From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America Steel Market Faces Negative Outlook Amid Trade Tensions

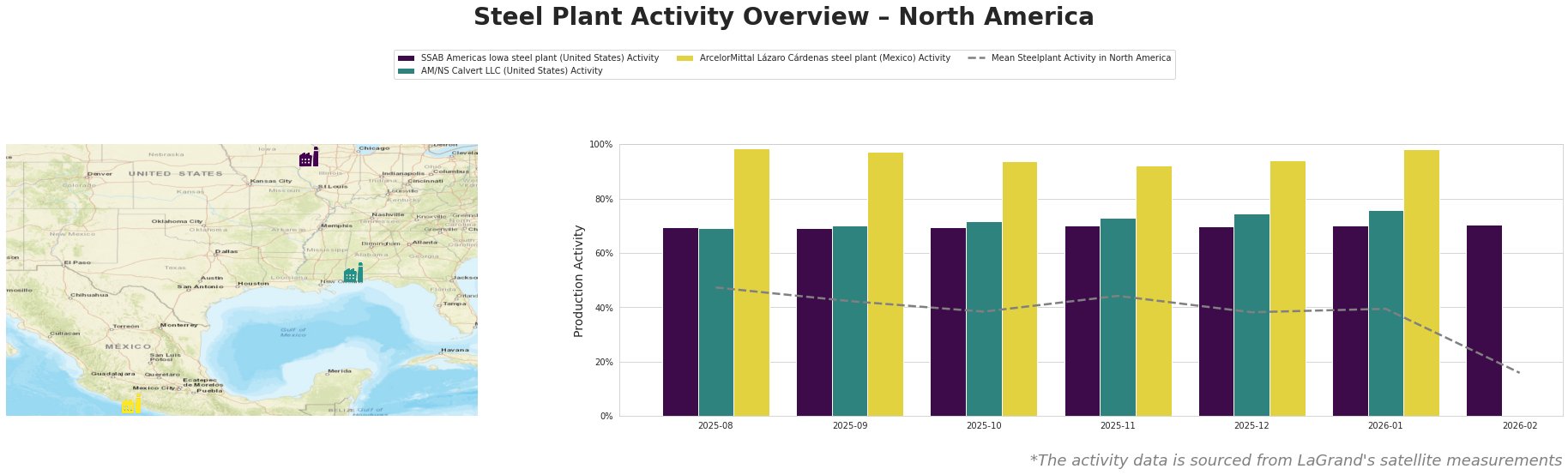

Recent geopolitical tensions have significantly impacted the North American steel market, as highlighted in articles like “Trump threatens Canada with 100% tariffs over Beijing trade deal: ‘China will eat Canada alive’“ and “Trump warns Canada is being taken by China, says 100% tariffs are coming if they become a ‘drop off port.’ Do this now“. These threats of substantial tariffs and the critique of Canada’s trade agreements with China underscore potential disruptions in supply chains. The latest satellite-observed data indicates a sharp decline in activity levels across key steel plants, with observations showing Mean Steelplant Activity plummeting to a mere 16% in February 2026, compared to 39% in January 2026.

At the SSAB Americas Iowa steel plant, activity remained stable at 70% despite wider market declines. This plant primarily focuses on producing semi-finished products using electric arc furnaces (EAF), serving energy and transportation sectors. The stability here may offer some resilience against trade uncertainties but bears attention due to potential tariff implications; notably, no direct activity correlation can be established with the recent tariff threats.

In contrast, the AM/NS Calvert LLC plant shows increasing activity leading up to February, peaking at 76% in January 2026, indicating a potential short-term demand influx possibly in anticipatory response to market fluctuations. The plant’s role in supplying finished rolled products to key sectors will be crucial as tariffs could shift buying patterns, yet again, there is no direct link to recent news developments.

The ArcelorMittal Lázaro Cárdenas steel plant maintained high activity levels of 98% in January but lacks data for February, suggesting possible operational adjustments in response to increasing geopolitical tensions highlighted in the aforementioned articles. Given the plant’s integrated operations, any disruption could have notable repercussions on regional supply chains, particularly in automotive and infrastructure sectors, but, again, no direct connections can be established with the news.

Considering these insights, steel buyers and market analysts are advised to prepare for potential supply disruptions, particularly from the uncertainty surrounding tariffs linked to Canada-China trade relations. Active monitoring of plant activity shifts is critical. Strategic procurement actions include securing contracts ahead of any anticipated tariff implementations and diversifying sources to mitigate risks linked to significant producers like ArcelorMittal and AM/NS, especially in light of the heightened market volatility.