From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals in European Steel: Ukraine’s Pig Iron Surge Offset by Regional Output Declines

Europe’s steel market presents a complex picture. Despite positive trends in Ukrainian pig iron exports, overall steel production faces headwinds. The increase in Ukrainian pig iron exports is highlighted in “Ukraine increased its pig iron exports by 55% year-on-year in January-July“. However, the article “Southeast Europe’s July steel output falls on-year” indicates regional production declines, potentially impacting supply chains. The satellite data shows decreased activity from July to August. No direct links between the observed activity changes in the steel plants and any specific news can be established.

Measured Activity Overview:

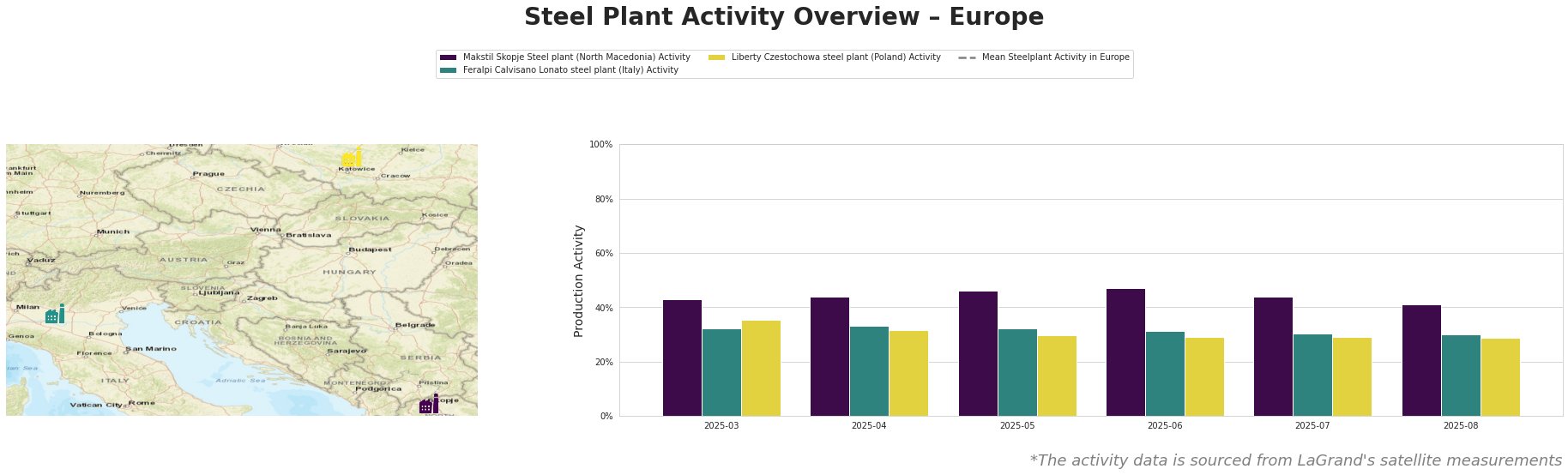

The mean steel plant activity in Europe fluctuated throughout the period, peaking in May and July. Makstil Skopje in North Macedonia showed a steady increase until June, reaching 47%, followed by a decrease to 41% in August. Feralpi Calvisano Lonato in Italy remained relatively stable, with a slight decline from 32% in March to 30% in August. Liberty Czestochowa in Poland experienced a consistent decrease from 35% in March to 29% in August.

Makstil Skopje, a North Macedonian steel plant with an EAF capacity of 550ktpa, primarily produces semi-finished slabs. Its activity decreased from 47% in June to 41% in August. No immediate correlation can be established with any news article.

Feralpi Calvisano Lonato, located in Italy, has an EAF capacity of 600ktpa, producing semi-finished billets. The plant showed minor variations in observed activity, stabilizing at 30% in the last two months. There is no obvious link between the changes in activity and any of the named news articles.

Liberty Czestochowa, a Polish steel plant with an EAF capacity of 840ktpa, is focused on semi-finished plate production. The plant’s activity levels decreased consistently, reaching 29% in August. There is no directly attributable link to the provided news articles.

Evaluated Market Implications:

The article “Southeast Europe’s July steel output falls on-year” suggests potential regional supply constraints, particularly within Southeast Europe. Meanwhile, the article “Ukrainian steel companies reduced exports of semi-finished products by 36% y/y in January-July” suggests constraints specifically with semi-finished steel products.

- Recommended Procurement Action: Steel buyers should closely monitor Southeast European steel prices and lead times due to potential output decreases. Consider diversifying supply sources outside the region for semi-finished steel products, factoring in potentially longer lead times and transportation costs from alternative suppliers.

- Recommended Procurement Action: Given the surge in Ukrainian pig iron exports reported in “Ukraine increased its pig iron exports by 55% year-on-year in January-July” especially to the US, buyers should explore potential cost advantages of sourcing pig iron, where applicable. Monitor potential trade policy changes that may affect pig iron imports.