From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMalaysian Steel Sector Shows Resilience Amidst EU CBAM Uncertainty: Ann Joo Activity Remains Strong

The Malaysian steel market demonstrates underlying strength as reflected in stable plant activity despite uncertainties surrounding the EU’s Carbon Border Adjustment Mechanism (CBAM). The stability contrasts with hesitancy reported in the European market as stated in “EU coil buyers left scratching heads over CBAM” and “EU roll buyers were left wondering about CBAM“. While these articles highlight potential challenges for Asian exporters, including those from Malaysia, the observed plant activities do not yet reflect a significant impact, with one plant standing out in particular. No direct link could be established between the article “MEIS: Asian steel exports to be impacted more by safeguard measures than CBAM” and the observed plant activities in Malaysia.

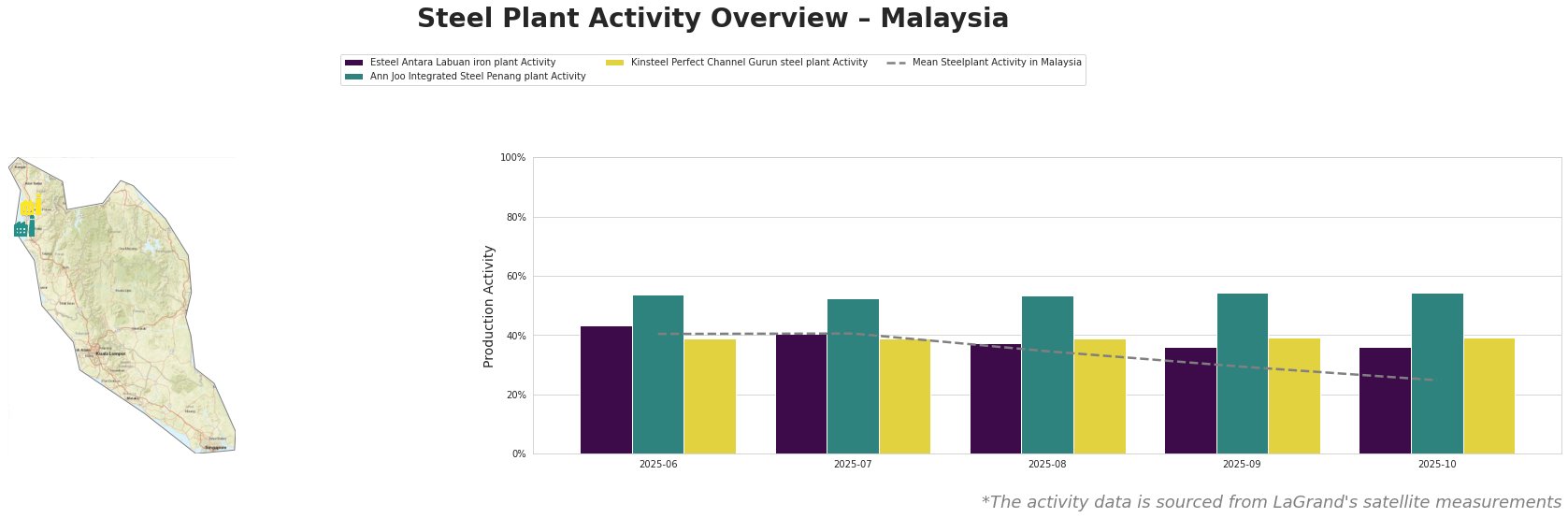

Overall, the mean steel plant activity in Malaysia declined from 40% in June 2025 to 25% in October 2025, showing a steady downward trend over the period. Esteel Antara Labuan iron plant activity peaked at 43% in June, then declined to 36% in October. Ann Joo Integrated Steel Penang plant shows the highest activity and resilience, maintaining a high level of 52-54% from June to October. Kinsteel Perfect Channel Gurun steel plant shows consistent low activity at 39% throughout the observed period.

The Esteel Antara Labuan iron plant, located on Labuan Island, focuses on ironmaking via DRI technology with a capacity of 900 ttpa of Iron (DRI/HBI). The activity level shows a moderate decline from 43% to 36% between June and October 2025, though it remains above the mean steel plant activity in Malaysia. This decline cannot be directly linked to the EU CBAM concerns discussed in “EU coil buyers left scratching heads over CBAM” or “EU roll buyers were left wondering about CBAM“.

Ann Joo Integrated Steel Penang plant, an integrated BF and EAF-based steel plant, demonstrates robust activity. The plant’s activity remains consistently high at around 53-54% during the period, significantly above the Malaysian average. This indicates a strong and stable production output, potentially driven by domestic demand or existing export agreements that are not immediately affected by the EU’s CBAM, as the articles “EU coil buyers left scratching heads over CBAM” and “EU roll buyers were left wondering about CBAM” highlight the uncertainty around its implications.

Kinsteel Perfect Channel Gurun steel plant, an EAF-based producer in Kedah with a capacity of 500 ttpa of Crude Steel. The consistent activity level around 39% suggests stable operations at this plant, but it operates below the overall average. No direct link could be established between its activity level and the concerns about the EU CBAM raised in the articles provided.

While the EU CBAM introduces uncertainty, the Ann Joo Integrated Steel Penang plant’s consistently high activity suggests resilience in certain segments of the Malaysian steel market. However, overall plant activity has declined.

Evaluated Market Implications:

Potential Supply Disruptions: The general decline in average plant activity, though not directly tied to CBAM, should be monitored.

Recommended Procurement Actions:

* Steel buyers should prioritize engaging with suppliers like Ann Joo Integrated Steel Penang plant that demonstrate stable production and potentially lower carbon intensity due to EAF technology.

* Carefully evaluate alternative suppliers and consider diversifying sourcing to mitigate the risk of potential future disruptions.

* Given the overall market decline, buyers should attempt to negotiate prices effectively.