From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Steel Market in Asia: Satellite Activity and US Oil Policy’s Implications

Recent developments in Asia’s steel market have reflected a neutral sentiment, significantly influenced by geopolitical events. The news articles “No upstream gain from US’ Venezuela intervention” and “US begins issuing Venezuela sanctions waivers” highlight the steady operational challenges in Venezuela’s oil sector that impact global energy prices, indirectly affecting steel production inputs. However, no direct link between these articles and satellite-observed activity changes in Asia’s steel plants is apparent.

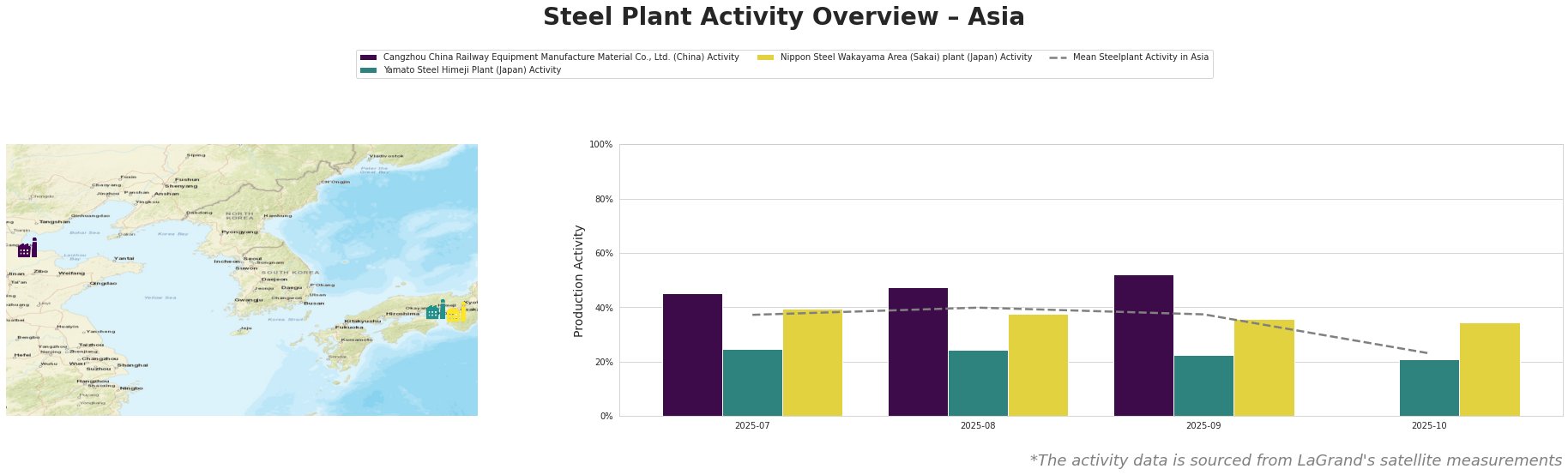

Cangzhou China Railway Equipment Manufacture Material Co. has seen fluctuating activity levels, peaking at 52% in September 2025, aligning with overall mean activity trends. In contrast, Yamato Steel exhibited a decline to 21% in October, significantly lower than the mean, indicating potential export challenges or domestic demand fluctuations. Nippon Steel’s activity maintained relative stability, albeit on a downward trajectory towards 36%. No news directly correlating with these shifts was identified.

Cangzhou operates an integrated steel plant with a crude steel capacity of 7,500 tons, producing high-quality hot-rolled materials primarily for tools and machinery. The recent peak activity may signal a brief uptick in local demand or short-term operational efficiencies. However, the lack of recent news or geopolitical ties limits further analysis.

Yamato Steel, in Kansai, has faced operational declines, potentially due to limited investment or market adjustments, descending from 25% to 21%. Its niche production of beams and structural shapes indicates vulnerability to sectoral demand shifts, yet no direct connection to US Venezuelan sanctions was identified.

The Nippon Steel Wakayama plant, known for its environmental certifications, experienced a mild drop, aligning with regional mean trends but lacking an explicit link to broader geopolitical impacting factors.

Given the current neutral market sentiment, potential procurement actions for steel buyers should focus on:

-

Monitoring Cangzhou: With its recent highs, steel buyers may benefit from establishing contracts for high-quality hot-rolled products sourced from this facility, anticipating short-term demand spikes before any market downturn.

-

Strategic Stockpiling from Nippon Steel: The stability seen in Nippon Steel may offer an opportunity for long-term contracts, as its operations appear resilient amidst shifting trends.

-

Caution with Yamato Steel: The recent decline could indicate operational instability or demand reductions. Buyers should validate procurement needs against actual production capacity before committing to new orders.

Establishing these strategies grounded in recent activity trends and supported by geopolitical developments will provide steel buyers and analysts with a resilient approach to market uncertainties.