From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Steel Market in France: Recent Production Trends and Activity Insights

France’s steel sector continues to face challenges, as highlighted by the article “France reduced steel production by 8.7% y/y in 2025“. This production decline correlates with observed decreases in activity levels across key steel plants, particularly in late 2025. Meanwhile, the industry is experiencing price fluctuations, noted in “French longs prices edge higher despite weak demand“ and “Prices for long positions in France are rising despite weak demand“, indicating a complex interplay between production costs and market demand.

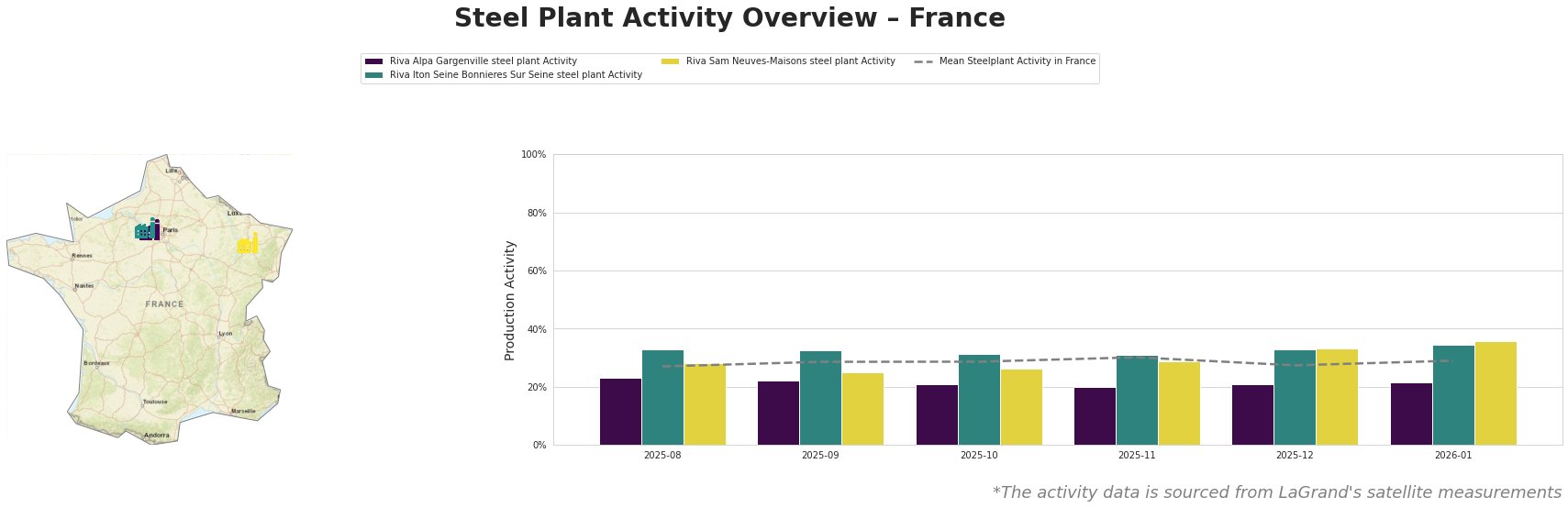

Activity levels for the Riva Alpa Gargenville steel plant have shown a downward trend, with a notable drop to 20% in November 2025, linking to declining production levels reported. Conversely, the Riva Iton Seine Bonnieres Sur Seine steel plant maintained relatively stable activity levels around 31-34% throughout the observed period, despite market conditions. Similarly, the Riva Sam Neuves-Maisons steel plant experienced a rise to 36% activity in January 2026, reflecting possible adjustments to changing market dynamics connected to the production cost increases addressed in recent articles.

These patterns reveal that, while some plants are stabilizing or adjusting output, broader market weaknesses and competitive pressures remain evident. Specifically, the construction sector’s underperformance, noted in “Prices for long positions in France are rising despite weak demand”, has hindered demand, making buyer sentiment cautious.

For steel buyers and market analysts, it’s recommended to strategically manage procurement, particularly as the market exhibits mixed signals. Increased prices for long products suggest opportunities to negotiate contracts with suppliers resistant to passing cost increases due to weak demand. Buyers should remain vigilant towards fluctuations in production capacity, especially as EU infrastructure funding ends, potentially exacerbating supply constraints.

In conclusion, professional buyers should continue to monitor steel plant outputs and market pricing trends closely to navigate a landscape characterized by fluctuating activity levels and pricing pressures effectively.