From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Outlook on Ukraine’s Steel Market: Activity Declines Amidst Ongoing Disruptions

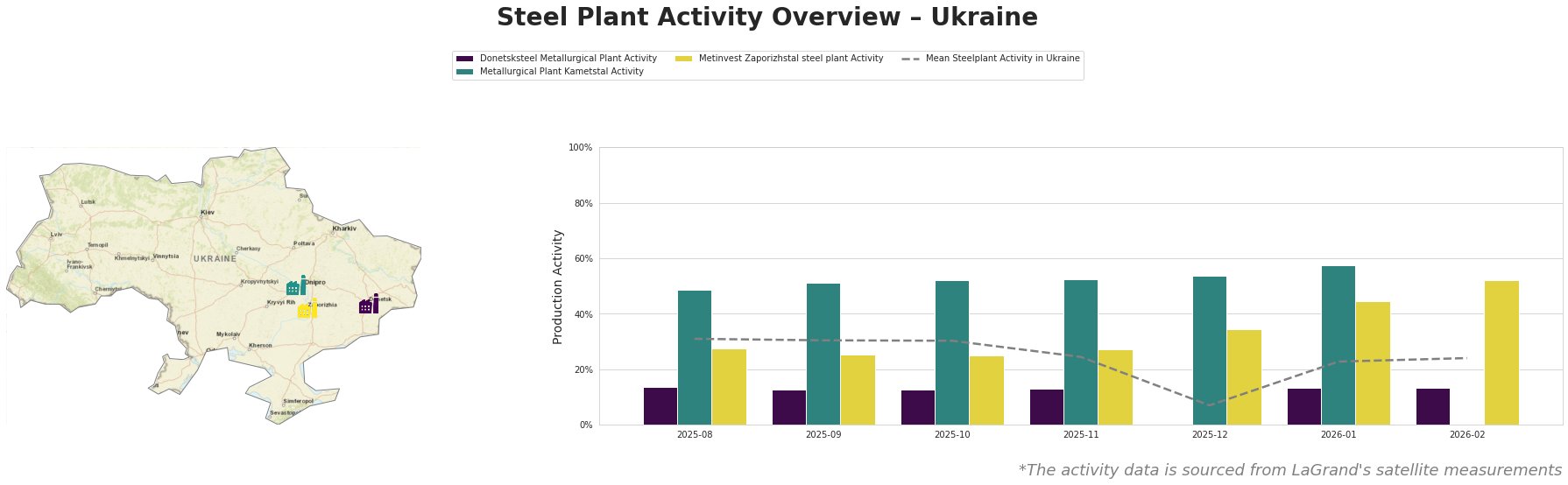

In Ukraine, the steel market currently reflects a neutral outlook as evidenced by Zaporizhstal reduced steel production by 15.8% m/m in January and Industrial production in Ukraine fell by 2.4% y/y in 2025. These reports correlate with significant reductions in activity levels at major steel plants due to ongoing challenges in the energy sector caused by Russian attacks.

The satellite-observed activity at Zaporizhstal indicates a considerable decline in activity, particularly following the reported 15.8% decrease in January production related to operational interruptions. Kametstal exhibited stable activity months leading up to January, holding at 58%, but still fell short of pre-war activities during the recent months due to energy constraints as highlighted in Industrial production in Ukraine fell by 2.4% y/y in 2025. Donetsksteel has remained at a low activity level, registering a persistent 13% throughout this period, indicating severe operational restrictions.

Metinvest Zaporizhstal steel plant has seen notable changes; following the 15.8% m/m reduction, activity registered at 44% in January and 52% in February, reflecting ongoing operational challenges. The plant’s reliance on stable energy supply aligns with the reported 20.4% drop in pig iron production suggesting an overall negative impact on steel output.

Kametstal’s production capacity remains robust, yet disruptions have persisted significantly due to external factors such as energy supplies and transport issues, as evidenced by the continuing low activity levels despite maintaining higher output stability compared to other plants.

It is critical for steel buyers to recognize potential supply disruptions primarily from Zaporizhstal, Kametstal, and Donetsksteel amidst these challenging environments. Recommendations include closely monitoring energy supply stability and securing procurement agreements in advance to hedge against further production declines. Engage with suppliers to ensure compliant and alternative supply routes are established to mitigate impacts from ongoing geopolitical tensions, particularly for clients dependent on regions directly affected by production reductions.