From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals in European Steel: Plate Prices Waver Amid CBAM Uncertainty, Rebar Dips

Europe’s steel market presents a mixed picture, with plate prices facing headwinds while rebar sees further declines. According to the news article “Italian plate hikes fail amid sluggish post-holiday restart,” Italian heavy plate prices remain stable, constrained by weak demand despite producers’ intentions to improve margins. Simultaneously, the article “European rebar, wire rod prices on downward track” indicates that European rebar and wire rod prices have decreased due to weak demand, falling scrap prices, and import pressure. No direct relationship could be established between these price trends and the satellite-observed steel plant activities.

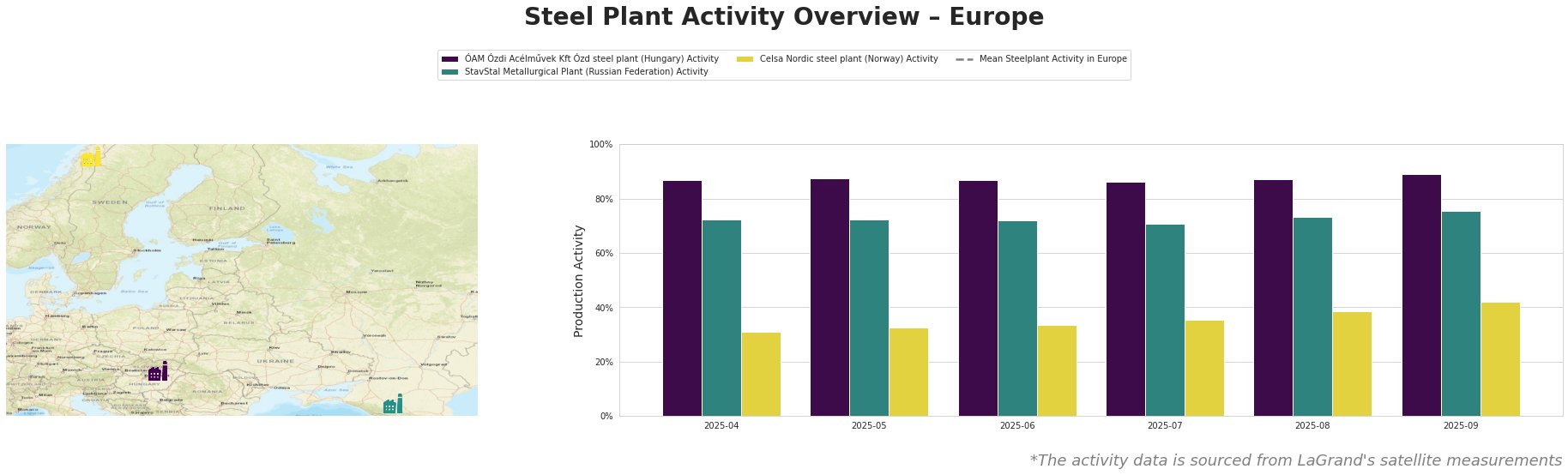

Here’s an overview of monthly activity levels:

The mean steel plant activity level in Europe fluctuated throughout the observed period.

ÓAM Ózdi Acélművek Kft Ózd steel plant, a Hungarian EAF-based producer with a crude steel capacity of 690 ktpa, primarily manufactures semi-finished and finished rolled products such as rebar and wire coils. The plant has maintained a relatively high and stable activity level, fluctuating between 86% and 89% during the observed period. No direct connection could be established between these stable activity levels and the recent news articles about European steel prices.

StavStal Metallurgical Plant, a Russian EAF-based producer with a 500 ktpa capacity focused on square billets, rebar, and wire rod, showed a slight increase in activity from 72% in April-June to 75% in September. No direct connection could be established between these activity levels and the recent news articles about European steel prices.

Celsa Nordic steel plant in Norway, another EAF-based producer with a 700 ktpa capacity producing billet, rebar, and wire rod, has shown a consistent increase in activity from 31% in April to 42% in September. This increase suggests potentially rising output. No direct connection could be established between these increasing activity levels and the recent news articles about European steel prices.

The article “Average European prices to decline in 2026: analyst” suggests potential price decreases in 2026, which could put downward pressure on current procurement strategies. Given the mixed signals in the market, with plate prices wavering and rebar declining, steel buyers should consider the following procurement actions:

- For rebar procurement: The article “European rebar, wire rod prices on downward track” notes declining rebar prices due to weak demand and import pressure. Buyers should leverage this downward trend to negotiate more favorable prices with suppliers, particularly in Italy, where prices have seen more significant declines.

- For plate procurement in Southern Europe: Considering the article “Italy steel heavy plate prices narrow upward ibn new deals; CBAM costs built into import offers“, Southern European buyers should carefully evaluate import offers from Asia, specifically factoring in CBAM costs. While domestic prices are not significantly higher, monitoring for concrete CBAM details from the European Commission remains crucial. If domestic prices stay competitive, buyers might prefer domestic sourcing to avoid import complexities and CBAM uncertainties.

- Overall: Given the forecast of declining prices in 2026 according to “Average European prices to decline in 2026: analyst“, buyers should exercise caution in long-term contracts and favor shorter-term agreements to capitalize on potential future price decreases.