From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMalaysia Steel Market: CCUS Initiatives Drive Optimism Amid Stable Plant Activity

Malaysia’s steel market exhibits a very positive sentiment, driven by regional decarbonization initiatives despite largely stable plant activity levels. News articles such as “Global steel leaders launch pre-feasibility study to accelerate decarbonization in Asia” and “BHP will lead a consortium to explore CCUS opportunities in Asia” highlight the focus on Carbon Capture, Utilization, and Storage (CCUS) technologies. While these initiatives suggest long-term market optimism, no immediate, direct link can be established between these developments and the observed activity levels at Malaysian steel plants.

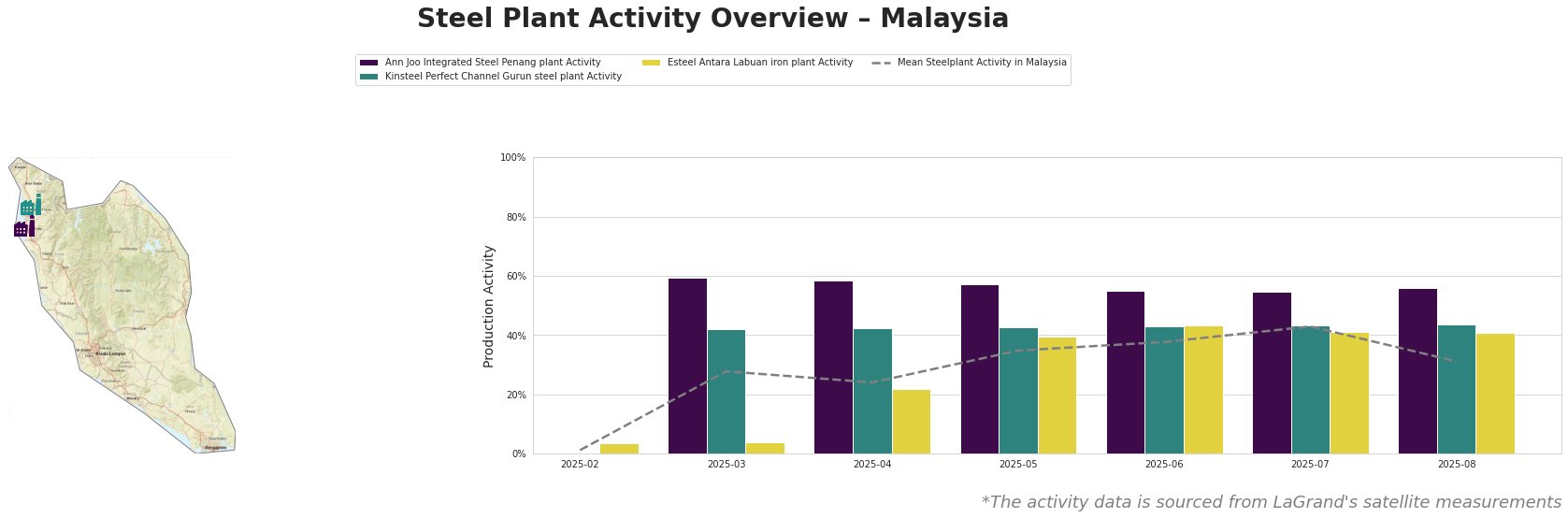

Here’s a summary of observed activity levels:

The mean steel plant activity in Malaysia shows an overall increasing trend from February (1.0%) to July (43.0%), before decreasing to 31.0% in August.

Ann Joo Integrated Steel Penang plant, an integrated BF-EAF steel plant with a 500ktpa crude steel capacity and ResponsibleSteel certification, consistently operated above the national mean, ranging between 55% and 59% activity. The observed trend shows activity has slightly decreased over the period with a maximum activity of 59% on March 31st, and a minimum of 55% on June 30th and July 31st. No direct impact from the CCUS initiatives described in “Industry Consortium Launches CCUS Hub Study” could be established on the observed plant activity.

Kinsteel Perfect Channel Gurun steel plant, an EAF-based plant with 500ktpa crude steel capacity and ResponsibleSteel certification, maintained a stable activity level, fluctuating between 42% and 44%. These are only slightly above the national average in June and July. No direct link to the named CCUS initiatives can be established based on the provided data.

Esteel Antara Labuan iron plant, a DRI-based iron plant with a 900ktpa iron capacity and ResponsibleSteel certification, has seen its activity increase from 4.0% in February and March to 41.0% in July and August, peaking at 43.0% in June. While showing a rising trend, no direct connection to the CCUS initiatives detailed in the news articles can be ascertained.

The stable production levels across Malaysian steel plants, observed via satellite data, coupled with the news of regional CCUS initiatives, present a mixed outlook. Despite no immediate disruption, the market sentiment is optimistic.

Evaluated Market Implications:

While current plant activity is stable, the news articles “Global steel leaders launch pre-feasibility study to accelerate decarbonization in Asia“, “BHP will lead a consortium to explore CCUS opportunities in Asia“, and “Industry Consortium Launches CCUS Hub Study” suggest a potential shift in long-term operational strategies.

Recommended Procurement Actions:

* Steel buyers should closely monitor announcements from the CCUS consortium mentioned in the news articles, particularly regarding specific project timelines and potential impacts on regional steel production.

* Given the focus on decarbonization, procurement professionals should engage with suppliers like Ann Joo, Kinsteel and Esteel Antara to understand their strategies for adopting CCUS technologies and potential implications for future steel pricing and availability. In particular, monitoring changes at Esteel Antara is important as this plant had a low activity at the beginning of the year, and as a DRI based steel plant might be more easily adapted to new Carbon Capture technologies.

* Given the fact that Ann Joo’s Penang plant activity is the highest observed, steel buyers should engage with this plant to secure competitive prices.