Berkeley, also based in South Carolina, showed minor fluctuations maintaining a steady output of around 64%. While this steadiness reflects resilience, these levels suggest that Nucor may not be as directly influenced by recent trade policies.

Evaluated Market Implications

With the ongoing trade agreements aiming to protect domestic production while encouraging exports, North American steel buyers should closely monitor AM/NS Calvert’s output for procurement opportunities. They are likely to benefit from competitive pricing stemming from lower tariffs.

Additionally, the enduring inactivity at Liberty Steel Georgetown poses risks of supply disruptions in the regional market. Steel buyers should consider this facility’s challenges when planning inventories and should look to diversify suppliers, particularly with rising outputs elsewhere.

Overall, the North American steel market presents promising avenues for procurement professionals, driven by current trade agreements and strategic plant performances.