From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNegative Sentiment in Asia’s Steel Market: Actionable Insights for Buyers Amidst Declining Activity

The steel market sentiment in Asia is turning negative due to significant activity drops in prominent steel plants across the region. Recent developments highlighted in China and the EU agree on steps to resolve their dispute over EV imports suggest that while there are attempts to stabilize trade relations, these efforts may not immediately benefit the steel sector. Satellite-observed activity at major plants indicates notable declines, particularly linked to reduced demand in downstream sectors.

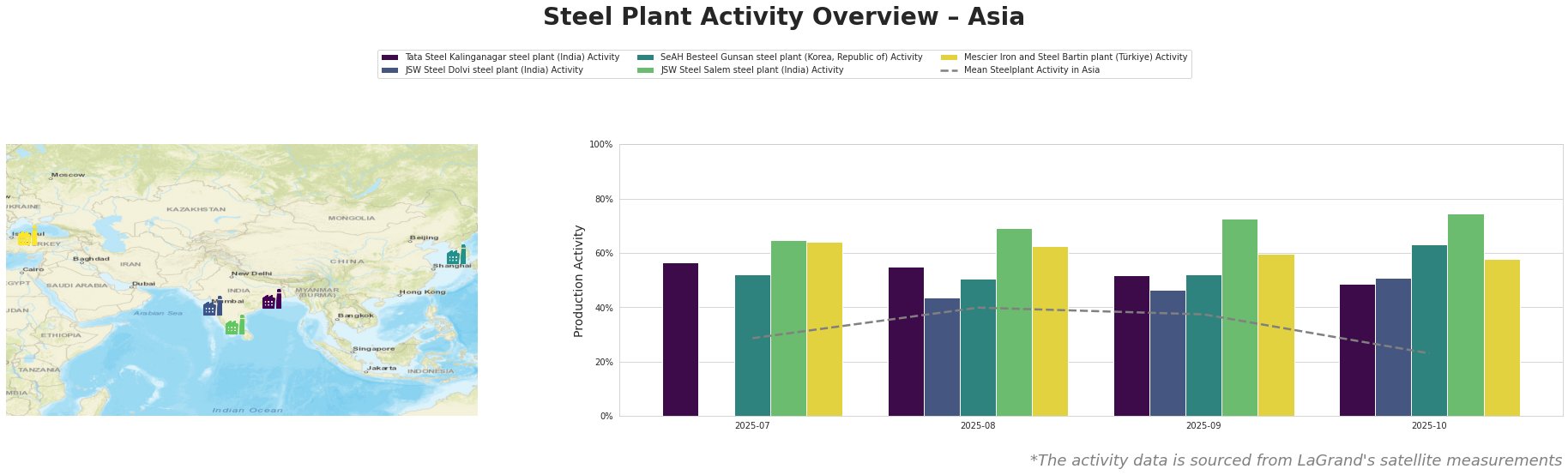

The recent data shows a downward trend in the overall mean steel plant activity, decreasing sharply from 40% to 23% between August and October 2025. Specifically, Tata Steel Kalinganagar’s activity fell from 55% to 49%, while JSW Steel Dolvi saw a recovery to 51% after a prior drop to 44%. Notably, JSW Steel Salem’s activity peaked at 75% in October, although this is not sustainable in the context of declining demand.

Tata Steel Kalinganagar produces automotive-grade steel, and the increase in electric vehicle imports from China, as indicated by EU guidance sets price undertaking route for Chinese EV imports, may intensify competition, affecting future orders. Demand fluctuations are evident, suggesting a supply disruption risk as production slows.

For steel procurement professionals, it is critical to adjust strategies accordingly. Given the declining activity levels, particularly at Tata Steel and in the context of the EU-China EV conflict, steel buyers should consider negotiating shorter-term contracts to navigate price volatility and potential supply shortages. Engage actively with suppliers to monitor production levels closely and align procurement schedules with the available capacities, especially for critical grades produced by JSW Steel Dolvi and Salem. It is advisable to prepare for potential shortages as production rates decline markedly and competition from subsidized EV markets evolves.