From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Outlook on European Steel Market: Polish Prices Rise Amid Supply Shifts

Recent activity in the European steel market, particularly in Poland, reveals a neutral sentiment shaped by rising prices amid evolving supply dynamics. According to “Polish long steel prices keep climbing amid higher costs, less pressure from import“, and “Prices for Polish rolled products continue to rise amid higher costs and less import pressure”, the increasing raw material costs and anticipated implementation of the Carbon Border Adjustment Mechanism (CBAM) have markedly influenced plant operations and long steel prices. Notably, the recent reports do not directly connect these observations to the satellite data, showing a lack of definitive operational impacts from capacity changes.

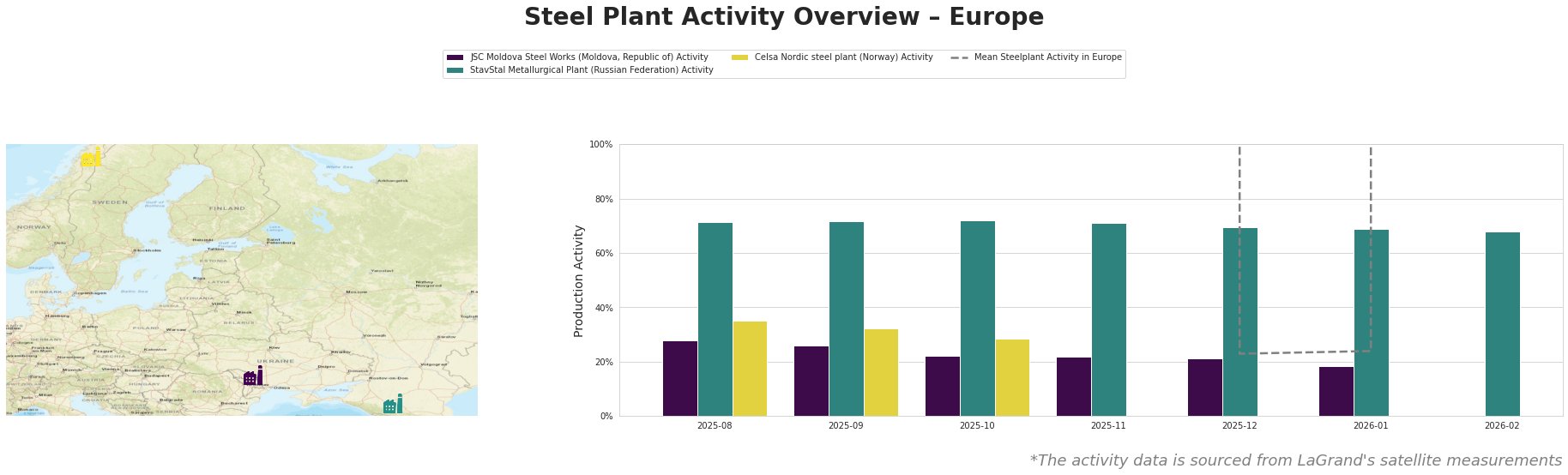

Activity levels across the observed steel plants show significant fluctuations, particularly highlighted by the StavStal Metallurgical Plant, which maintained steady activity at around 71% throughout late 2025 before slightly dropping to 68% in early 2026. Conversely, JSC Moldova Steel Works experienced notable declines, falling from 28% in August 2025 to just 18% by January 2026. This drop aligns with the uncertainty created by the CBAM, suggesting supply chain disruptions rather than demand constraints.

JSC Moldova Steel Works, specializing in electric arc furnace (EAF) production of semi-finished and finished rolled products such as wire rod and rebar, has witnessed a decline in activity by approximately 10% from August to January. This is reflective of broader market operations influenced by rising costs, as indicated in “Growing costs push European domestic rebar prices higher.” Despite its ISO certifications, the plant’s reduced activity may hinder responsiveness to rising demand signals in the struggling market.

StavStal Metallurgical Plant sustained stable operations, regularly producing square billets and rebar, yet has not seen an increase in demand in correlation with rising domestic prices. With activity levels fluctuating by only a few percentages, this plant may be positioned to benefit from elevated Polish price trends without immediate disruptions indicated by the CBAM, allowing it to capitalize on local demand.

Celsa Nordic in Mo i Rana has maintained a more stable operational profile but similarly faces challenges due to increased costs. However, it’s worth noting that the latest satellite data shows no direct relation to external pressures highlighted in the news articles.

Procurement Recommendations:

– Prioritize domestic sourcing from stable suppliers like StavStal to mitigate supply chain risks caused by the CBAM and rising costs.

– Monitor rebar and wire rod prices closely, especially from Polish producers, as indicated by “Prices for Polish rolled products continue to rise amid higher costs and less import pressure.“ Expect variations due to seasonality and raw material shortages.

– Diversify supply sources to avoid reliance on limited producers while maintaining flexibility given the uncertain market conditions.

These actions are crucial for maintaining competitive positioning amidst evolving market dynamics highlighted by recent developments in Europe.