From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineKorean Steel Market Faces Headwinds: EU Duties Extended Amidst Declining Plant Activity

The South Korean steel market faces increased challenges due to the extension of EU anti-dumping duties, while observed plant activity is generally declining. The impact of these duties, as reported in “EU extends Korea, Malaysia, Russia fittings AD duties,” “EU extends tariffs on valve advertising for Korea, Malaysia and Russia,” and “EU issues definitive AD duty on tube and pipe fittings from three countries,” cannot be directly linked to specific, recent changes in plant activity levels, based on observed satellite data, even as the mean activity across all plants has decreased.

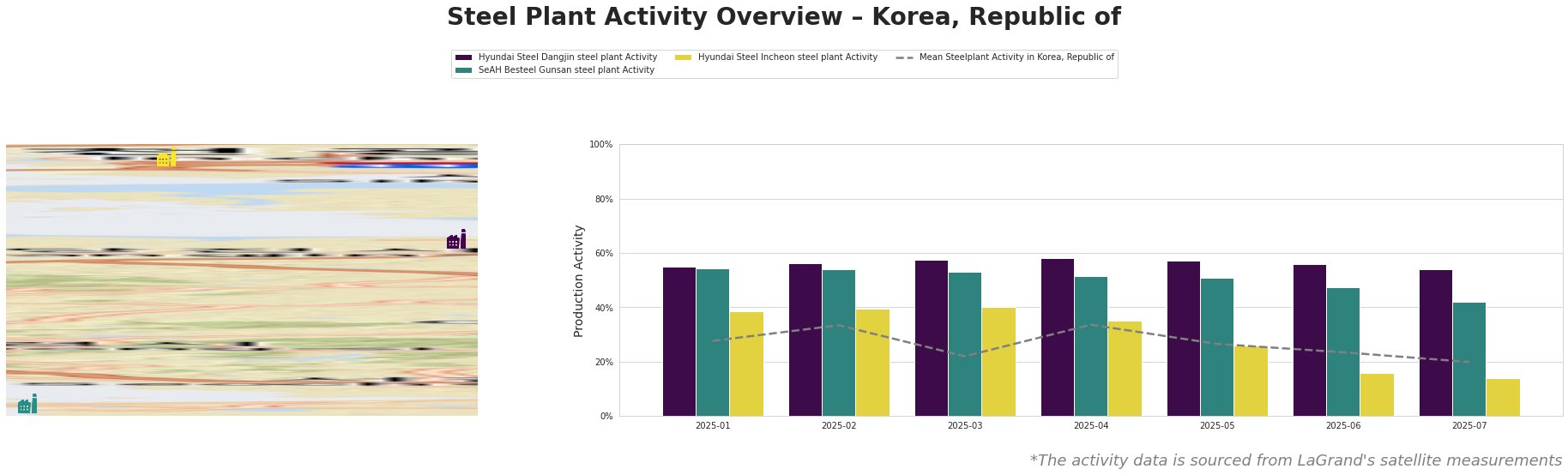

Overall, the mean steel plant activity in the Republic of Korea has decreased significantly, from a high of 34% in April to 20% in July. The Hyundai Steel Dangjin plant has consistently shown above-average activity levels, while the Hyundai Steel Incheon plant has been trending well below average.

Hyundai Steel’s Dangjin plant, an integrated BF/BOF steelmaker with a crude steel capacity of 16.6 million tonnes, including both BOF and EAF production, has maintained relatively stable activity levels, hovering around 54-58%. Despite the EU’s extension of anti-dumping duties as outlined in “EU extends Korea, Malaysia, Russia fittings AD duties,” there is no observable immediate impact on the plant’s activity levels based on the provided data. The plant’s focus on automotive, building, and transport sectors, combined with its diverse product range from hot-rolled sheet to rebar, may buffer it from the immediate effects of the EU duties.

SeAH Besteel’s Gunsan plant, an EAF-based special steel producer with a 2.1 million tonne capacity, has shown a decreasing trend in activity, dropping from 54% in January and February to 42% in July. While the EU’s actions, as described in “EU extends Korea, Malaysia, Russia fittings AD duties,” target specific fittings, there isn’t a direct, clearly established connection between this and the observed activity decline, although it is possible that reduced overall market confidence and export prospects play a role.

Hyundai Steel’s Incheon plant, another EAF-based facility with a 4.8 million tonne capacity, primarily producing rebar, H-sections, and heavy machinery for building and infrastructure, has seen a marked decrease in activity. Starting at 39% in January, it has fallen to only 14% in July. Similar to SeAH Besteel, no direct connection to the EU’s anti-dumping duties can be established based on the provided information. This sharp decline warrants further investigation into potential domestic demand factors or specific production adjustments.

The extension of EU anti-dumping duties, particularly as detailed in “EU issues definitive AD duty on tube and pipe fittings from three countries“, could lead to increased domestic supply of affected products, which may cause price volatility. Given the overall negative market sentiment and decline in plant activity, steel buyers should closely monitor domestic price trends and consider negotiating contracts with built-in flexibility to adjust to potential price fluctuations. Specifically, the significant decline in activity at the Hyundai Steel Incheon plant suggests potential localized supply constraints for rebar and H-sections; buyers relying on these products should diversify their supply base or secure longer-term contracts to mitigate risks.