From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Market Insights: European Steel Activity in Response to Serbian Import Quotas

The European steel market is currently in a neutral state, facing recent developments particularly influenced by regulatory changes in Serbia. The article Serbia introduces six-month import quotas on certain steel products (published on January 15, 2026) details new restrictions on steel imports, which have resulted in observable shifts in plant activities across the region. Concurrently, concerns from Bosnia and Herzegovina as highlighted in Bosnia and Herzegovina concerned about Serbian quotas on steel imports (January 19, 2026), raise implications regarding trade flows and export reliability.

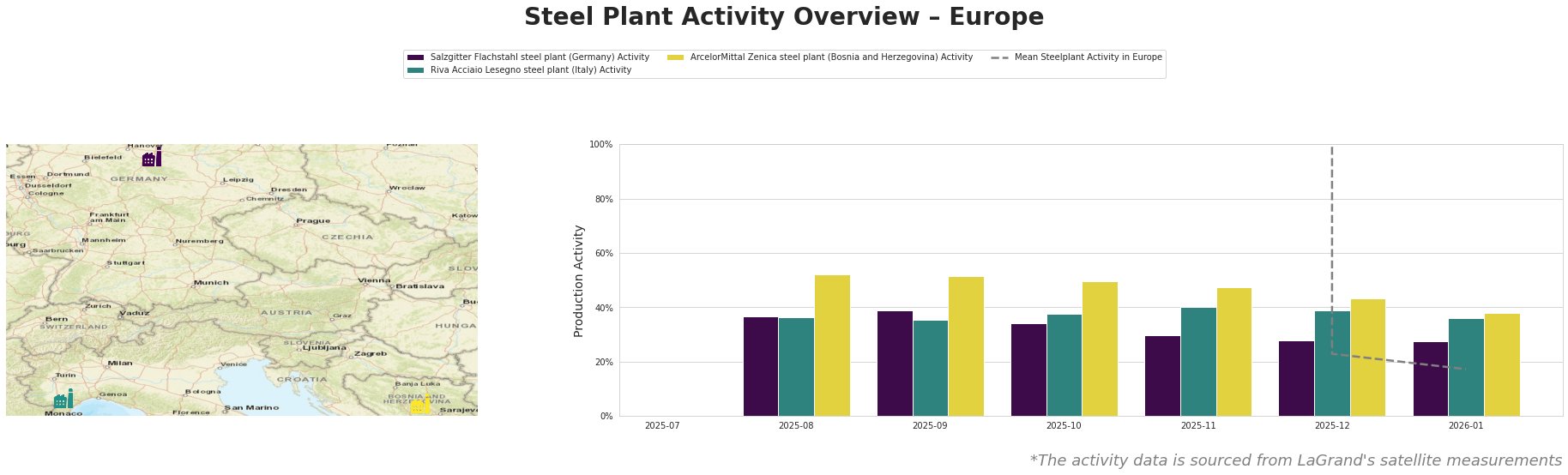

The Salzgitter Flachstahl plant has seen a decline in activity from 37.0% in August 2025 to 27.0% by January 2026, suggesting possible impacts from market uncertainties due to new trade regulations. Despite its robust production capacity, the declining trend aligns with increased focus on compliance with import quotas as referenced in the news.

Riva Acciaio Lesegno has also shown a downward trend but remains relatively stable, indicating its flexibility to absorb changes. Meanwhile, the ArcelorMittal Zenica plant, which serves the construction sector in Bosnia, observed a drop from 52.0% to 38.0%. This decrease highlights the potential implications of the aforementioned Serbian import quotas affecting its export capabilities, as raised by concerns in Bosnian industry urges action over Serbian import quotas (January 20, 2026).

These dynamics suggest that the Serbian quotas are creating significant bottlenecks not only in trade relations but also affecting production levels, particularly for plants reliant on exports to affected markets.

To mitigate potential supply disruptions, steel buyers should consider the following procurement actions:

- Monitor Serbian regulatory developments closely. With Serbia’s monthly utilization reports impacting imports, aligning procurement cycles with this data will be critical for maintaining steady supply.

- Diversify supplier bases within the EU and Turkey to offset potential shortages resulting from restrictive quotas. This will help maintain production continuity and safeguard against delays attributed to border crossing issues highlighted in the news.

- Engage with Bosnia’s steel producers proactively. Given the concerns raised by the Foreign Trade Chamber, long-term contractual relationships may need reshaping to reflect current realities, ensuring commitments remain reliable.

The market sentiment remains neutral, yet careful navigation through these regulatory changes can position steel buyers advantageously in a fluctuating landscape.