From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineKorea Steel Market Faces Headwinds: EU Quota Delay and Plant Activity Shifts Signal Procurement Challenges

The steel market in Korea, Republic of, faces increased uncertainty due to shifts in export conditions and fluctuating domestic plant activity. The “EU postpones country-specific quotas on angles, shapes and sections to August” (multiple publications) directly impacts export prospects, although no immediate correlation to the July plant activity data can be established. Specifically, this affects Korean exports of angles, shapes, and sections of iron or non-alloy steel (Category 17) to the EU.

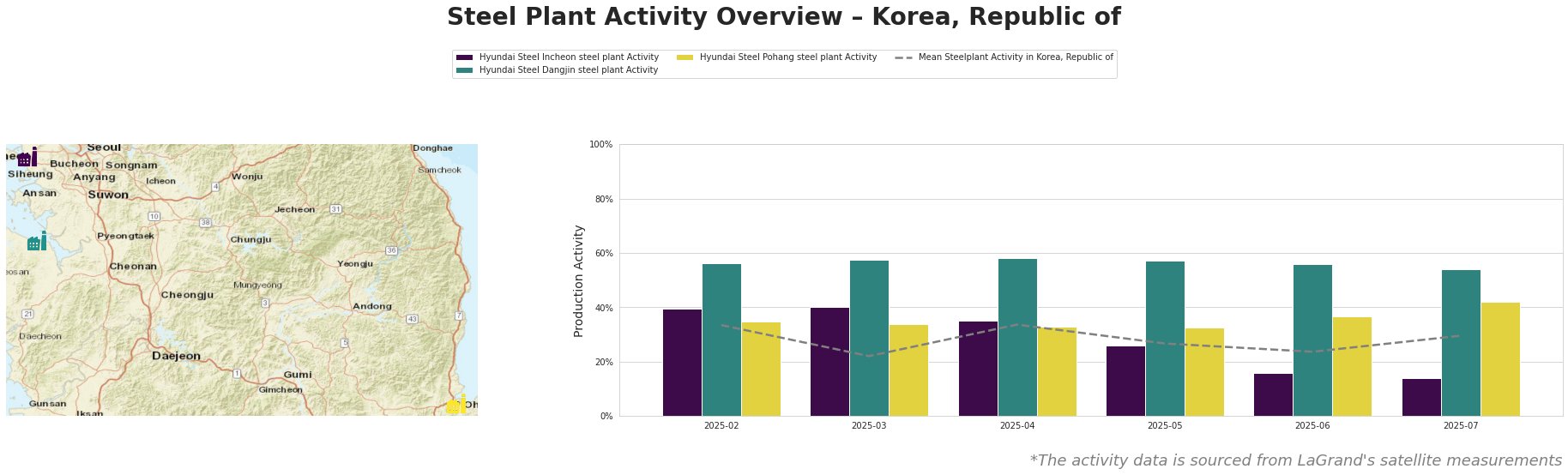

Overall, the mean steel plant activity in Korea, Republic of, fluctuated, showing a small recovery to 30% in July after reaching a low of 22% in March and staying below 30% in May and June. Hyundai Steel Dangjin consistently showed the highest activity across all observed plants, peaking at 58% in April, and remains significantly above the national mean.

Hyundai Steel Incheon, an EAF-based plant focused on rebar and H-sections for building and infrastructure, experienced a significant drop in activity, falling from 40% in February and March to just 14% in July. This considerable decline, with a drop of 22% from June to July, does not appear to have a direct link with the EU quota news.

Hyundai Steel Dangjin, an integrated BF/BOF and EAF plant producing a wide range of products including hot/cold rolled sheet, heavy plate and rebar, maintained relatively stable activity, fluctuating between 54% and 58%. This plant consistently operates well above the national average. The observed activity trend does not seem to be directly affected by the news regarding EU quotas.

Hyundai Steel Pohang, an EAF-based plant focusing on rebar and H-steel, showed a slight increase in activity in July, reaching 42%, up from 37% in June and a low of 33% in April and May. This represents the highest activity level amongst the three plants in July. No direct link to the EU quota news is evident.

Evaluated Market Implications:

The delay in removing country-specific EU quotas on angles, shapes, and sections, as highlighted in “EU postpones country-specific quotas on angles, shapes and sections to August”, presents a direct risk to Korean steel exporters. The quota limitations and the potential 25% duty on exceeding allocated volumes will likely put downward pressure on Korean steel exports of these specific product categories to the EU.

The sharp decline in activity at the Hyundai Steel Incheon plant, particularly the substantial drop in July, suggests potential domestic supply constraints for rebar and H-sections.

Recommended Procurement Actions:

- Steel buyers reliant on Hyundai Steel Incheon for rebar and H-sections should proactively engage with Hyundai Steel to ascertain future production capacity and potential delivery delays. Diversification of suppliers for these products is recommended to mitigate potential supply disruptions.

- Steel buyers who are exporting angles, shapes, and sections of iron or non-alloy steel (Category 17) to the EU should re-evaluate their existing export strategy. Procurement strategies should be adjusted based on the allocated quotas for the next four quarterly periods. The quota volumes can be found in the cited news articles. Consider shifting focus to non-EU markets or adjusting product mix to minimize the impact of the quotas.