From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNegative Momentum in China’s Steel Market: Recent Plant Activity and Implications

China’s steel market is currently facing a downturn, reflected in the recent article “EU-Wirtschaftsgipfel: Große Worte, kleine Listen” which underscores the need for Europe to bolster its trade competitiveness against China and the US, revealing a broader sentiment impacting China’s export potential. The article discusses the necessity for concrete actions which may determine future market dynamics, but as of now, there’s no direct link to observed activity data for specific steel plants. Meanwhile, “Europe must be open to reviewing the carbon market – Merz“ implies that high carbon pricing pressures industries, adding to the stress felt across the sector due to rising energy costs.

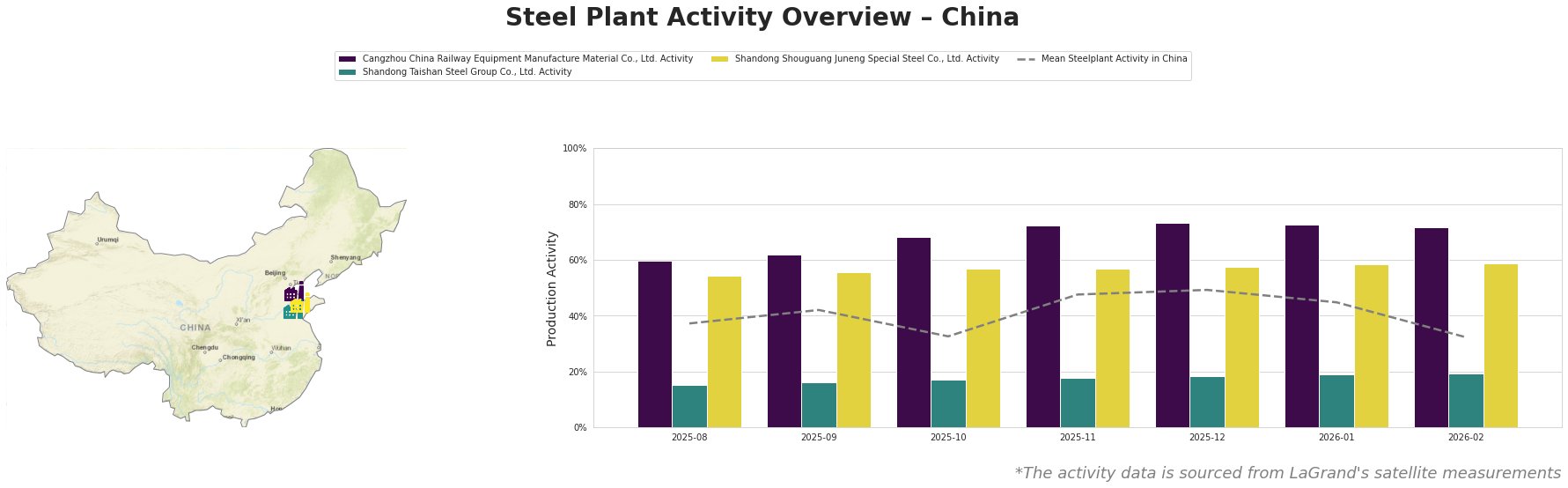

The recent satellite-observed activity at key steel plants corroborates a troubling trend. The Cangzhou China Railway Equipment Manufacture Material Co., Ltd. exhibited a minor reduction in activity, stabilizing at 72% in February from 73% in December; this plant remains well above the national average of 32%. Shandong Taishan Steel Group Co., Ltd. demonstrated a significant decline to 16% in activity from 19%, indicating deeper operational challenges. Conversely, Shandong Shouguang Juneng Special Steel Co., Ltd. has remained stable, recorded at 59%, but is still impacted by the prevailing negative sentiment in the sector.

Given the recent shifts and conditions outlined in “EU-Wirtschaftsgipfel: Große Worte, kleine Listen” and “Europe must be open to reviewing the carbon market – Merz”, the following implications for procurement actions are critical for steel buyers:

-

Cangzhou China Railway Equipment: Stable activity despite the overall downturn may suggest continued operational integrity, but fluctuations signal potential supply challenges. Buyers should lock in contracts or inventory to hedge against larger future drops.

-

Shandong Taishan Steel Group: A sharp decline indicates potential reliability issues; higher scrutiny and alternative sourcing should be considered to mitigate risk.

-

Shandong Shouguang Juneng: While currently stable, ongoing socio-economic pressures may worsen. Maintain close monitoring of market changes to adjust procurement strategies promptly.

Given the overall negative sentiment, agility in procurement approaches will be vital as market dynamics evolve.