From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMalaysian Steel Market Braces for Price Hikes Amidst Weak Demand: Activity Declines Signal Supply Concerns

Malaysia’s steel market faces a challenging outlook, marked by potential price increases and sluggish downstream demand. European market trends may affect Malaysia indirectly, as indicated in news articles such as “Blechexpo: Coil cost will rise, but downstream consumption will be weak” and “Blechexpo: European coil buyers question increases, Asian purchases continue,” pointing to a global hesitancy among buyers. While no direct link can be established between these European market dynamics and the Malaysian steel plants’ activities using satellite data, a decrease in overall plant activity in Malaysia might signal a potential constraint on steel availability.

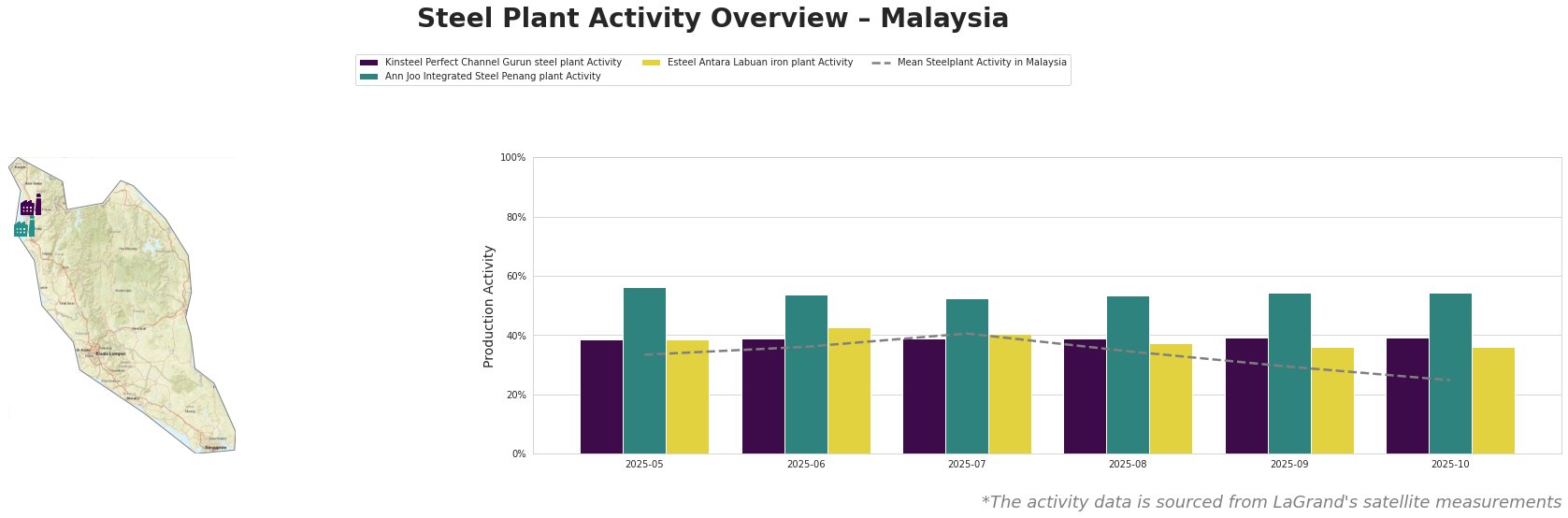

The mean steel plant activity in Malaysia decreased significantly from 41% in July to 25% in October, representing a notable downward trend. Kinsteel Perfect Channel Gurun steel plant maintained a consistent activity level of 39% throughout the observed period, consistently operating above the national mean in October. Ann Joo Integrated Steel Penang plant showed an initial activity of 56% in May, which decreased to 52% in July, before stabilizing at 54% from August through October, consistently operating well above the national mean activity. Esteel Antara Labuan iron plant experienced fluctuating activity, peaking at 43% in June, but settled at 36% in October, below the activity levels of the other two plants and the national mean.

Kinsteel Perfect Channel Gurun steel plant, located in Kedah, possesses an EAF-based crude steel capacity of 500 ttpa, focusing on semi-finished and finished rolled products such as billets and wire rod. Its stable activity at 39% despite the overall market decline might indicate resilience, or possibly existing stock. No direct connection to the news articles can be established.

Ann Joo Integrated Steel Penang plant, situated in Penang, operates with an integrated BF and EAF process, also boasting a crude steel capacity of 500 ttpa. This plant’s activity, while experiencing minor fluctuations, has remained significantly above the national average. The “Blechexpo: European coil buyers question increases, Asian purchases continue” article highlights how competitively priced Asian coil could challenge processors. However, no direct link can be established with Penang plant activity.

Esteel Antara Labuan iron plant on Labuan Island specializes in DRI production, with an iron capacity of 900 ttpa. Its activity decreased to 36% in October, aligning with the overall market downturn. No direct connection to the provided news articles can be established.

Given the declining mean steel plant activity in Malaysia and the context of weak downstream demand and potential price increases in the global market (as indicated by the Blechexpo news articles), steel buyers should consider the following:

- Potential Supply Disruptions: The overall decrease in mean plant activity suggests potential supply constraints within Malaysia. While Ann Joo Integrated Steel Penang plant is operating well, the decrease in overall activity, combined with potential global price pressures, may lead to local price increases.

- Recommended Procurement Actions:

- Assess Inventory Levels: Evaluate current steel inventory against projected demand to identify potential shortfalls.

- Strengthen Supplier Relationships: Proactively engage with existing suppliers to negotiate and secure stable pricing and delivery schedules. Specifically, given the relatively stable activity at Kinsteel Perfect Channel Gurun, explore opportunities to secure supply of billets and wire rod.

- Explore Alternative Sourcing (with caution): While the article “Blechexpo: European coil buyers question increases, Asian purchases continue” mentions Asian steel’s price competitiveness, buyers should thoroughly evaluate import costs, lead times, and quality certifications before switching suppliers.

- Monitor Market Developments Closely: Continuously track activity levels at major steel plants and stay informed about global price trends and trade policies to make informed procurement decisions.