From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMexico Steel Market Under Pressure: Trade Deficit and Industrial Contraction Impacting Production

Mexico’s steel market faces headwinds amid a widening trade deficit and industrial contraction, signaling potential challenges for steel buyers. The downturn is underscored by the news that “Mexico trade deficit widens in Sep on record imports” and “Mexico’s economy contracts in 3Q“. However, a direct relationship between these reports and immediate changes in satellite-observed plant activity levels is not explicitly established.

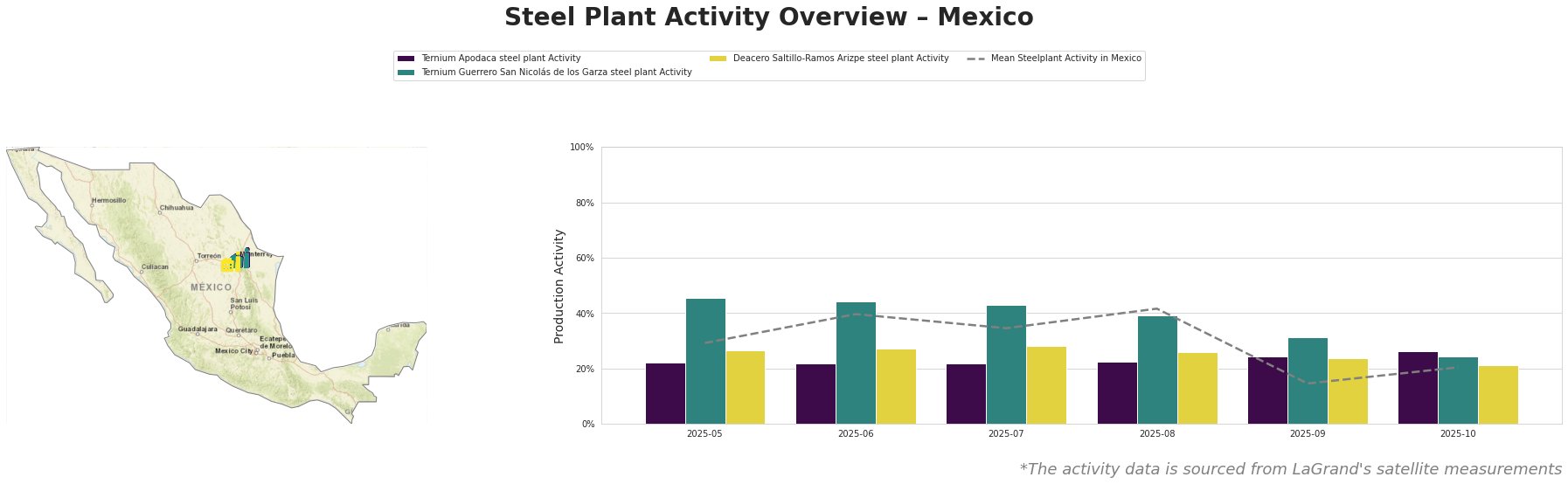

The following table summarizes recent monthly activity trends in selected Mexican steel plants:

The average steel plant activity in Mexico experienced a significant drop in September to 15.0%, before recovering slightly to 20.0% in October.

Ternium Apodaca steel plant, located in Nuevo León, operates with EAF technology and a crude steel capacity of 600 thousand tonnes per annum (ttpa), focusing on billets and rebar for the building and infrastructure sectors. The plant’s activity has remained relatively stable, ranging from 22% to 26% over the observed period, showing a small increase in the last two months. This stability does not reflect the overall downward trend observed across Mexico. No direct correlation can be established between the plant’s activity and the news articles provided.

Ternium Guerrero San Nicolás de los Garza steel plant, also in Nuevo León, is an integrated DRI-EAF facility with a crude steel capacity of 2,400 ttpa. It produces hot- and cold-rolled coils, profiles, and tubes. A notable decline in activity is observed in October, dropping to 24% from a high of 45% in May. This sharp decrease contributes significantly to the overall decline in the average steel plant activity in Mexico. No direct correlation can be established between the plant’s activity and the news articles provided.

Deacero Saltillo-Ramos Arizpe steel plant, situated in Coahuila, utilizes EAF technology with a crude steel capacity of 700 ttpa to produce steel profiles for building and infrastructure. Its activity mirrors the overall market trend, declining to 21% in October. No direct correlation can be established between the plant’s activity and the news articles provided.

The contraction of Mexico’s economy by 0.2% in the third quarter, as reported in “Mexico’s economy contracts in 3Q,” coupled with the widening trade deficit detailed in “Mexico trade deficit widens in Sep on record imports,” suggests a weakening domestic demand for steel. The drop in automotive exports mentioned in the articles may impact demand for Ternium Guerrero’s products.

Evaluated Market Implications:

The economic contraction reported in “Mexico’s economy contracts in 3Q” and the increased trade deficit, according to “Mexico trade deficit widens in Sep on record imports“, combined with the decreased activity observed at Ternium Guerrero plant, indicates a potential localized supply disruption affecting flat and long steel products.

Recommended Procurement Actions:

- Steel buyers: should closely monitor the availability of hot- and cold-rolled coils, profiles and tubes from Ternium Guerrero (San Nicolás de los Garza) steel plant.

- Market analysts: need to incorporate data on plant activities into their models to provide a more detailed image on the sector.