From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Market Sentiment: Italy’s Steel Production Declines Amid Mixed Activity Trends

In Italy, steel production has faced notable declines, with the headline issue being an 11.8% drop in production reported in the article “Italy reduced steel production by 11.8% m/m in November“. This decline corresponds with satellite activity data, showing reduced operational levels at key steel plants, particularly in November.

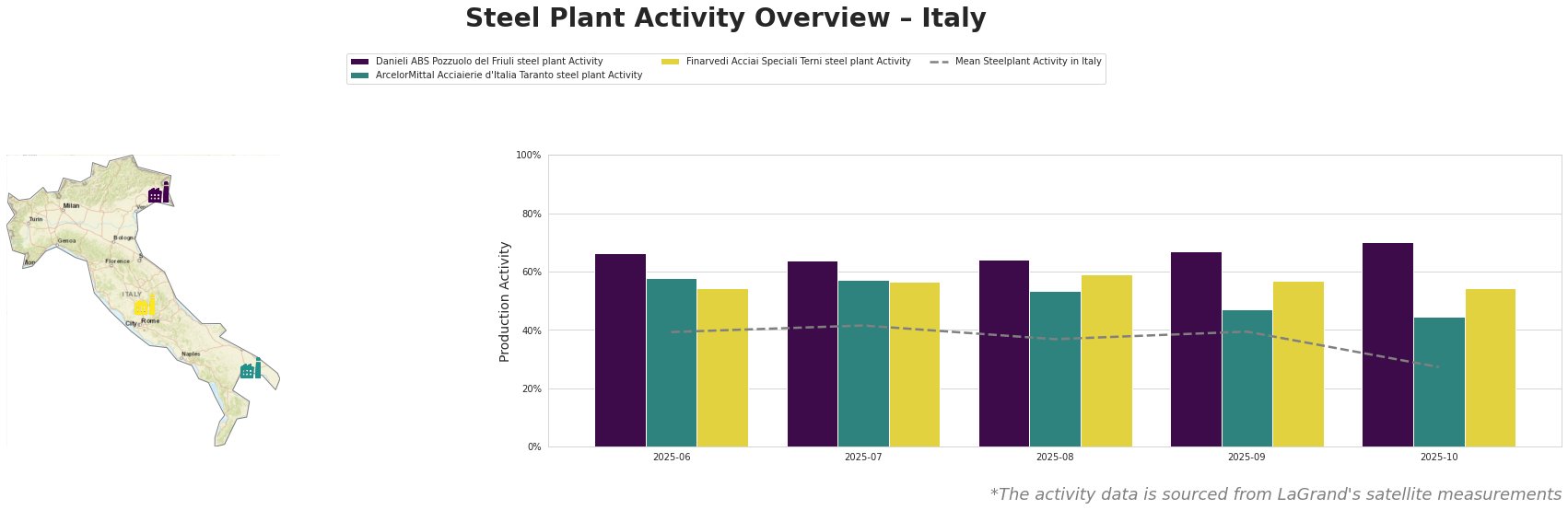

Measured Activity Overview

Recent data indicate a significant decline in mean activity, dropping to 27.0% in October 2025, notably lower than earlier months, likely linked to the reduction in production capacity mentioned in “Italian crude steel production down 2.8 percent in November 2025”. The activities of individual plants reflect varied performance; Danieli experienced a peak of 70.0% in October but showed no specific direct alignment with production declines, as no matching production data is available.

Plant Insights

Danieli ABS Pozzuolo del Friuli Steel Plant: Located in Udine, this electric arc furnace (EAF) facility has a capacity of 1,100 tons of crude steel and primarily produces semi-finished and finished rolled products. Despite activity peaking at 70.0% in October, substantial production declines contrast with the broader industry trends noted in November, linking indirectly to the 11.8% reduction cited earlier.

ArcelorMittal Acciaierie d’Italia Taranto: As one of Italy’s largest integrated steel plants, its capacity reaches 11,500 tons, focusing on flat products. A drop to 45.0% activity in October reflects the downturn in output, related to the industry-wide decline highlighted in “Crude steel production in Italy decreased by 2.8% in November 2025“.

Finarvedi Acciai Speciali Terni: This plant operates with 1,450 tons capacity via EAF technology, focusing on high-value products like stainless steels. Activity has remained relatively stable, but declines noted across the broader market do suggest potential vulnerabilities in fulfilling rising demand.

Evaluated Market Implications

Potential supply disruptions seem evident as production reductions affect long and flat steel outputs, particularly from the ArcelorMittal facility. Buyers should closely monitor the evolving situation, particularly in light of the declines reported in “Italy reduced steel production by 11.8% m/m in November”, where specific reference to monthly trends may indicate a shift in procurement strategies.

Steel buyers are advised to explore alternative sources or ensure contracts with suppliers like Danieli, whose operational capacity remains relatively robust despite recent fluctuations. Analysts should prepare for potential reactive market changes as these production shifts unfold in the coming months.