From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Market Sentiment: Asia’s Steel Industry Faces Regulatory Adjustments and Production Declines

The Asia steel market is navigating a complex landscape characterized by regulatory changes in China and a significant drop in crude steel production. Noteworthy reports such as “China issues new regulations for exports of steel products“ and “China’s crude steel output falls below 70 million mt in Nov, down 4.0% in Jan-Nov 2025” indicate a tightening supply chain and decreased production volumes, correlating with observed declines in plant activity levels.

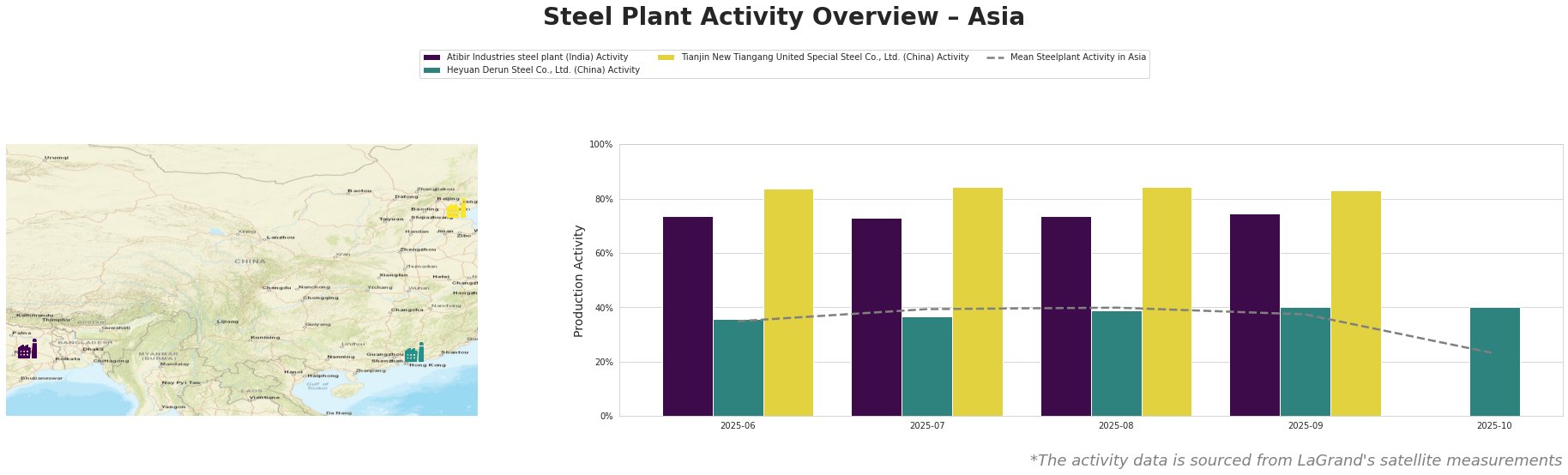

Recent satellite data reveals that the Tianjin New Tiangang United Special Steel Co., Ltd. maintained high activity levels around 83-84% until October 2025 but saw operations taper off significantly to a mean of 23% by October 31st, aligning with the decline in overall crude steel production in China attributed to “China cut steel production to a two-year low in November.” Conversely, both the Atibir Industries steel plant and Heyuan Derun Steel Co., Ltd. have maintained relatively stable activity levels above 70%, reflective of their robust operational strategies amidst regulatory pressures. No explicit connections can be established for the decline in activity at Heyuan Derun, suggesting internal factors may be at play as China’s new export regulations come into effect.

The Atibir Industries steel plant in India continues to leverage its integrated BF technology, allowing for steady production of crude and rolled products, currently running optimally around 74%. This plant is resilient against supply chain disruptions given India’s strong production metrics, highlighted by “India’s crude steel production rises over 11 percent year on year to nearly 110 million mt in Apr-Nov’25.” Meanwhile, Heyuan Derun has maintained operation largely due to the heightened demand for finished products like hot rolled rebar, aligning with China’s policy shifts but potentially being impacted by regulatory uncertainties pertaining to exports.

Given the anticipated supply disruptions from China’s stringent new regulations and declining production, steel buyers should consider:

- Increasing procurement from the Atibir Industries steel plant, capitalizing on India’s rising production and stable activity levels ensuring availability.

- Monitoring the ongoing output trends at Tianjin New Tiangang, as reduced activity may hinder capacity for fulfilling large orders in the near term.

- Strengthening relationships with local producers and exploring alternatives to Chinese steel, which may be subject to higher costs and availability issues post-regulation implementation.

These recommendations are imperative for navigating potential supply shifts and ensuring sustainability in steel sourcing.