From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNetherlands Steel Market Poised for Green Transition: Tata Steel Acquisition Fuels Positive Outlook

The Netherlands steel market shows a very positive sentiment driven by Tata Steel Nederland’s strategic move toward green steel production. Recent news articles including “Tata Steel Nederland to acquire Wattenfall power plants to support transition to green metallurgy” and “Tata Steel Nederland to acquire Vattenfall power plants to support green steel transition” (Published: 2025-11-18T23:00:00Z and 2025-11-17T23:00:00Z respectively) detail Tata Steel’s acquisition of Vattenfall power plants. While these acquisitions are prospective (January 1, 2026), current observed plant activity does not yet reflect the impact of this transition, as no direct relationship can be established between the news and the most recent activity data.

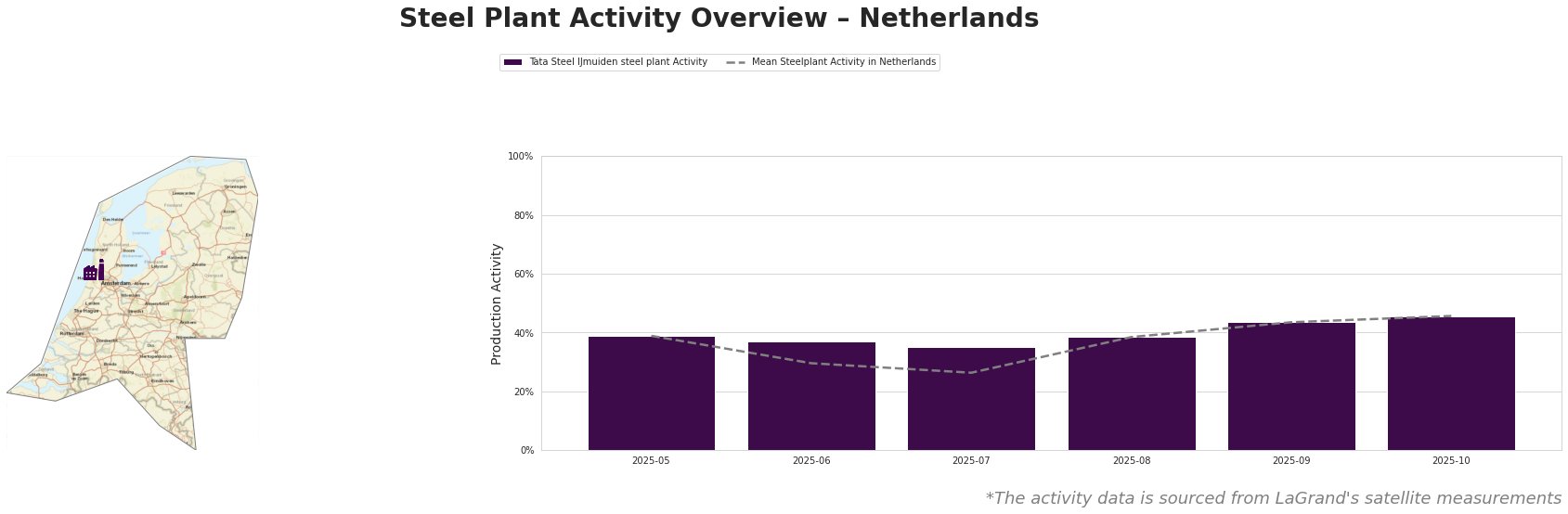

Observed activity levels show a general upward trend in both the mean steel plant activity in the Netherlands and the activity at Tata Steel IJmuiden steel plant between May and October 2025. The mean steel plant activity increased from 39.0% in May to 46.0% in October. Tata Steel IJmuiden steel plant similarly shows an increase from 39.0% in May to 46.0% in October. The Tata Steel plant activity levels are slightly above the mean between June and August.

Tata Steel IJmuiden steel plant, located in North Holland, is an integrated steel plant with a crude steel capacity of 7.5 million tonnes via the BOF route and iron capacity of 6.31 million tonnes via BF. The plant produces semi-finished and finished rolled products, including slabs, hot and cold rolled coil, and coated strip products. The plant holds ResponsibleSteel Certification and ISO14001 certification. The activity at Tata Steel IJmuiden mirrors the average for the Netherlands, increasing to 46% in October. The acquisition of the Vattenfall power plants, as highlighted in “Tata Steel Nederland to acquire Vattenfall power plants to support transition to green metallurgy” is a forward-looking strategy. There is no immediate, observable impact of this acquisition on current activity levels, which reflects business as usual.

The acquisition of the Vattenfall power plants by Tata Steel, as announced in the news, indicates a commitment to long-term green steel production. Given the expected transfer date of January 1, 2026, no immediate supply disruptions are anticipated. However, steel buyers should monitor future activity levels at the Tata Steel IJmuiden plant and be prepared for potential supply chain adjustments as the company integrates the power plants and transitions to greener steelmaking processes, as described in “Tata Steel Nederland to acquire Vattenfall power plants to support transition to green steel transition” (Published: 2025-11-17T14:21:34Z). Procurement professionals should begin assessing alternative sourcing options and engage in proactive discussions with Tata Steel regarding their transition plans and potential impacts on product availability and pricing.