From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMexico Steel Market: Import Tariffs Loom, Auto Sector Mixed, ArcelorMittal Activity Soars

Mexico’s steel market presents a complex picture, influenced by industrial output declines, mixed auto sector performance, and rising inflation. According to “Mexico slaps import tariffs on 1,371 products starting in 2026,” the government is implementing tariffs to bolster domestic industries. These tariffs could reshape supply chains and pricing dynamics for steel buyers. While “Mexico’s industrial output extends declines in July” indicates a weak start to Q3, and “Mexico auto exports up, output down in August” reveals a mixed performance in the automotive sector, a key steel consumer. However, satellite data shows a significant surge in activity at one major steel plant.

The news articles do not explain the specific activity changes measured by satellite data.

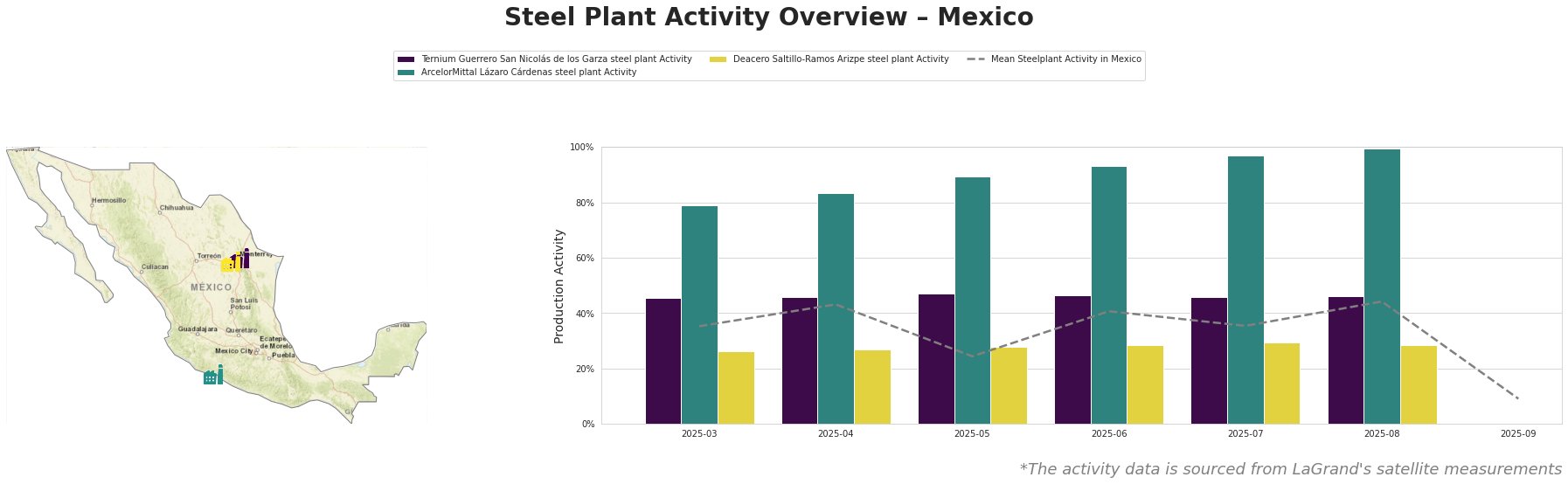

Across all observed plants, the mean steel plant activity in Mexico initially increased from 35% in March to 44% in August, before dropping sharply to 9% in September.

The Ternium Guerrero San Nicolás de los Garza steel plant, an integrated DRI-EAF facility producing 2.4 million tonnes of crude steel annually, demonstrated relatively stable activity from March to August, fluctuating narrowly between 45% and 47%. This stability does not appear to be directly linked to any of the provided news articles.

The ArcelorMittal Lázaro Cárdenas steel plant, a major integrated BF-BOF and DRI-EAF facility with a 5.7 million tonne crude steel capacity, exhibited a consistent and significant increase in activity, rising from 79% in March to 99% in August. This plant’s focus on automotive, building & infrastructure, and energy sectors means its high activity could indicate strong demand in those areas. The news articles do not explain the high level of recent activity that has been measured by satellite data.

The Deacero Saltillo-Ramos Arizpe steel plant, an EAF-based facility producing 700,000 tonnes of steel profiles, showed gradual increases in activity, rising steadily from 26% in March to 29% in August. Like Ternium, no direct connection could be established between this plant’s activity and the provided news articles.

Evaluated Market Implications:

The implementation of import tariffs starting in 2026, as reported in “Mexico slaps import tariffs on 1,371 products starting in 2026,” will likely increase domestic steel prices. Given the consistently high activity at the ArcelorMittal Lázaro Cárdenas plant, and its significant capacity, this plant appears well-positioned to benefit from increased domestic demand driven by the tariffs, potentially mitigating supply disruptions.

The news articles do not explain the significant drop of “Mean Steelplant Activity in Mexico” in the last period.

Recommended Procurement Actions:

- Steel Buyers: Given the upcoming tariffs, immediately assess current supply chain vulnerabilities and diversify sourcing strategies to include a greater proportion of domestic steel, particularly from ArcelorMittal Lázaro Cárdenas.

- Market Analysts: Closely monitor the automotive sector and its impact on the steel market, especially how domestic steel producers react to the increasing share of electric vehicle production, as per “Mexico auto exports up, output down in August”.

- Both: Due to the lack of explanation for the major change in average steel plant activity in Mexico, extra due diligence and caution should be exercised when making procurement or analystic decisions.