From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJapan’s Steel Market Soars: Recent Investments and Production Boosts Indicate Strong Growth Potential

Recent developments in Japan’s steel industry signal a robust upward trajectory, especially following contracts awarded to Maruichi Stainless Tube Co. Ltd. for advanced production facilities, as detailed in SMS Group to supply advanced tube production line to Maruichi in Japan (2025-10-09) and SMS group to deliver fully automated extruded stainless tube line to Japan’s Maruichi (2025-10-10). These projects correlate with increased satellite-observed activity at key plants, especially in the Chūgoku region, reinforcing a strong market sentiment characterized as Very Positive.

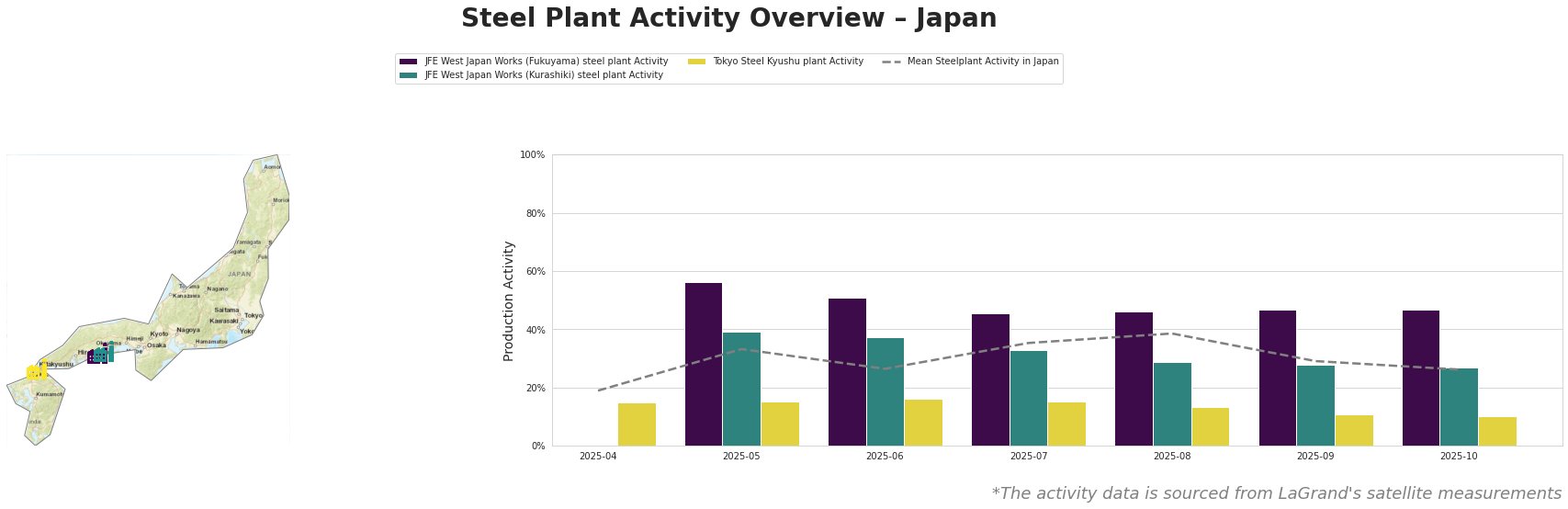

The table reveals significant fluctuations in activity. Notably, JFE West Japan Works (Fukuyama) experienced a peak of 56.0% in May 2025, well above the mean activity, correlating with rising demand driven by the automotive and construction sectors. This plant’s subsequent stabilization around 47.0% reflects well-established operational efficiency amidst heightened market dynamics.

The Kurashiki plant followed suit with a peak of 39.0% in May, suggesting a healthy operational flow likely fueled by a vibrant market demand. However, it has seen a slight decline in recent months, with activity reaching 27.0% by October, but still average for the recent period compared to historical performance.

Conversely, the Tokyo Steel Kyushu plant saw a consistent decline in activity, dropping from 15.0% in April to 10.0% in October. The lack of strategic investment or technological upgrades is evident as this plant appears to be lagging behind its competitors.

JFE’s operational enhancements, such as the commissioning of Japan’s First CRS® Roller Straightener as mentioned in SMS group, Yamato Steel Commission Japan’s First CRS® Roller Straightener (2025-10-13), further elucidates the competitiveness and increased operational capacity of plants like Fukuyama and Kurashiki. However, no explicit connection links the downturn of Tokyo Steel Kyushu’s production to these advancements.

Given the positive momentum reinforced by Maruichi’s investments, buyers should cautiously strategize procurement from JFE West Japan Works to leverage robust capability amidst new production line implementations. The sustained activity at Fukuyama makes it a preferred partner for high-demand periods, whereas buyers might consider diversifying from the Tokyo Steel plant due to its declining performance.

In summary, proactive engagement with JFE’s plants, especially the Fukuyama site, is recommended for procurement professionals to capitalize on their improved production capabilities, ensuring alignment with market growth trends and the impending supply of high-demand products.