From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMexico Steel Market: Tariff Pause Amidst Import Surge and Plant Activity Shifts

Mexico’s steel market faces a complex situation, marked by a tariff negotiation pause and a surge in imports. According to “Mexico president confirms tariff pause after call,” negotiations with the US have been extended, potentially impacting trade flows. This development occurs against a backdrop of record imports as reported in “Mexico trade deficit widens in Sep on record imports” and “Mexico’s trade deficit widened in September amid record imports,” but a direct link to specific plant activity changes cannot be definitively established.

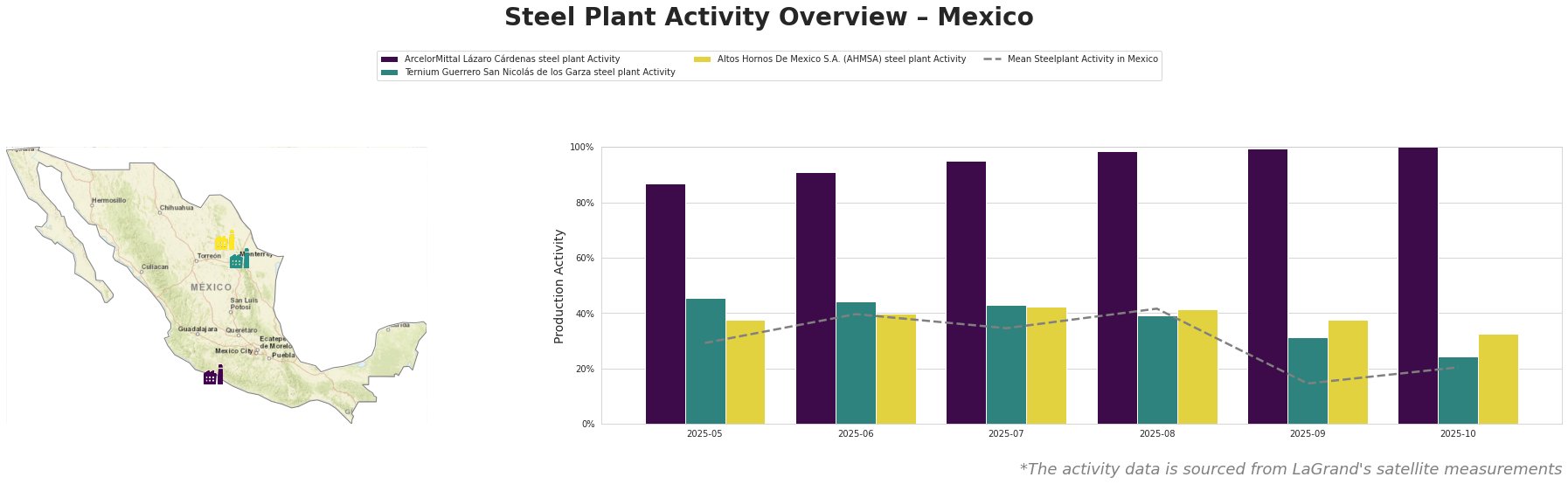

The mean steel plant activity in Mexico saw a significant dip in September to 15.0%, recovering slightly to 20.0% in October.

ArcelorMittal’s Lázaro Cárdenas plant, a major integrated steel producer with both BF/BOF and DRI/EAF production routes and a capacity of 5.7 million tonnes of crude steel, shows consistently high activity. Its activity climbed steadily to 100% in October. This plant’s output of rods, wire rods, billets, and slabs is crucial for automotive and construction sectors, but no direct link to the news articles could be established.

Ternium’s Guerrero plant in San Nicolás de los Garza, an integrated DRI-EAF facility with a 2.4 million tonne crude steel capacity specializing in hot- and cold-rolled coils, profiles and tubes, experienced a decrease in activity from 45.0% in May to 24.0% in October. This decline might correlate with the automotive export decreases noted in “Mexico trade deficit widens in Sep on record imports” and “Mexico’s trade deficit widened in September amid record imports“, given the plant’s product applications.

Altos Hornos De Mexico S.A. (AHMSA), an integrated BF/BOF steel plant with EAF capacity based in Coahuila and boasting a 5.5 million tonne crude steel capacity, shows a slow decline in activity from 38.0% in May to 33.0% in October. Its production of hot and cold rolled sheets, structural profiles, and tinplate caters to the building, infrastructure, and steel packaging sectors. No direct link to the named news articles could be established.

Given the “Mexico president confirms tariff pause after call,” steel buyers should anticipate continued price volatility due to the unresolved trade negotiations. Buyers heavily reliant on Ternium’s Guerrero plant products should actively monitor the automotive export situation and consider diversifying suppliers to mitigate potential supply disruptions arising from the plant’s declining activity. Procurement analysts should pay close attention to official customs data as it is released to verify whether recent legislative changes or new legislation will impact Chinese car imports.