From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals in European Steel: French Trade Weakens, Spanish Output Dips Amidst Broader EU Production Declines

Europe’s steel market presents a mixed landscape. While manufacturing output shows signs of recovery in some regions, broader industrial production faces headwinds. The sector is influenced by trade fluctuations, production adjustments, and evolving activity levels at key steel plants, as evidenced by recent news and satellite observations. Notably, France’s steel trade weakens in early 2025, while metal industry output edges up in June, and Spain’s steel production declined in June, painting a complex picture for market participants. While a direct relationship between these news and plant activity cannot be fully established with the given data, the reports highlight underlying trends potentially influencing operations.

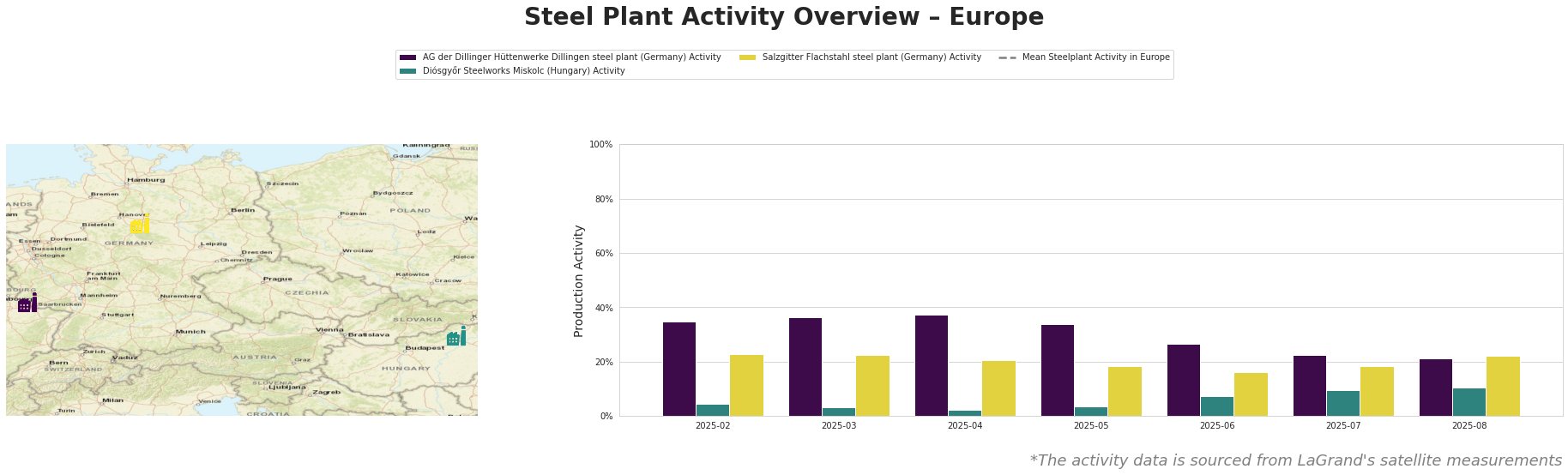

Here’s a summary of recent activity trends across key European steel plants:

Activity levels across the observed plants show a general downward trend over the past few months. AG der Dillinger Hüttenwerke experienced a significant drop from 37% in April to 21% in August. Diósgyőr Steelworks saw an increase from a low of 2% in April to 11% in August. Salzgitter Flachstahl experienced a decline from 23% in March to 16% in June, followed by a slight recovery to 22% in August. The “Mean Steelplant Activity in Europe” value in the table shows no actionable data and will be disregarded.

AG der Dillinger Hüttenwerke Dillingen steel plant

AG der Dillinger Hüttenwerke Dillingen steel plant, located in Saarland, Germany, is an integrated steel plant with a crude steel capacity of 2,760 ttpa (BOF) and an iron capacity of 4,790 ttpa (BF). The plant focuses on producing semi-finished and finished rolled products, including non-alloy structural steels and high-strength quenched & tempered fine-grained steels, serving sectors like automotive and energy. Satellite data reveals a substantial activity drop from 37% in April 2025 to 21% in August 2025. Given the news that France’s steel trade weakens in early 2025, while metal industry output edges up in June, the decreased activity may indicate decreased export demand from France, although no direct correlation can be explicitly established from the provided information.

Diósgyőr Steelworks Miskolc

Diósgyőr Steelworks Miskolc, situated in Borsod-Abaúj-Zemplén, Hungary, operates an electric arc furnace (EAF) with a crude steel capacity of 550 ttpa. The plant specializes in producing semi-finished and finished rolled products, including case-hardening steels and construction steels, primarily for the building and infrastructure sector. The satellite data shows a steady increase in activity from a low of 2% in April 2025 to 11% in August 2025. This rise in activity does not directly correspond to any of the news articles provided, and no explicit link can be established.

Salzgitter Flachstahl steel plant

Salzgitter Flachstahl steel plant, located in Lower Saxony, Germany, is an integrated steel plant with a crude steel capacity of 5,200 ttpa (BOF) and an iron capacity of 4,800 ttpa (BF). The plant produces hot and cold-rolled products, including galvanized and coated steel, catering to the automotive and construction industries. Salzgitter is transitioning its BF plants to DRI and switching to entirely hydrogen-based steel by 2050 as part of its Salcos Green Steel project. The observed activity declined from 23% in March 2025 to 16% in June 2025 but recovered slightly to 22% in August 2025. Given Industrial production in the EU decreased by 1% month-on-month in June, the dip in June might reflect broader industrial slowdowns. The subsequent recovery, however, suggests potential adaptation to changing market conditions, although an explicit correlation is not possible.

Evaluated Market Implications

Based on the provided data, the following market implications can be identified:

- Potential Supply Disruptions: The significant activity decrease at AG der Dillinger Hüttenwerke (from 37% to 21% between April and August) suggests potential supply disruptions, especially for specific products like high-strength quenched & tempered fine-grained steels. France’s steel trade weakens in early 2025, while metal industry output edges up in June further suggests that reduced steel trade in France coupled with a rise in the metal industry may be impacting Dillinger Hüttenwerke. The dip in activity at Salzgitter Flachstahl also warrants attention but it does not pose an immediate supply risk since the dip has largely recovered by August.

Recommended Procurement Actions:

- Steel Buyers focusing on sourcing from Dillinger Hüttenwerke: Consider diversifying supply sources for critical steel products to mitigate risks associated with potential supply disruptions. Engage in proactive communication with AG der Dillinger Hüttenwerke to gain clarity on production outlook and potential lead time adjustments. Due to France’s steel trade weakens in early 2025, while metal industry output edges up in June, keep an eye on demand changes in France.

- Market Analysts: Closely monitor the impact of broader EU industrial production trends, as highlighted by the Industrial production in the EU decreased by 1% month-on-month in June report, on steel plant activity and overall market stability.