From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Sentiment in Asia’s Steel Market Amid Tariff Uncertainty: Insights and Recommendations

Recent developments in the Asia steel market are driven by escalating trade tensions, notably highlighted in articles such as “Trump’s tariff pause is set to expire, threatening a trade war flare-up“ and “US to lay out tariff demands in coming days: Trump“. These articles indicate a looming threat of renewed tariffs which may disrupt supply chains and influence market prices, particularly with the US set to impose tariffs effective August 1st.

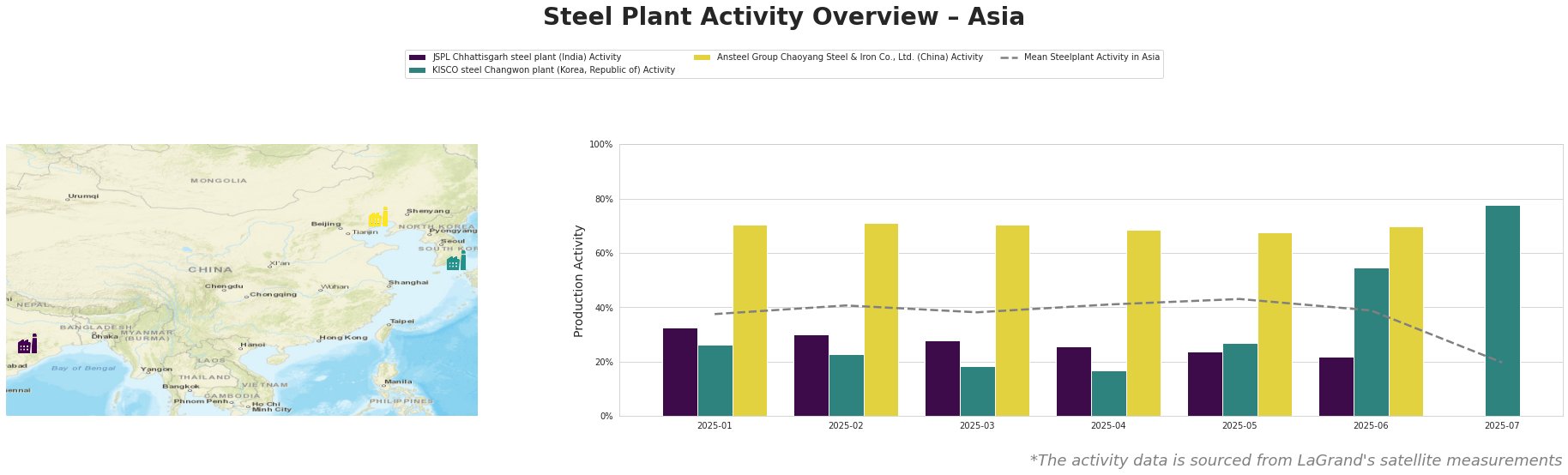

Activity levels showcase a stark decline across most Asian steel plants, with the mean activity dropping to 20% in July 2025, reflecting significant disruptions likely tied to the ongoing trade conflict. Notably, JSPL Chhattisgarh’s activity wasn’t recorded for July, having fallen from a high of 33.0% earlier in the year, while KISCO Steel’s increased activity to 78.0% in July shows a contrasting recovery trajectory. This rise aligns with discussions in the news articles regarding a potential shift in production strategies due to tariff pressures.

The JSPL Chhattisgarh steel plant, located in India, relies on an integrated process incorporating DRI and EAF methods, but recent inactivity (22% in June) coincides with the uncertainty regarding US tariffs, as articulated in “Marktbericht: Anleger warten auf Neues in Sachen Zollkonflikt“. The plant’s incapacity to report July’s activity signals potential operational constraints amid fluctuating market conditions.

Conversely, KISCO’s recovery to 78% activity suggests resilience in the steel market driven perhaps by domestic demand and strategic adjustments ahead of the impending tariffs. Despite this, the lack of direct connections to the tariff discussions indicates that this increase may be more reflective of specific market conditions in South Korea rather than a reaction to US policy changes.

The Ansteel Group’s operational stability at around 70% through June signals its robust integration strategies; however, its inactivity in July prevents further insight into its production adaptions amid external pressures.

Potential supply disruptions could arise from the uncertain tariff landscape, particularly affecting JSPL Chhattisgarh, which may necessitate strategic procurement planning. Steel buyers should consider the potential for escalated prices in August if tariffs are imposed, especially for imports reliant on materials sourced from impacted regions.

Steel buyers are advised to:

– Engage in preemptive purchasing before August to mitigate risks associated with anticipated tariff hikes.

– Diversify sourcing strategies to include local alternatives or alternative suppliers less affected by the US tariffs.

– Monitor KISCO’s upward activity as a bellwether for possible resilience in the regional market, indicating shifting supply dynamics.

These measures could help navigate the uncertain terrain of the steel market in Asia amidst looming tariff threats.